USDA Weekly Export Inspections, Corn Misses Low Expectations, Soybeans & Wheat Come in At High-End Projections.

Asian trading saw firmer Chicago soybean futures on Monday due to concerns over reduced production in drought-hit Argentina and support from strong US exports this month, despite some relief from recent rains. The most-active soybean contract on the Chicago Board of Trade (CBOT) rose 1% to $15.24-1/2 per bushel. Wheat increased 0.6% to $7.54-1/2 per bushel and corn gained 0.4% to $6.85-1/2 per bushel.

A cold snap in the US Plains boosted wheat futures as it fanned worries about supply and potential escalations in the Russia-Ukraine war. The CBOT wheat outlook is stronger than usual but still not reaching the record 162,327 contracts seen in April 2017. Unlike 2016 and 2017, when funds held a net wheat short exceeding 100,000 contracts with strong open interest, the current scenario is different. CBOT wheat traded between $4.16 and $4.37 per bushel in April 2017, but as of Friday, the contract settled at $7.50 with a 2% increase in the last three sessions.

Traders also watched for signs of fresh demand from China, leading to higher corn prices. CBOT corn ended at $6.83 per bushel on Friday, a 5% increase from the month’s low and stronger than the year-ago $6.36. Both corn and wheat futures strengthened due to re-escalating tensions in the Black Sea and worries about insufficient supply there. March delivery corn futures rose 3 ¼ cents to $6.86 ¼ per bushel.

CORN -527,932 MT

Export inspections are down 200,860 MT from last week’s tally. Inspections are running 30.4% behind a year-ago, compared to 30.3% behind last week. USDA projects exports in 2022-23 at 1.925 billion bu., 22.0% below the previous marketing year.

