Unexpected Rise Challenges Expectations

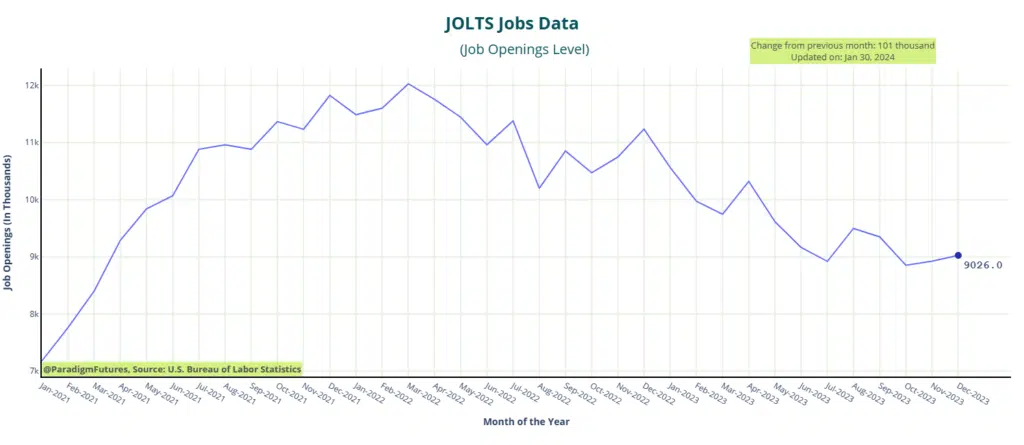

In an unexpected turn of events, U.S. job openings rose in December, exceeding analyst expectations and challenging the notion of a cooling labor market. The data, released by the Labor Department on Tuesday, revealed an increase from 8.925 million in November to an impressive 9.026 million in December. This surge, coupled with upward revisions for the previous month, indicates a labor market that may be too robust for the Federal Reserve to consider interest rate cuts in the near term.

Signs of a Gradual Cooling and Wage Growth Slowdown

While the job openings data signals strength in the labor market, there are signs of a gradual cooling. Americans seem to be staying in their current jobs, potentially slowing wage growth. Notably, the number of people quitting their jobs, often seen as a sign of seeking better opportunities, hit its lowest point in nearly three years.

Implications for Federal Reserve’s Rate Decision and Inflation Concerns

The job openings report also highlighted that there were 1.44 positions for every unemployed person, maintaining stability from November but down from the two-job ratio in March 2022 when the U.S. central bank initiated rate hikes. With Federal Reserve officials expected to keep rates unchanged at the end of a two-day policy meeting, the resilient economy anchored by the labor market continues to influence consumer spending. Financial markets have responded by lowering the odds of a rate cut in March to below 50%.

Consumer Sentiment

This month’s Economic Confidence Index surged by 6 points from the previous month and has seen a remarkable increase of 14 points since November, reaching a current level of minus 26. The Gallup scale, which ranges from 100 (if all respondents perceive the economy as good and improving) to minus 100 (if all respondents view it as bad and worsening), serves as a benchmark for these assessments.

Since the onset of the COVID-19 pandemic in 2020, the index has predominantly maintained negative readings. In June 2022, it plummeted to its lowest point since the Great Recession, hitting minus 58. However, it has since embarked on a consistent upward trajectory.

In relation to current economic conditions in the country, approximately 45 percent of respondents surveyed for this month’s index characterized them as poor. One in four respondents regarded the conditions as excellent or good, while an additional 29 percent deemed them fair.

Regarding the overall economic outlook, 63 percent of respondents expressed a belief that the economy is deteriorating, while 30 percent indicated an optimistic view, stating that it is improving. Only 4 percent perceived the economy as staying the same.

Sector-Specific Trends and Regional Variances

In terms of sector-specific trends, the professional and business services sector saw an additional 239,000 job openings in December. However, there were decreases in unfilled jobs in the accommodation and food services industry and the wholesale trade sector.

Geographically, job opportunities were abundant in the South but fewer in the Midwest. The Northeast reported a modest increase in vacancies, while the West experienced a mild drop. The overall job openings rate remained unchanged at 5.4%.

Complex Economic Landscape – Layoffs, Hiring, and UPS Job Cuts

Hiring rose in December, with professional and business services, accommodation and food services, as well as state and local government leading the way. However, healthcare and social assistance hiring experienced a decline.

Despite these trends, layoffs increased, driven by job losses in transportation, warehousing, and utilities. Notably, United Parcel Service (UPS) announced plans to cut 12,000 jobs, while the professional and business services sectors also shed workers in December.

Looking Ahead – Nonfarm Payrolls Report and Economic Insights

While the job openings surge and increased consumer confidence signal resilience, the overall economic landscape remains complex, with investors and analysts closely monitoring the Federal Reserve’s decisions and their subsequent impact on market dynamics. The upcoming nonfarm payrolls report on Friday is anticipated to provide further insights into the state of the U.S. labor market.

Open a Trading Account – Paradigm Futures

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.