- ⛽EIA Energy Stocks🛢️

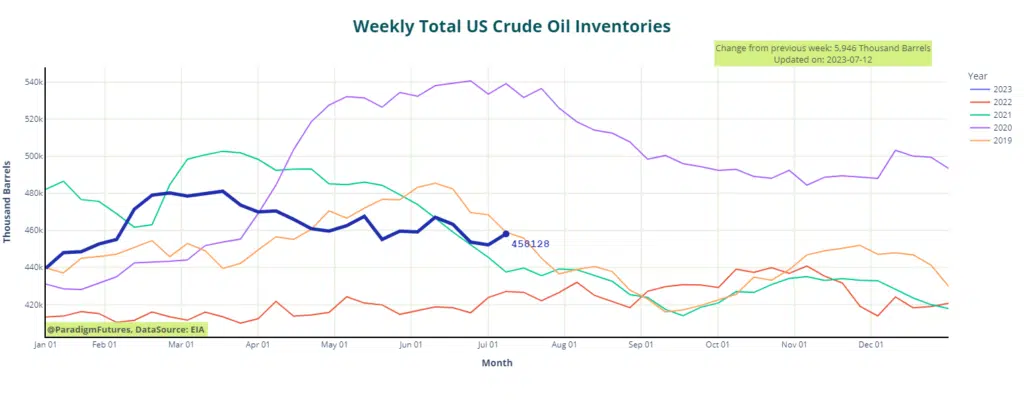

- Crude Inventories Up ⬆️ 5.9 M bbl

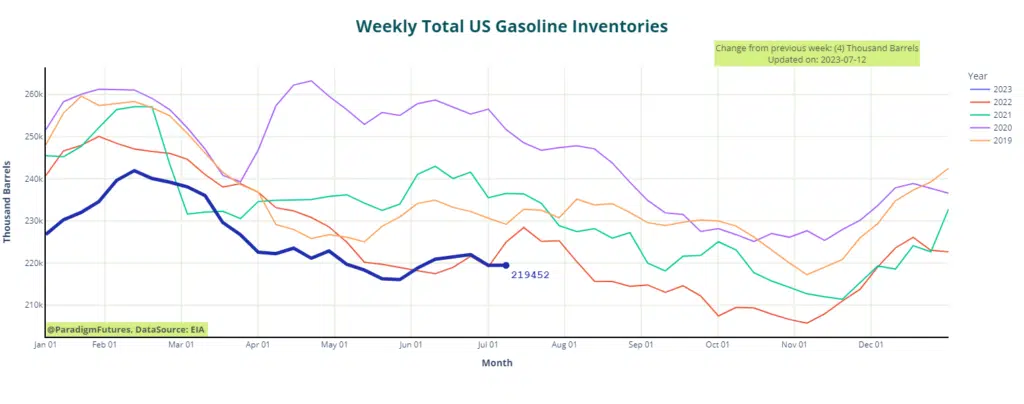

- Gasoline flat ⛔(virtualy no change)

