January OPEC Report, Looking Ahead to February 1st OPEC+ Meeting.

The OPEC+ meeting of the world’s top oil exporters, on Feb. 1 where it was expected to be no change in their production. The calming perception expected of this meeting probably changed on Monday, along with some increased attention to the outcome. Change to the otherwise all-but-known perception of what OPEC would do, when The Kremlin announced that President Vladimir Putin held a telephone conversation with Saudi Crown Prince Mohammed bin Salman, aka MbS, “to discuss cooperation within the group … in order to maintain oil price stability.”

Reports from Saudi Officials commented saying they “reviewed bilateral relations…” and “a number of issues of common concern were discussed.”

OPEC Report

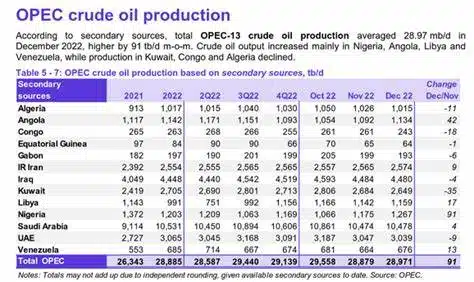

OPEC crude output was revised lower in October 2022 by 12 kb/d compared to last month’s report and November 2022 OPEC crude output was revised higher by 53 kb/d. Output has increased by 1088 kb/d since December 2021, from 27883 kb/d to 28971 kb/d in December 2022.

OPEC’s oil output decreased in January as a result of declining Iraqi exports and a lack of further recovery in Nigerian output, while Gulf members remained in strong compliance with the OPEC+ deal on production cuts to support the market. The survey found that OPEC pumped 28.87 million barrels per day (bpd), which is a decrease of 50,000 bpd from December. In September, OPEC reached its highest output since 2020. OPEC and allies, including Russia, collectively known as OPEC+, increased production throughout 2022 as demand improved. However, in November, with oil prices weakening, the group made its largest cut to production targets since the early days of the COVID-19 pandemic in 2020, calling for a 2 million bpd cut to the OPEC+ output target, with about 1.27 million bpd expected to come from the 10 participating OPEC countries.

The OPEC Reference Basket (ORB) averaged $79.68/b in December, with a 11.2% decrease or $10.05 drop month-over-month. The ICE Brent front-month average decreased 10.5% or $9.51 to $81.34/b. NYMEX WTI saw a 9% decrease, or $7.87 drop.

Demand, and Outlook.

Slight upward revision of the world economic growth forecast for 2022 to 3% is due to better-than-anticipated economic performance in various key economies in the second half of 2022. Despite the growth momentum, the world economy still faces challenges such as high inflation and monetary tightening by major central banks.

The world oil demand forecast for 2022 remains unchanged at 2.5 mb/d, but the third quarter of 2022 saw a downward adjustment due to declining demand in the OECD and China. The forecast for non-OECD countries outside of China was revised higher.

The US, Russia, Canada, Guyana, China, and Brazil drive the estimated 1.9 mb/d growth in non-OPEC liquids supply in 2022. Norway and Thailand are expected to experience the largest declines in production.

Refinery margins weakened in December in all main trading hubs, with the largest losses in the Atlantic Basin due to declining transport fuels. In Asia, elevated refinery runs and fuel supplies pressured margins.

Dirty freight rates in December declined from elevated levels as activities slowed before the seasonal holidays. VLCCs saw the biggest average decline, with spot freight rates on the Middle East-to-East route falling 31% month-over-month. Suezmax dirty spot rates dropped 22% on the US Gulf Coast to Europe route.

US crude imports followed seasonal trends and dropped to an eight-month low of 6.2 mb/d in December. Despite a cold wave that shut down US refineries and disrupted travel, US product flows remained steady. Initial figures show that crude imports into OECD Europe stayed at healthy levels until the end of the year.

Preliminary November data shows total OECD commercial oil stocks increased 2.7 mb from the previous month. Crude stocks declined by 25.8 mb, while product stocks rose by 28.5 mb month-over-month. OECD commercial stocks are 0.3 days above levels from the same month last year.

Demand for OPEC crude in 2022 remains unchanged from previous assessments, around 0.5 mb/d higher than in 2021. The demand for OPEC oil in 2023 also remained unchanged.