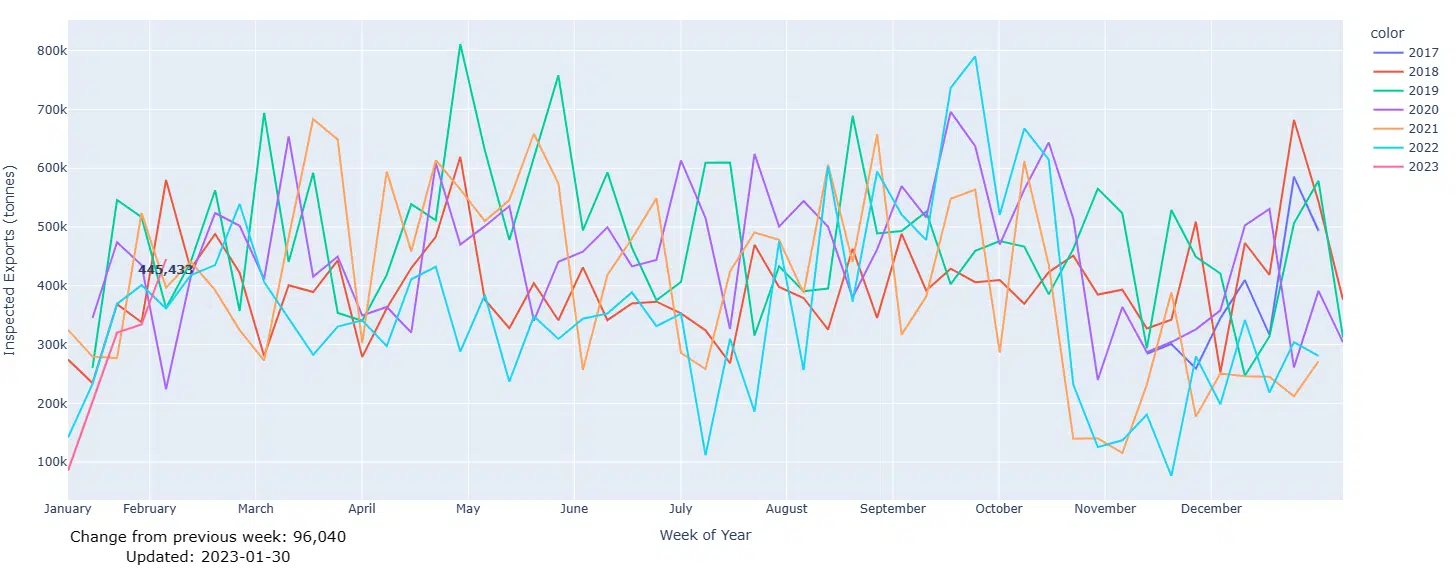

WHEAT- 445,433MT

Export inspections are up 96,040 MT from the previous week’s figure. Shipments are running 2.9% behind a year-ago, compared with 3.6% behind a year-ago last week. USDA projects exports in 2022-23 at 775 million bu., down 3.1% from the previous marketing year.

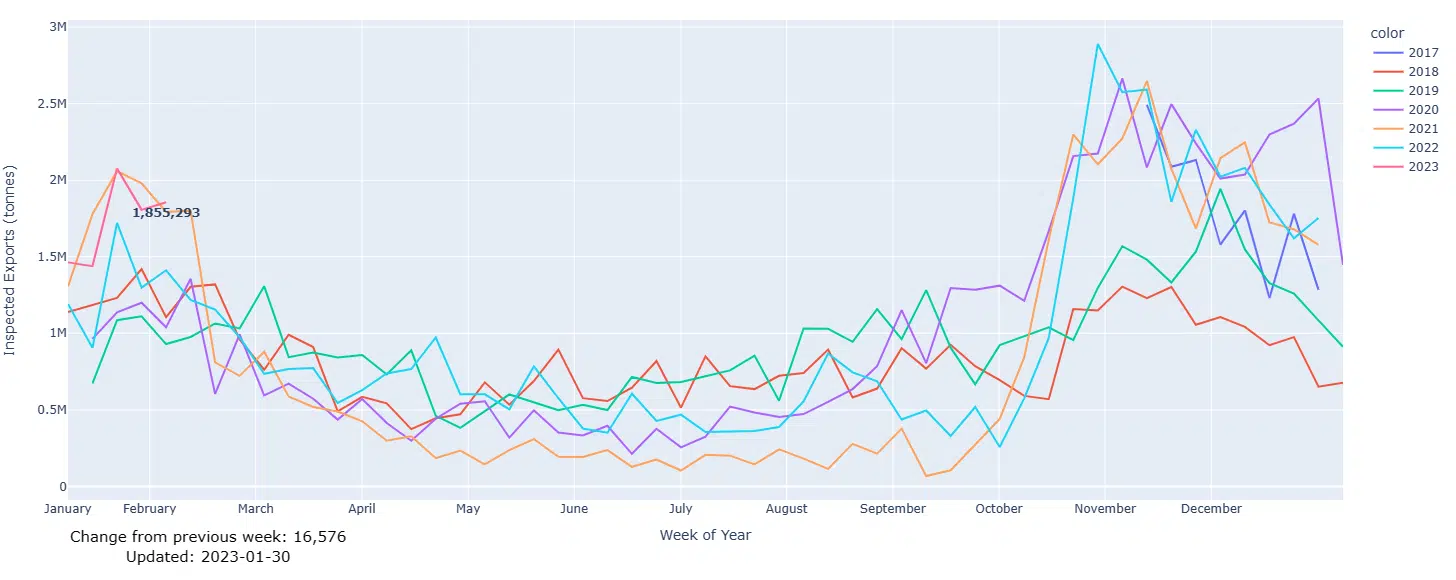

SOYBEANS -1,855,293MT

Export inspections are up 16,576 MT from last week’s tally. Inspections are running 1.3% behind a year ago, compared to 2.7% behind last week. USDA’s 2022-23 export forecast of 1.990 billion bu. is 8.0% below 2021-22.