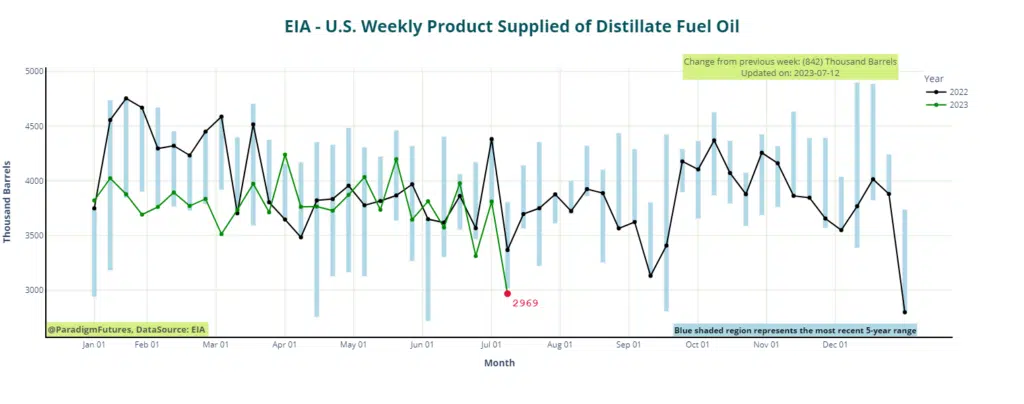

- Distillates up⬆️ 4.8M bbl

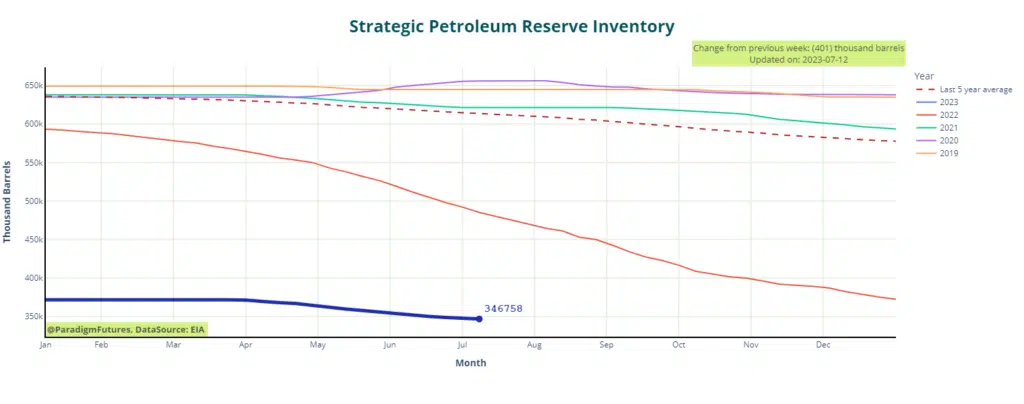

- SPR down 🔽 0.4M bbl

- Domestic prod: 12.3MMbpd

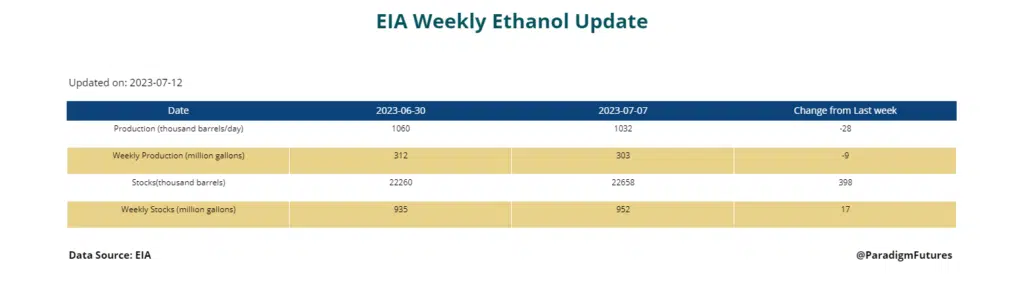

- Ethanol up⬆️398k bbl

- Impd mogas demand 8.76Mbpd

- Refiner utilization: 93.7%

Today, crude oil prices experienced a decrease following the U.S. Energy Information Administration’s report of a 5.9 million barrel inventory increase for the week ending on July 7.

This inventory increase stands in contrast to the previous week, which saw a modest drawdown of 1.5 million barrels that had little impact on prices.

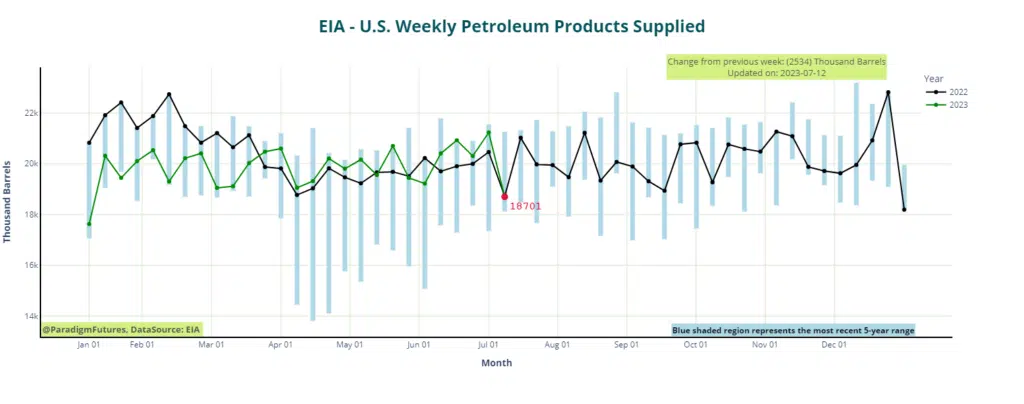

Regarding gasoline, the authority estimated a drawdown in inventory, while for middle distillates, it reported a significant rise in inventory.

Gasoline and Distillates

During the week ending on July 7, gasoline stocks only slightly declined, with daily production averaging 10.1 million barrels. These stocks are approximately 7% below the five-year seasonal average.

The previous week saw an inventory draw of 2.5 million barrels, indicating robust demand, alongside a daily production rate of 10.3 million barrels.

Last week, there was an increase in middle distillate stocks by 4.8 million barrels, with a daily production average of 5.1 million barrels.

In comparison, the previous week witnessed an inventory draw of 1 million barrels and an average daily production rate of 4.9 million barrels.

Earlier this week, prices began to rise as both OPEC and the IEA forecasted tightening global supply due to increased oil demand and production controls. Furthermore, there were indications of a decline in Russian oil export volumes, contributing to the upward movement of oil prices.

On another note, the American Petroleum Institute reported an inventory build of over 3 million barrels for the last week, following a draw of over 4 million barrels the previous week. Nonetheless, prices continued to climb due to other positive factors.Meanwhile, the latest U.S. inflation report indicated a lower-than-expected annual rise in inflation, at 3% instead of the anticipated 3.1%.However, when excluding food and energy prices, inflation stood at 4.8% on an annual basis, which remains higher than the desired level set by the Fed.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.