EIA Petroleum Report 3/1

Crude Inventories build at a slower pace, while Gas and Distillates see strong draw.

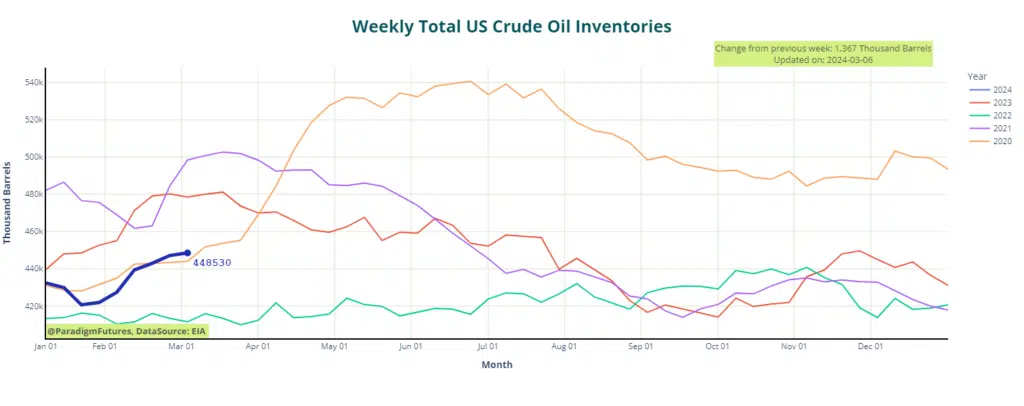

In its latest update, the U.S. Energy Information Administration (EIA) revealed a build of 1.4 million barrels in crude oil inventories for the week ending March 1. This comes in contrast to the previous week’s build of 4.2 million barrels, accompanied by a draw across Distillates and Gasoline.

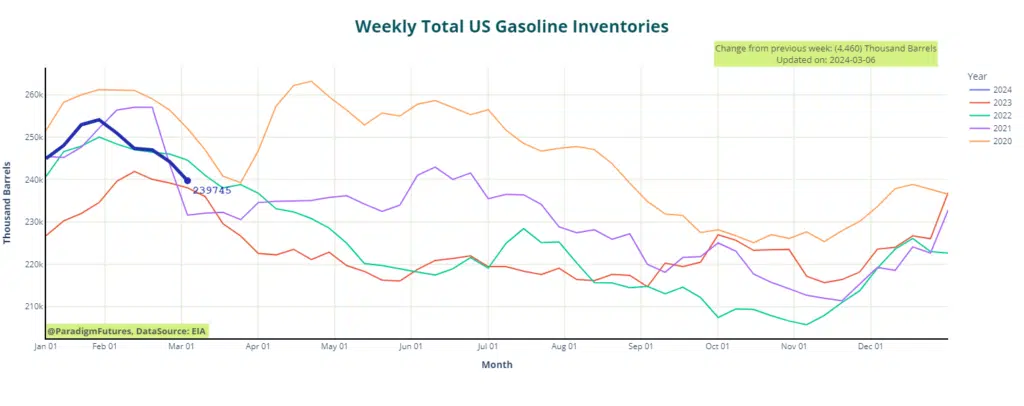

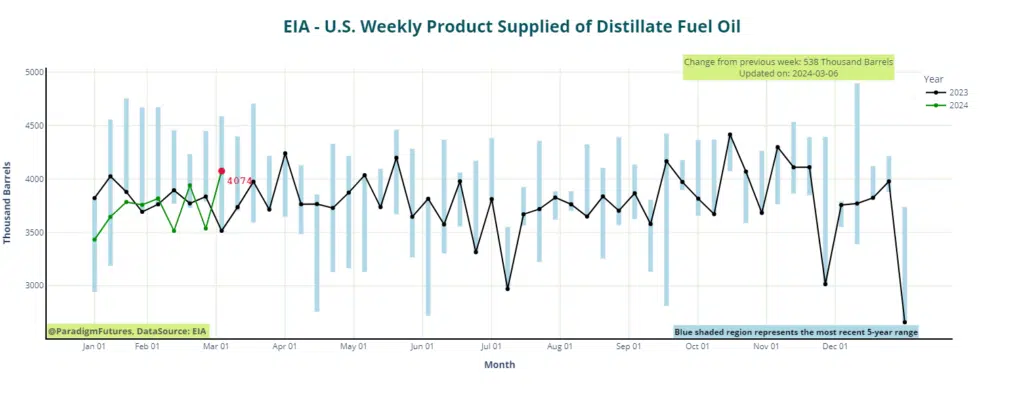

The EIA‘s report also highlighted significant draws in gasoline and middle distillate stocks, with both experiencing decreases of over 4 million barrels each. In comparison, the American Petroleum Institute had reported a modest crude inventory increase of 423,000 barrels for the same week.

Gas & Distillate Product Draw.

Gasoline inventories, according to the EIA, saw a substantial decline of 4.5 million barrels in the last week of February, contrasting with a draw of 2.8 million barrels in the previous week. The daily average gasoline production increased from 9.4 million barrels to 9.6 million barrels over the same period.

For middle distillates, the EIA reported a draw of 4.1 million barrels in inventories for the week to March 1, compared to a draw of half a million barrels in the prior week. Middle distillate production remained virtually unchanged at 4.3 million barrels daily.

OPEC+ and China’s Policy Shift traders focus.

While the oil market observed these inventory dynamics, oil prices experienced a slight uptick earlier in the day. Traders shifted their focus to the latest developments in the OPEC+ meeting, temporarily setting aside concerns about Chinese economic activity and U.S. demand. This shift despite China’s recent announcement of new measures to stimulate growth, which fell short of market expectations.

Despite the lack of details, the market witnessed a rise in prices as the realization that OPEC+ would persist in withholding 2.2 million barrels per day from the global market for another three months.

Open a Trading Account – Paradigm Futures

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.