| EIA Energy Stocks Crude Inventories Up ⬆️10.2M bbl Domestic prod: 13.2MMbpd Gasoline Down ⬇️1.3M bblI mpld demand: 8.58Mbpd Distillates Down⬇️1.8M bbl SPR 🚫 No Change Refiner utilization: 85.7% |

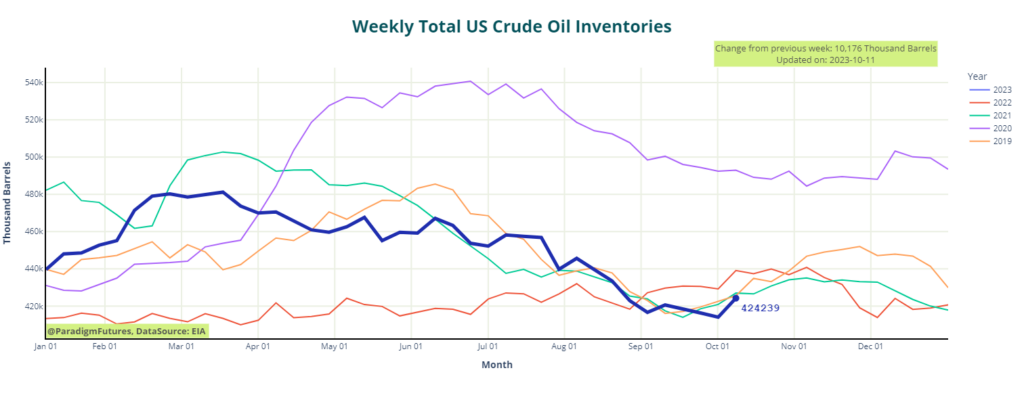

Crude Inventories See Substantial Increase.

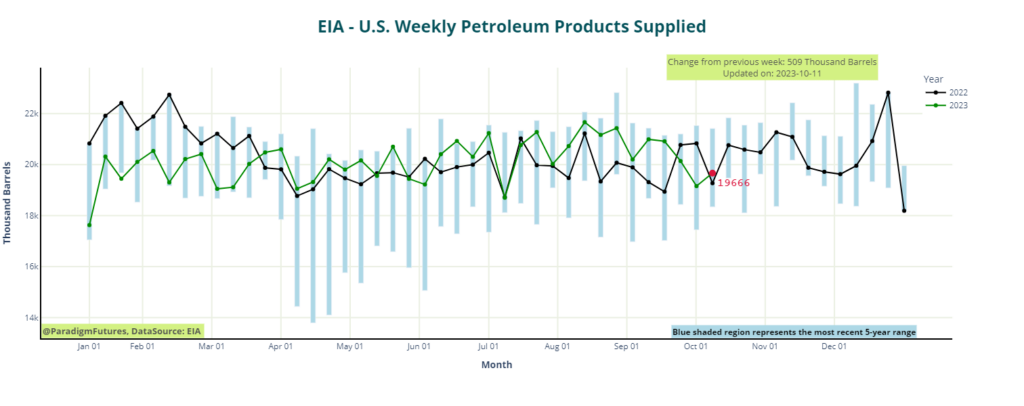

In a market that is ever-sensitive to inventory fluctuations and global events, the Energy Information Administration (EIA) recently reported a substantial inventory build of 10.2 million barrels for the week ending October 6. This notable change follows a previous week’s draw of 2.2 million barrels, which, surprisingly, failed to influence prices as anticipated. This lack of price response was due to the EIA’s simultaneous estimation of a significant increase in gasoline inventories, raising concerns about the state of demand.

