Personal Income Increased, Spending Drops.

Personal income increased $49.5 billion (0.2 percent) in December, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $49.2 billion (0.3 percent) and personal consumption expenditures (PCE) decreased $41.6 billion (0.2 percent).

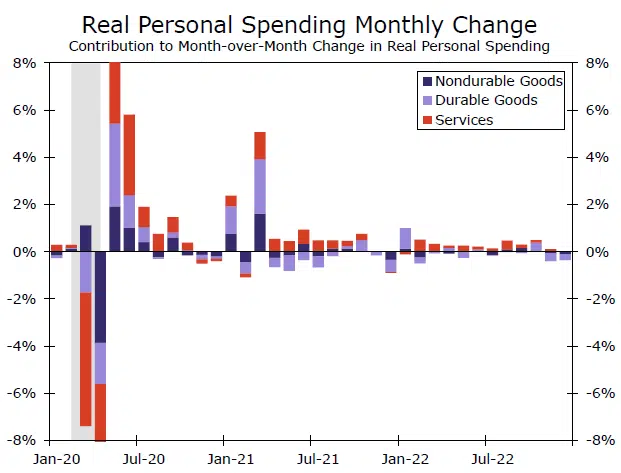

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 9). Real DPI increased 0.2 percent in December and Real PCE decreased 0.3 percent; goods decreased 0.9 percent and services were unchanged.

The Devil in the Details, GDP Highlights Shadowed by Today’s Report.

The staying power of consumer spending hit a hurdle in the fourth quarter. Despite a modest and temporary jump in the saving rate in December, many American households are facing mounting bills. After adjusting for inflation, spending on food, energy and other non-durable goods has decreased for two consecutive months.

The weakness is particularly evident in big-ticket durable goods items where real spending has decreased four out of the past five months, with the largest declines in November and December. The most disconcerting development is that real service spending stalled in December. Without the offset from this larger category that typically remains stable even during recessions, overall consumer spending ended the year with two consecutive monthly declines in real spending. This makes it very difficult for first quarter real PCE spending to come in positive.

The GDP report revealed that real personal consumption expenditures rose at a 2.1% annualized pace during the fourth quarter. However, a weak end to the year frames the first quarter of this year poorly. The economy was losing momentum as the quarter progressed, and today’s personal income and spending report confirms this trend. Overall, real consumer spending increased by 0.4% in October, before falling 0.2% in November and tumbling another 0.3% in December.

The drop in November was concentrated on the goods side, particularly real durable goods spending, which fell 2.1%. Marking the worst monthly drop in big-ticket outlays of the year. Spending on non-durable goods was down only slightly. The November goods weakness was partly offset by a modest 0.2% increase in real services outlays. However, the help from services vanished in December as real spending outlays stalled. Another drop in real durable goods, this time 1.6%, along with a 0.4% drop in non-durable goods resulted in an overall decline of 0.3% in real spending.