Draw Confirmed by todays EIA report, Crude Prices See Upside.

EIA Energy Stocks

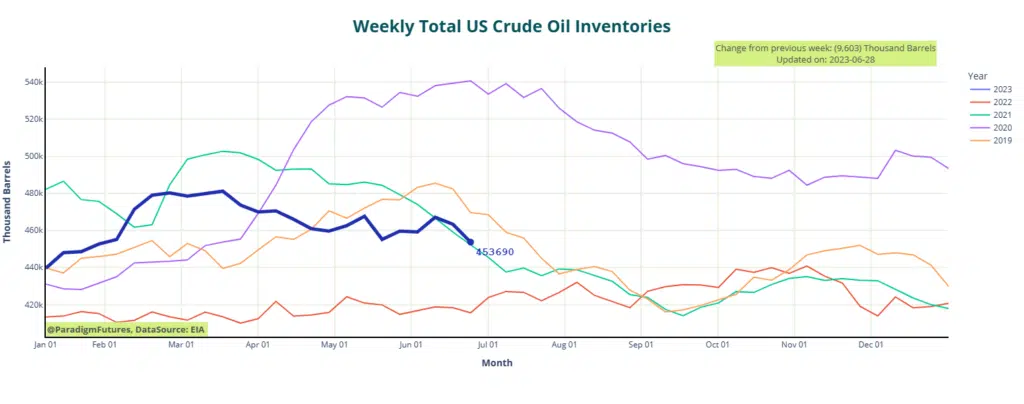

- Crude Inventories down 🔽9.6M bbl

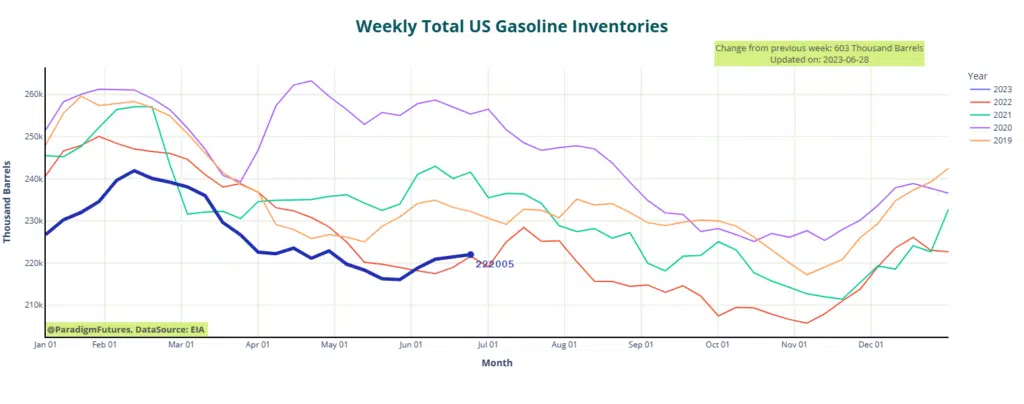

- Gasoline up 🔺0.6M bbl

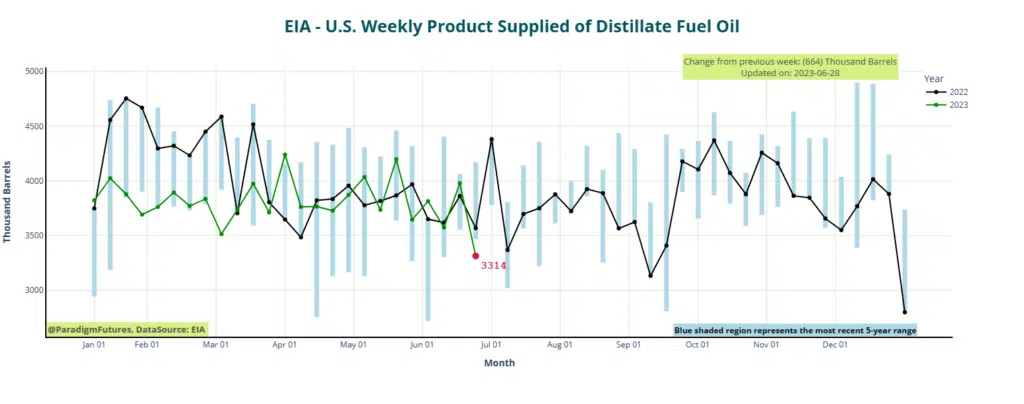

- Distillates up 🔺0.1M bbl

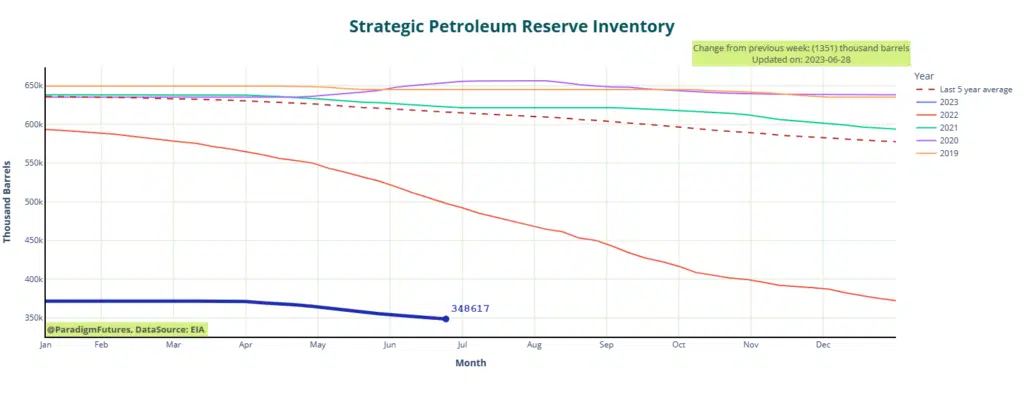

- SPR down 🔽 1.4M bbl

- Domestic prod: 12.2 MMbpd

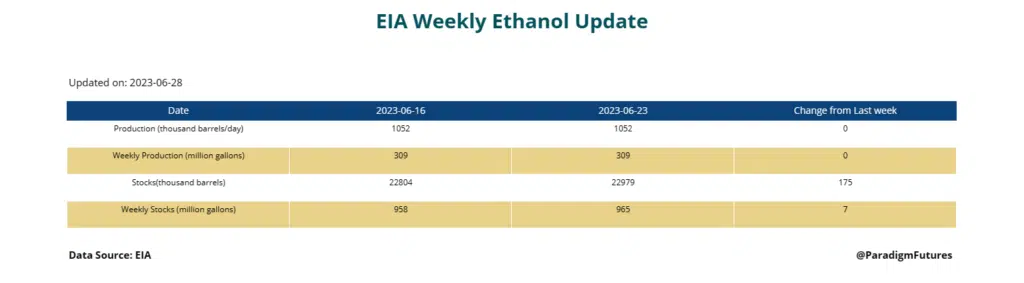

- Ethanol up ⬆️ 175k bbl

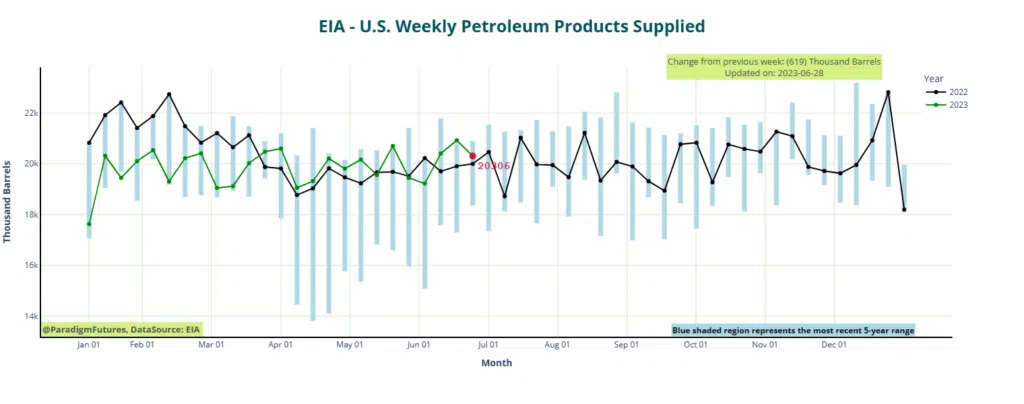

- Impd mogas demand 9.31Mbpd

- Refiner utilization: 92.2%

API Estimates (6/27/23)

Crude: -2.408M

Gasoline: -2.85M

Distillates: +0.777M

Today’s EIA report shows an inventory draw of 9.6 million barrels for the week ending on June 23, causing crude oil prices to move higher.

In comparison, the previous week saw an inventory decline of 3.8 million barrels. Despite its relatively large size, this decline failed to significantly impact prices.

Gasoline, Ethanol and Distillates

Regarding fuels, the EIA estimated modest inventory builds. Gasoline inventories increased by 600,000 barrels during the week ending on June 23, with a daily production average of 10.1 million barrels.

previous week saw a modest inventory build of half a million barrels and a daily production average of 9.8 million barrels.

In middle distillates, production averaged 4.7 million bpd, with an inventory increase of 100,000 barrels.

During the previous week, there was a moderate inventory addition of 400,000 barrels, while production averaged 5.1 million barrels daily.

Meanwhile, Central banks reinforced expectations of more rate hikes earlier this week. Christine Lagarde, the president of the Central European Bank, reinforced this by stating in a speech on Tuesday that inflation remained stubbornly high and central banks were not done with the hikes. She then warned of another ECB hike coming next month.

Lagarde said, “The central bank will unlikely be able to state with full confidence that the peak rates have been reached in the near future.”

“One analyst from Price Futures Group told Reuters, ‘Despite concerns for the slowing economy in Europe, they are going to put the pedal to the metal with interest rates, and that puts pressure to the downside.'”

In the U.S., consumer confidence appears to be on the mend. However, for the Fed, this is bad news that calls for more rate hikes.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.