Soft Futures have been getting a lot of attention lately. Main reason being the exuberant rallies that some of the soft markets have gone through the past 12 months. Orange Juice being one market that punched out a new all-time high in November 2023. Some other markets having massive rallies recently include Cocoa, and Sugar.

Some of the other Soft Commodities such as Coffee, Cotton, Lumber and Palm Oil have been in correction or consolidation mode since they had massive moves to the upside in 2021, and 2022. It is common for markets to need to digest large moves and take time in a sideways market.

When should you be using Soft Futures?

Commodity markets are designed to help producers and end-users transfer the cost of production risks to a counter party that wants to take on the risk of the other side of the trade.

Soft product categories:

- Cocoa

- Sugar

- Coffee

- Cotton

- Lumber

- Palm Oil

- Oranges

Producers

You have a cost associated with growing or producing these products. Some costs would include the use of land, labor, equipment, fuel, interest, storage. When a commodity producer adds up all their costs and they can get begin to understand when to offset the risk.

End-users

The same works if you are an end-user and you assume the price risk of the product. This could be a textile company, a sweetener producer, a building developer, or an orange juice producer. The business of producing a Hersey chocolate bar is not to gamble in the Cocoa futures market and bet if it is going to go higher or lower.

The core function of the business is the process of converting the cocoa into a product that the consumer will want to purchase. The process of converting raw cocoa into a candy bar and then marketing the product is where The Hershey Company builds its legacy.

This is a common thought throughout different commodity markets. In the energy markets there is what is called a 3-2-1 crack spread. This spread is used by oil refiners when in the business of processing oil into gasoline and diesel. The spread between buying crude oil and selling gasoline and diesel is the profit that a refiner will look to lock in using the futures markets.

How can a producer offset their risk in Soft Futures?

At Paradigm Futures we make it very accessible for our clients to call in and talk to a experienced broker at our trade desk line 1-605-886-1920. Here you can work with a broker and talk though your position and identify where your risks are.

Paradigm Futures utilizes Rj O’Brien’s trade platform to execute trades. Whether you are using a broker or if you would like access to enter your own trades you can do both from anywhere if you have access to internet or telephone.

As a producer of a Soft, to transfer risk, you will need to offset your long physical position. To do this, you will need to take a short position in the Soft Futures.

This can be a simple as, utilizing a short futures position, or you can utilize an option strategy that can allow for upside while protecting a downward price move. Paradigm’s brokers work with futures, options and combinations of futures and options together daily so they will know how to tailor a scenario that fits your needs.

How can an end-user offset their risk in Soft Futures?

As we discussed on how a producer can offset their risk using Soft Futures, a end-user can do the same by working with one of our brokers, or if your desire you can enter the trades personally.

As an end-user you will transfer risk by offsetting your physical short position using a long position. This can be done using a simply long futures position, using options or a combination of both. If you are unsure the brokers at Paradigm Futures are happy to help.

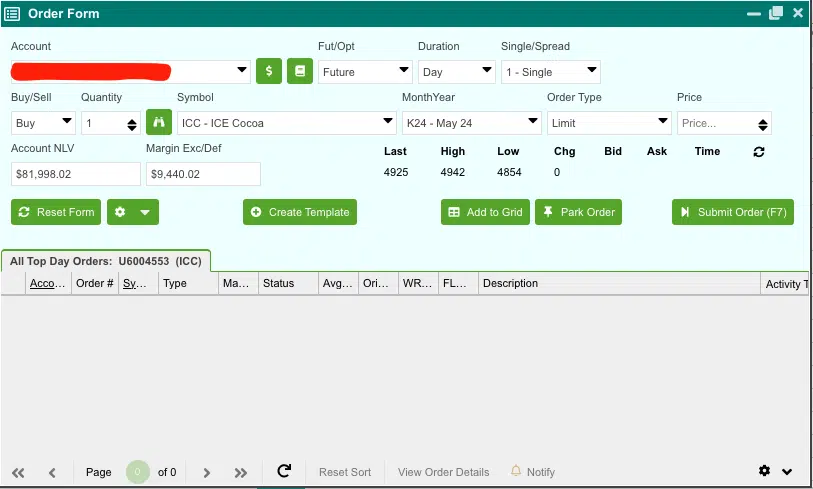

Below is a example of a ticket to buy 1 contract of May Cocoa, order type is a limit and you are able to input which price you would buy at if the market were to trade that particular level. These orders can be placed as a day order or as a Good till Cancel.

A Hedgers Mindset

One final message that is important to understand if you are a producer or a end-user of Softs and you are looking to use a futures account to transfer risk.

It is important to understand that this should not be viewed as a “investment” account. A hedge account will not always produce a net gain or a net loss at the end of the year. If you are a producer and you expect the hedge account to always make money, you would consistently need to be selling at the highs each year which is not practical.

Hedge exists to transfer the risk of growing or using a product and if there is a gain it is used to offset the position in the physical market. If there is a loss in the account, then the loss is applied to the physical position. If it is a loss for a producer then likely their physical positions have gained to more profitable levels.

Contact Us

Still interested in trading Softs Futures? Reach out to one of our experienced, series 3 licensed commodity brokers at Paradigm Futures.

This material has been prepared by a sales or trading employee or agent of Paradigm Futures, and is, or is in the nature of, a solicitation. This material is not a research report prepared by Paradigm Futures. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that (Insert IB Name) believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.