Headline Number Shows Strength in Recent Employment Report.

What does the breakdown of the numbers show us? Are we in a strong jobs market; Or is it a house of cards?

- 311,000 jobs added.

- Unemployment ticks up.

- Wage growth slows.

- Participation rate still far lower than pre-pandemic

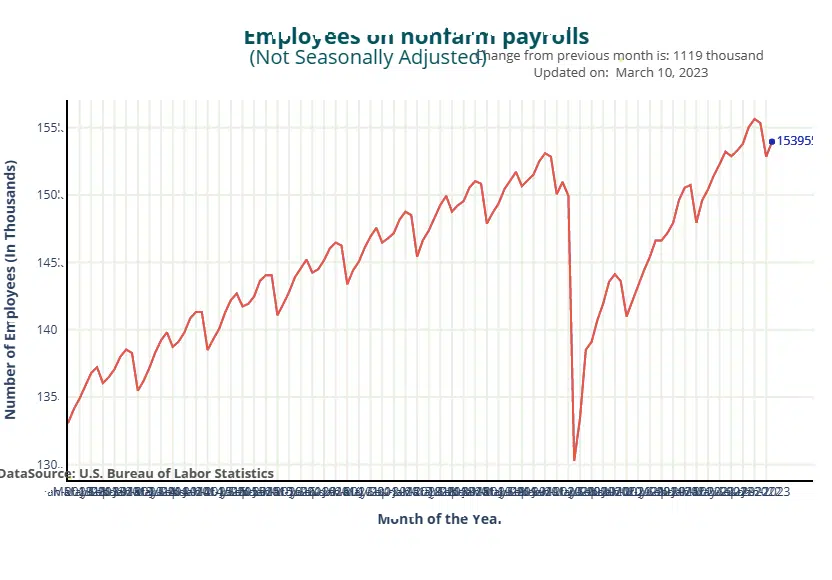

The US economy added jobs at a strong clip in February, according to the carefully anticipated employment data from the Labor Department. This suggests that the Federal Reserve will maintain interest rates higher for longer. Last month, there were 311,000 more jobs added to nonfarm payrolls. The number of jobs added in January that had previously been reported as 517,000 has been lowered to 504,000. 205,000 new jobs were predicted to be created by economists surveyed by Reuters. To keep up with the expansion in the working-age population, the economy must add 100,000 new jobs each month. But wage inflation appeared to be slowing down.

A number of variables, according to economists, including exceptionally warm weather, annual benchmark changes to the statistics, and too lenient seasonal adjustment factors, had artificially inflated the figures.

the increase of jobs in January. The seasonal adjustment model is used by the government to remove seasonal variations from the data. However, a portion of the strong consumer spending growth in January was related to seasonal considerations.

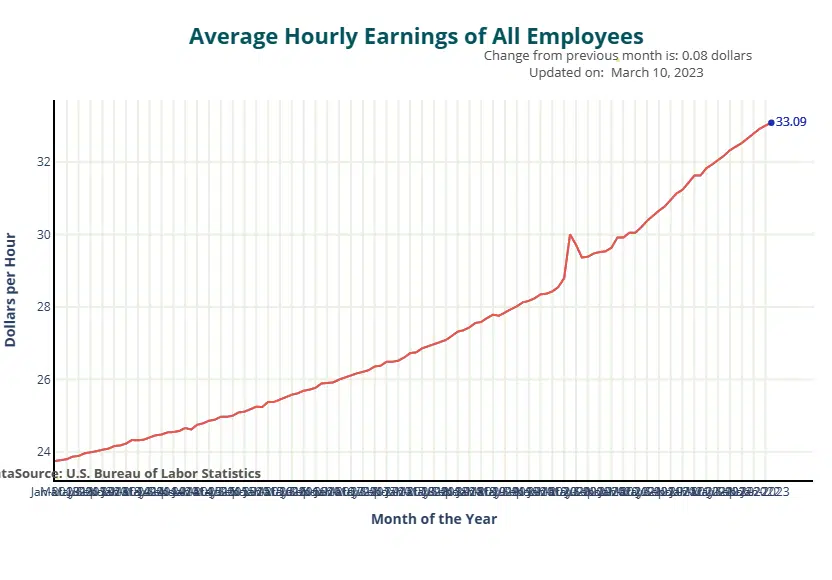

After rising by 0.3% in January, average hourly wages grew by 0.2% in the most recent month.

The topline number of a 311,000 increase in payroll, which is still quite significant, and a welcome sign to many over the previous year. ourly earnings increased by 4.7 percent, but only by roughly 3 percent over the previous two months. On the household side, the unemployment rate increased marginally to 3.6 percent due to a modest increase in labor force participation. Overall, the figures are consistent with a very solid job market that has only slightly cooled, according to Jay Powell and the Fed are committed to further cooling through interest rate increases. Indeed, the largest job market change since February 2020 is the growing difficulty employers have had filling jobs. A job vacancy rate of 4.5 percent in 2020 has grown to 6.5 percent in 2023 – down a bit from its peak last year of over 7 percent, but still very high by any standard. And the vacancy rate remains almost twice as high as the unemployment rate in the US, now at 3.6 percent.

Yet since it will be three full years before the job market reaches its pre-pandemic peak in February 2020, we can adopt a longer perspective. We went through a really severe dip in the job market during the pandemic, followed by an incredibly quick recovery (fueled by a great deal of fiscal and monetary stimulus). What, however, has changed more significantly in the last three years in the US labor market? Over that period, the number of available payroll jobs—which includes both filled and unfilled positions—has increased by a sizable 6.6 million, or more than 2 million a year. But 3.6 million of this extra employment, or more than half, are now in the service sector.

After this release and the revised down yet still huge January report, the elephant in the room “What will the decision be for the Fed in its upcoming meeting?” Will the back-to-back good jobs reports push a hawkish Fed to raise interest rates by 50bps? or are we likely to see another 25bps hike?

Look to the bond markets to get a feel for the general sentiment from investors and where they see it going. However, after his recent testimony on the Hill Chairman Powell at least in tone, would appear to signal a larger increase may be coming.