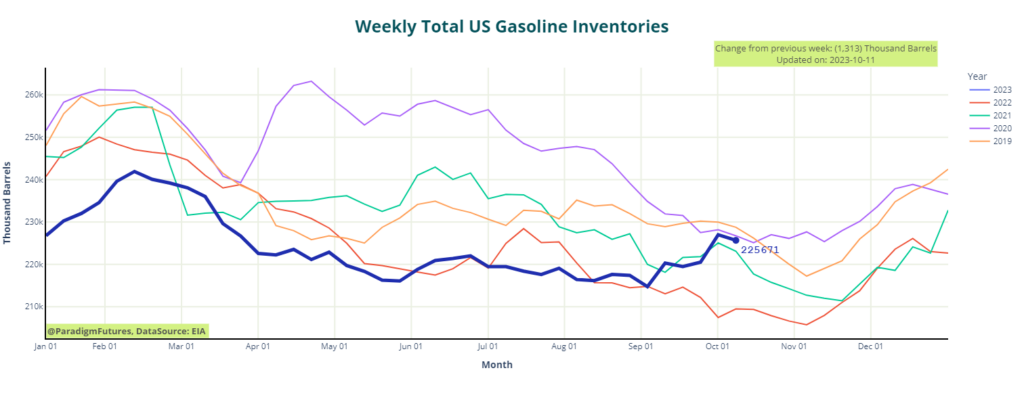

Gasoline Inventory Trends

For the first week of October, the EIA reported a 1.3 million barrel decline in gasoline inventories, marking a stark contrast to the previous week when inventories saw a considerable 6.5 million barrel build. Gasoline production for the reported week averaged 9.7 million barrels per day, up from 8.8 million barrels per day in the last week of September.

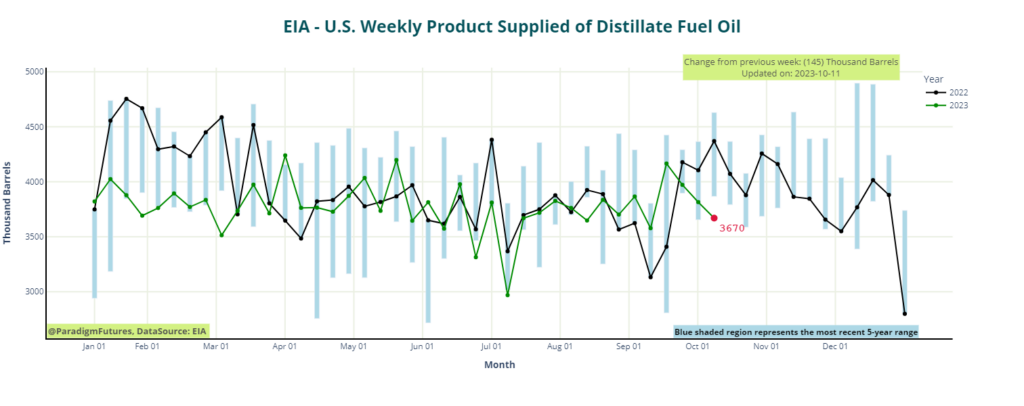

Middle Distillates and Production

Regarding middle distillates, the EIA estimated a 1.8 million barrel draw for the week ending October 6, following a 1.3 million barrel draw in the prior week. Middle distillate production remained relatively stable at 4.7 million barrels daily, showing minimal change compared to the previous week.

Price Movements and Geopolitical Factors

Crude oil prices have experienced a series of fluctuations this week, with a notable retreat on Thursday following the American Petroleum Institute’s (API) report of a staggering crude inventory build of almost 13 million barrels for the week ending October 6. This sudden surge in inventories led to a drop in prices, despite the war premium added due to recent developments in the Middle East.

Commenting on the war premium, ING analysts noted that if the conflict in the Middle East remains confined to Israel and Palestine, the war premium could gradually diminish. However, if Iran becomes involved, the potential U.S. response in the form of sanctions could tighten the supply situation in the coming year.

The API’s reported inventory build could be a result of seasonal refinery maintenance, suggesting that it might be temporary. Conversely, JP Morgan analysts pointed out that fuel prices are starting to impact demand negatively, indicating that bearish pressures could grow stronger in the near future.

“Tenterhooks”

The International Energy Agency (IEA) expressed the view that oil markets would “remain on edge as the crisis continues to evolve.” Given the fluid and uncertain nature of the Middle East conflict, the IEA stressed the rapid pace of events. Amidst the context of oil markets that have been tightly balanced for a considerable period, the global community will maintain a vigilant focus on the potential risks to the region’s oil supply.

The IEA further emphasized its commitment to closely monitoring the oil market, with a readiness to take action as needed to ensure a consistent and adequate supply to the markets.

Oil prices had loomed near the $100 per barrel threshold in mid-September, following an agreement between Saudi Arabia and Russia to extend production cuts through the end of 2023. Additionally, low levels of crude oil and distillate inventories had added to the market’s nervousness.

As the energy market remains ensconced in a dynamic and intricate landscape, where inventory figures and geopolitical developments wield substantial influence over crude oil prices, both investors and analysts continue to scrutinize these factors closely. The industry is in a state of constant change, with potential shifts in supply and demand poised to shape the course of oil markets in the months ahead.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.