USDA Thursday tightened its estimates for U.S. wheat, corn and soybean stocks. The forecast was higher than expected by analysts, helping to boost futures prices.

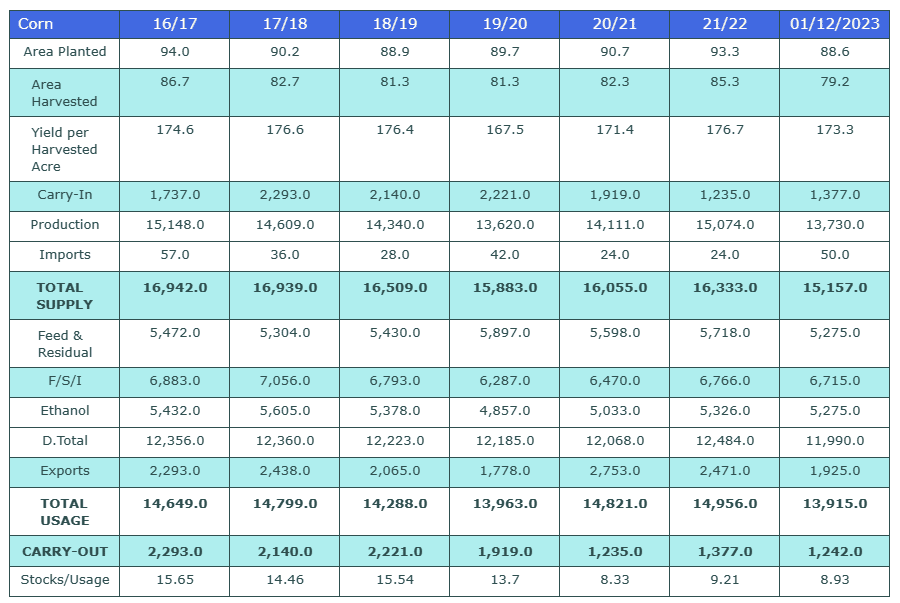

January WASDE- Grain Futures saw a solid Thursday following the release of USDA’s latest World Agricultural Supply and Demand Estimates report. Corn prices saw a modest improvement after the agency slashed production estimates by 200 million bushels. Soybean prices were also firm following a 69-million-bushel production reduction. That is a 7% and 4% reduction respectively. Farmers harvested just 79.2 million acres of corn last year, down from an earlier estimate of 80.8 million.

“Corn production is estimated at 13.73 billion bushels, down 200 million, as an increase in yield is more than offset by a 1.6-million-acre cut to harvested area,” USDA said in the January WASDE report.

And with less corn, more wheat is likely to go into feed, commented Suderman. That also contributed to stronger futures prices for wheat on Thursday.

U.S. soybean supplies are also tight. USDA trimmed its harvested acreage and production estimates for the 2022 crop and reported tighter supplies in the Grain Stocks report. Harvested acreage dropped by 300,000 and that resulted in the quarterly stocks coming in tighter than anticipated by about 90 million bushels.

USDA is now estimating U.S. soybean production for the 2022-23 marketing year at 4.276 billion bushels, down from a previous prediction of 4.346 million, according to WASDE. And the Grain Stocks report shows 3.02 billion bushels in storage as of Dec. 1.

Like to learn more about how grain futures can add great diversity and liquidity to your investment portfolio? contact us by clicking here.! https://paradigmfutures.net/contact/

Continue on for a full summary of the report.

Full WASDE Report Summary

Wheat

The January 2023 WASDE report indicates that feed and residual use has been raised due to higher second-quarter disappearance. The projected 2022/23 ending stocks for wheat have been lowered slightly due to larger domestic use. Wheat production has been raised in the EU, Ukraine, Kazakhstan, and India. Global ending stocks have been raised by 1.1 million tons to 268.4 million.

Coarse Grains

For coarse grains, the yield estimate has been raised by 0.01 acres to a record high of 14.2 tons per acre. The total corn use has been lowered by 185 million bushels to 13.915 billion. The foreign coarse grain outlook for this month is for lower production, greater trade, and reduced stocks. Brazil’s corn production has been cut due to dry conditions for the first-crop.

Cotton

The U.S. cotton production and ending stocks forecast has been raised for this month, with no changes to mill use or the U.S. share. Lower production in India has more than offset gains in the United States and Brazil. World trade is down 600,000 bales, to 41.7 million.

Soybeans

The U.S. Department of Agriculture’s latest Prospective Plantings report projects a record soybean crop in the U.S. Brazil’s 2021/22 crop is seen at 129.5 million tons. Argentina’s crop has been cut by 4 million tons due to lower area and dry weather. China’s imports have been lowered due to lower crush demand.

Sugar

Domestic use for sugar has been raised by 5.0 million cwt to 147.0 million, with ending stocks lowered by 6.0 million. Revisions for 2021/22 have increased beginning stocks by 4,472 STRV.

Meats

The report also indicates higher broiler and turkey production in the fourth quarter, offsetting lower beef and pork production. Milk production forecast has been lowered from last month with lower expected production per cow. The forecast for 2022 and 2023 for all components are lower.