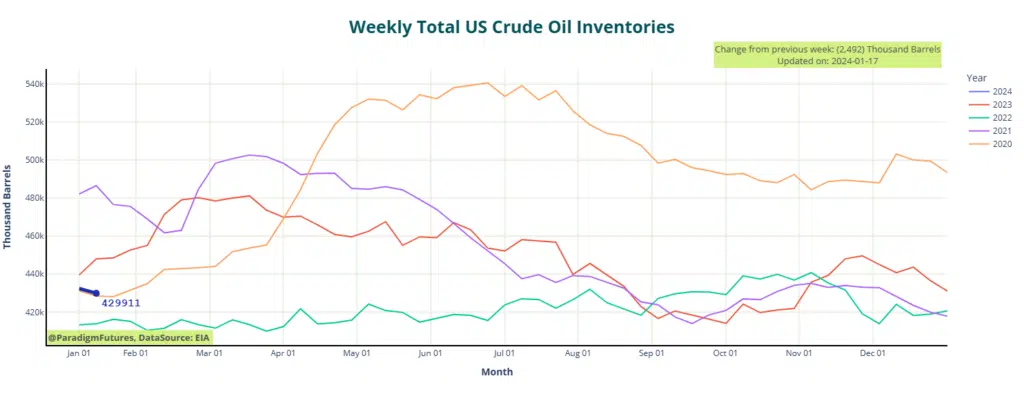

Today’s EIA Report Shows 2.5 Million Barrel Decline.

Crude oil prices saw a modest uptick today as the U.S. Energy Information Administration reported a decline of 2.5 million barrels in estimated inventory for the week ending January 12. This marks a departure from the previous week, which witnessed a moderate build of 1.3 million barrels, along with significant increases in fuel inventories that drove prices downward.

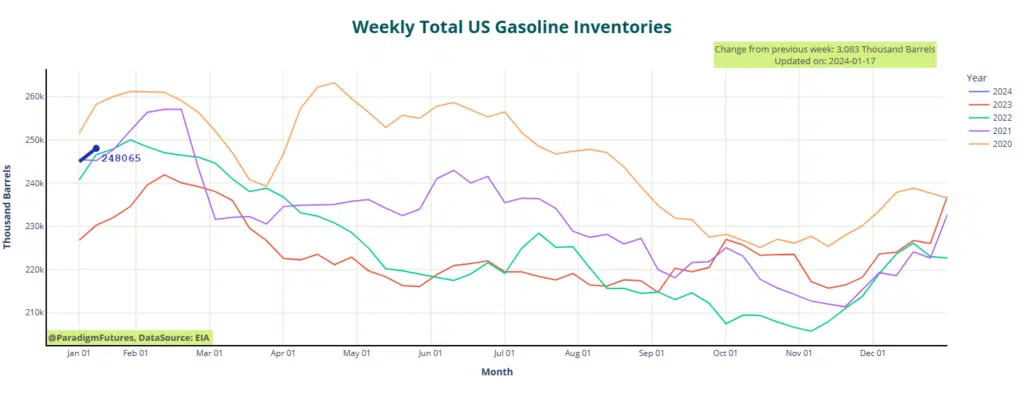

Gas and Distillates continue build from weeks previous.

The latest findings from the EIA also indicate builds in gasoline and middle distillate stocks. Gasoline inventories experienced a rise of 3.1 million barrels for the week ending January 12, compared to the previous week’s 8 million-barrel build. Gasoline production averaged 9.4 million barrels daily, down from the prior week’s 9.7 million bpd.

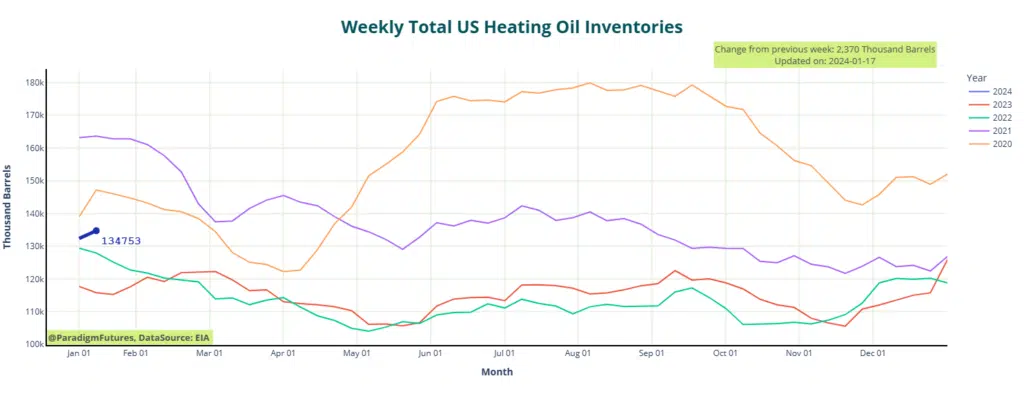

Middle distillates showed a 2.4 million-barrel inventory build for the week ending January 12, in contrast to the 6.5 million-barrel build reported the previous week. Middle distillate production averaged 4.9 million barrels daily, slightly lower than the 5.2 million bpd recorded in the week before.

OPEC and Global Uncertainty remain a contributing factor.

Earlier in the week, oil prices received a boost following OPEC’s release of its inaugural monthly report for the year. The cartel projected robust demand growth at 2.25 million bpd for the year, maintaining the same forecast as earlier. OPEC also foresaw strong demand growth for 2025, at 1.85 million barrels daily. Additional support for prices stemmed from the supply situation in the U.S., impacted by a cold snap that temporarily halted production, resulting in a loss of 650,000 to 700,000 bpd in North Dakota.

Furthermore, U.S. and UK forces launched a fresh series of attacks against Yemeni military targets on Wednesday, contributing modest support to prices.

Despite these factors, the International Energy Agency downplayed the risk of supply disruption in the Middle East, citing robust supply elsewhere and expectations of weaker demand.