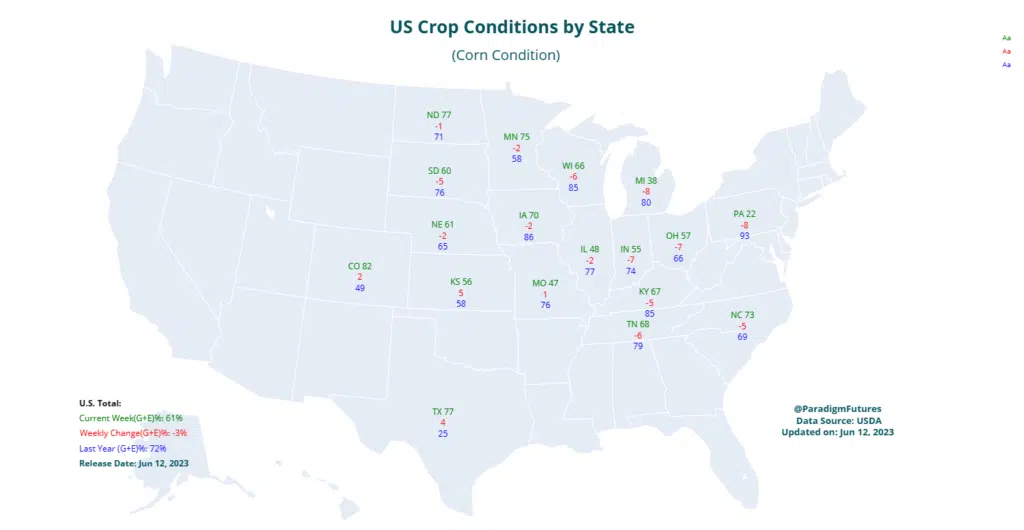

Corn🔹(G+E%) 61

-3% WoW

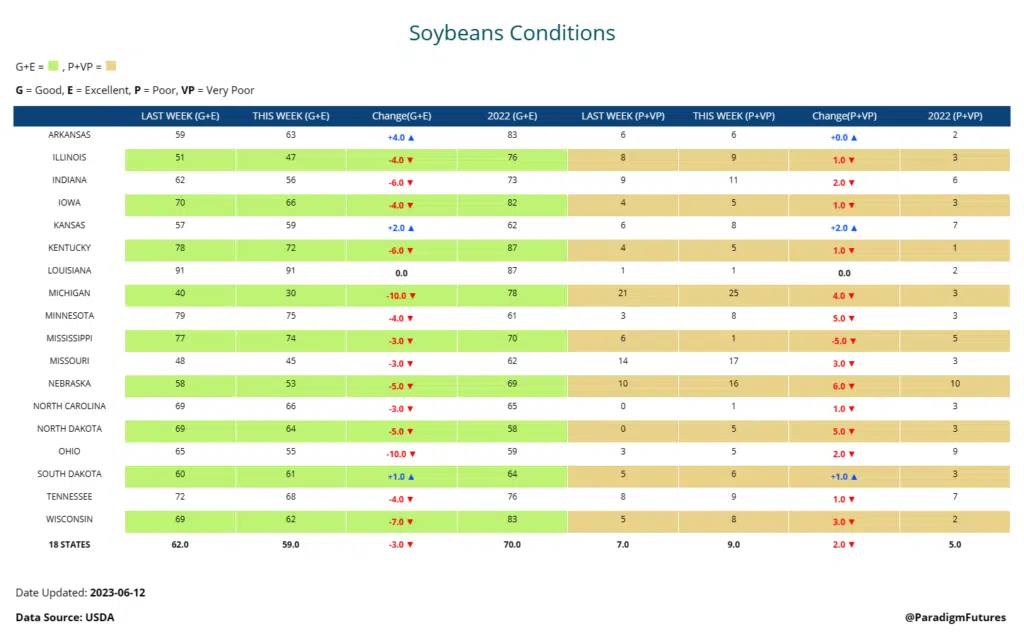

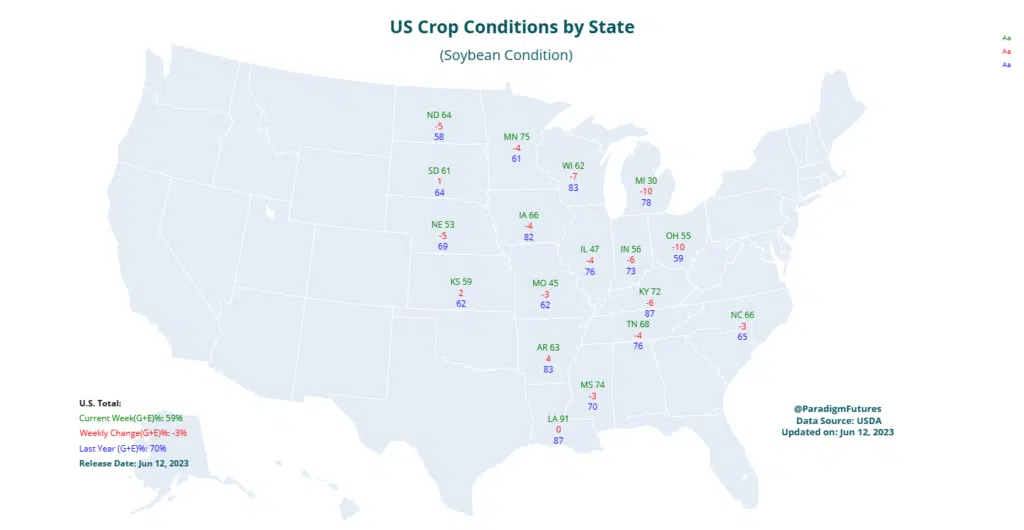

Soybeans🔹(G+E%) 59

-3% WoW

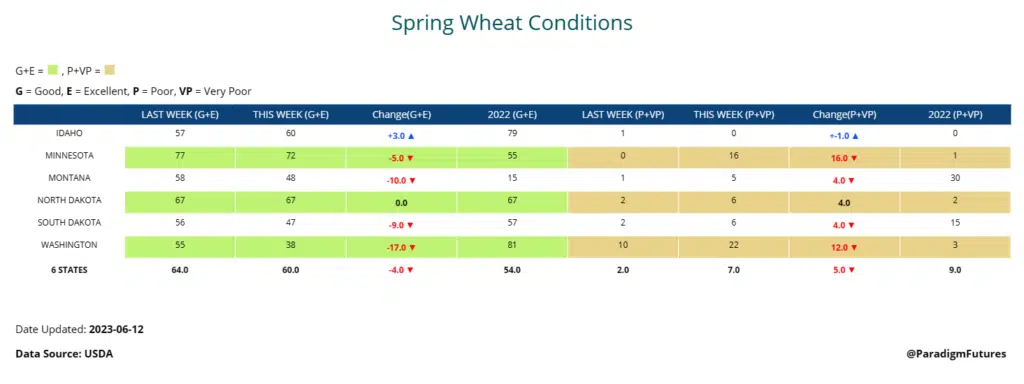

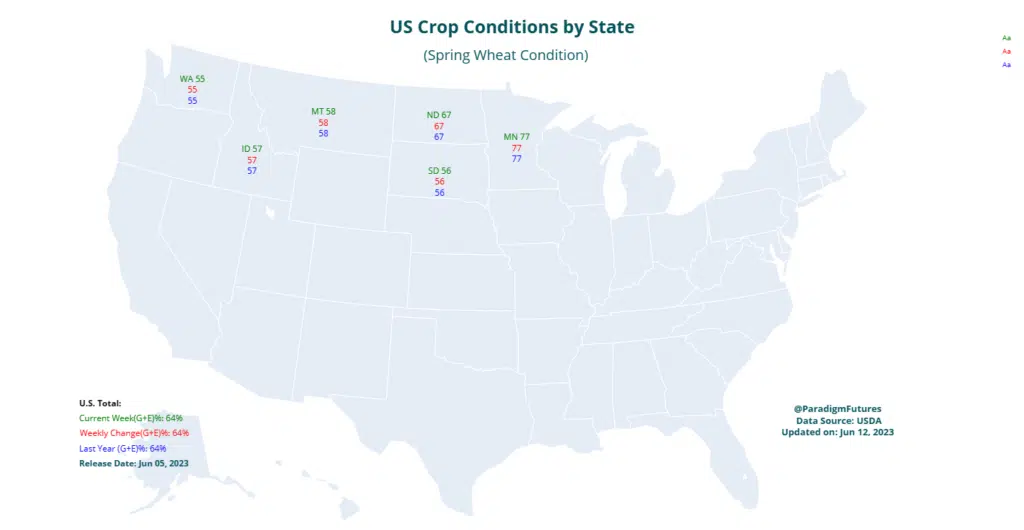

Spring Wheat🔹(G+E%) 60

-4% WoW

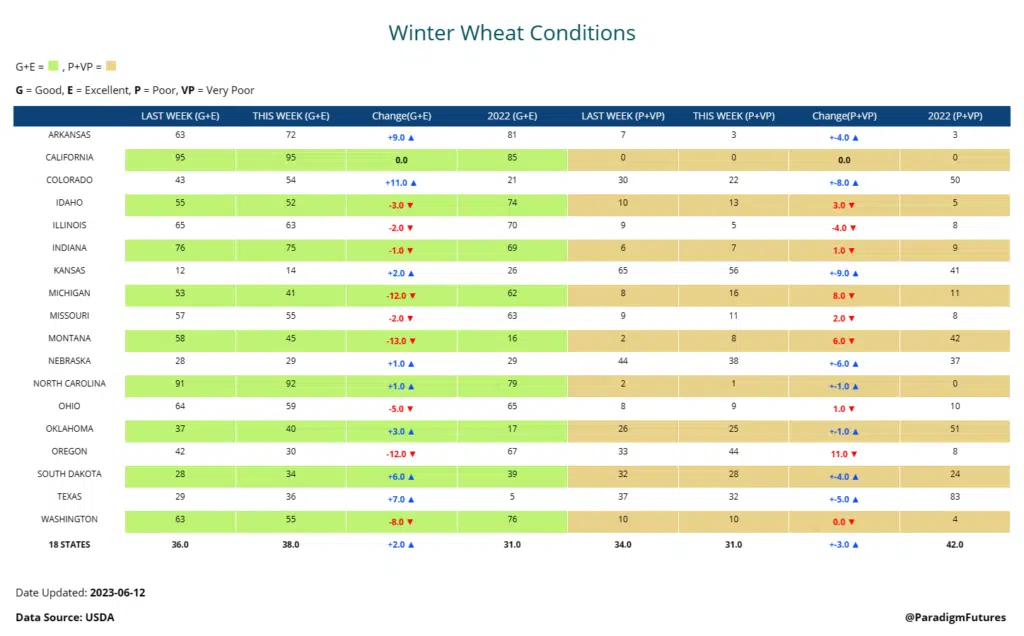

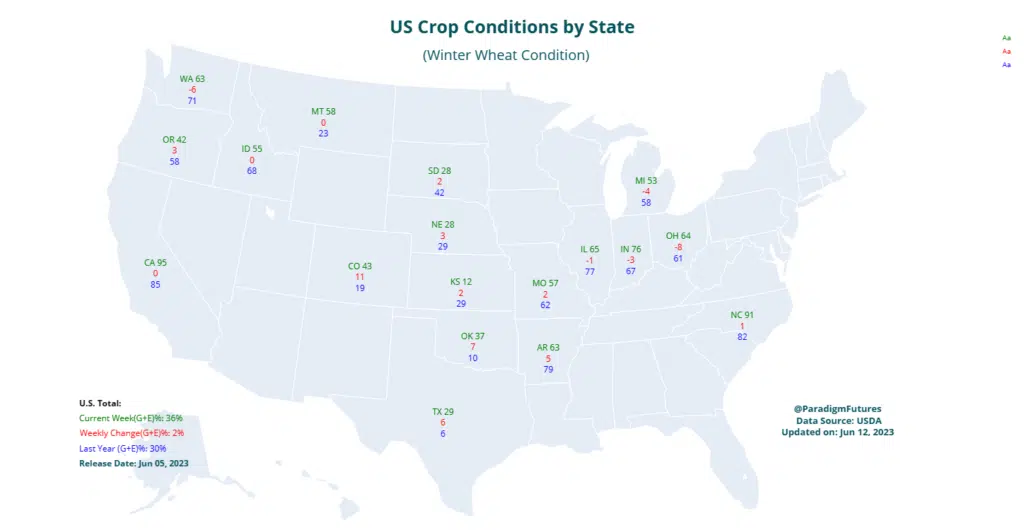

Winter Wheat🔹(G+E%) 38

+2% WoW

Crop conditions face concerns about continued dryness in the U.S. Midwest is underpinning corn and soybeans. Farmers and traders now want to see rain actually falling and not just forecast, despite some rain in the forecasts this week.

On Saturday, an Egyptian minister stated that a supplier who sold 55,000 tonnes of Russian wheat to Egypt could seek to source the grain from another country. This statement arose due to confusion surrounding a minimum price of $240 a tonne FOB, unofficially imposed by Russia.

The seller in Egypt’s tender last week sold Russian wheat at $229 FOB, while all other Russian wheat was offered at $240. From available reports it appears Russia could still have large volumes of wheat to sell from its crop this summer. However, an unofficial Russian minimum price could mean that other exporting regions would face less competition from cheap Russian wheat than previously feared.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.