Today, crude oil prices declined as the Energy Information Administration reported substantial fuel inventory builds for the week ending December 29.

Crude Drops for Second Straight Week to End 2023

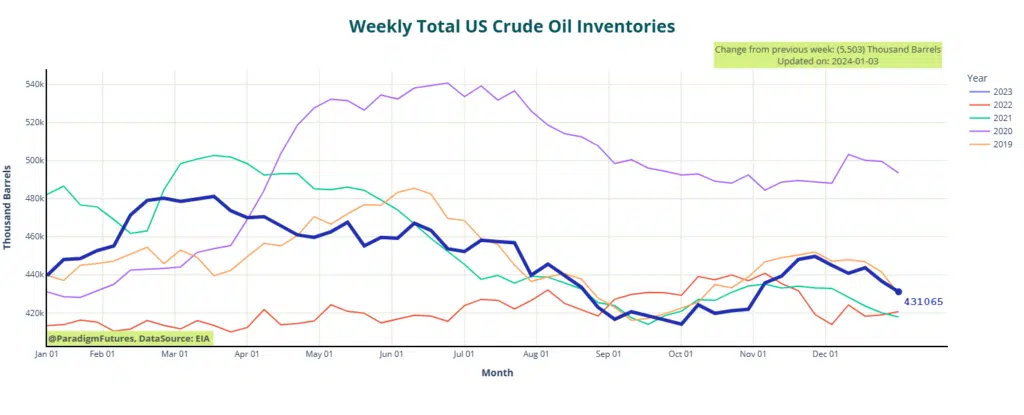

In crude oil, the authority estimated a notable inventory decline of 5.5 million barrels for the final week of 2023. This marked a departure from the previous week’s data, which showed a weekly inventory draw of 6.9 million barrels. Notably, fuel inventories experienced mixed changes during that week, with gasoline stocks decreasing and middle distillate inventories expanding.

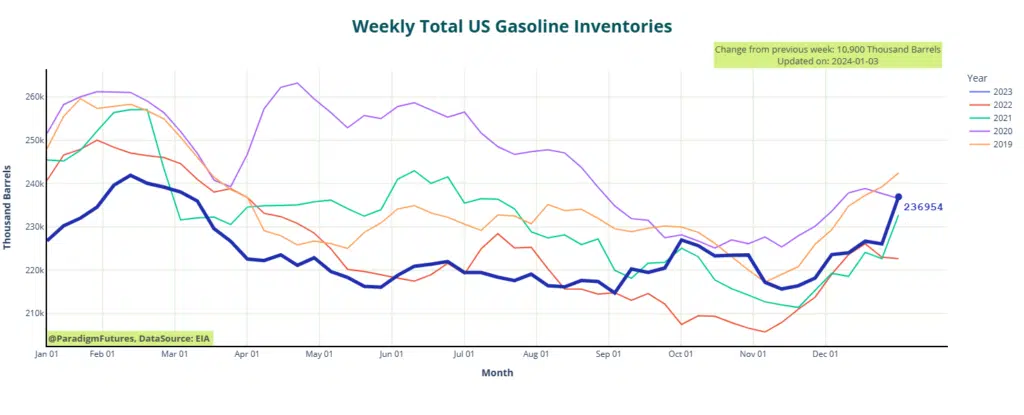

A day before the EIA released its report, the American Petroleum Institute indicated an estimated 7.4-million-barrel draw in crude oil inventories, coupled with substantial inventory builds in gasoline and middle distillates, both exceeding 6 million barrels. For the same period, the EIA projected a gasoline inventory build of 10.9 million barrels, contrasting with the 600,000-barrel decline observed in the previous week.

Product Builds Substantially, Overshadowing Middle East Fears and Crude Draws.

Gasoline production averaged 8.8 million barrels daily in the most recent week, a significant decrease from the 10 million barrels daily recorded in the previous week.

In the category of middle distillates, the EIA reported an estimated inventory increase of 10.1 million barrels for the week ending December 29, in contrast to the 800,000-barrel build reported in the previous week. Middle distillate production averaged 5.1 million barrels daily in the final week of December, consistent with the 5.1 million bpd observed in the previous week.

Amid these developments, crude oil prices have been on the rise, driven by an outage at Libya’s largest producing field, Sharara, and heightened tensions in the Middle East. Protests have blocked the Sharara field, while Yemen’s Houthis conducted another attack on a cargo ship in the Red Sea.

In response to these events, Brent crude edged closer to $80 per barrel earlier today, while West Texas Intermediate moved higher, surpassing $70 per barrel.

Open a Trading Account – Paradigm Futures

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.