Minutes from Januarys’ FOMC Meeting Shows Officials Reluctant to Make Cuts Too Quickly.

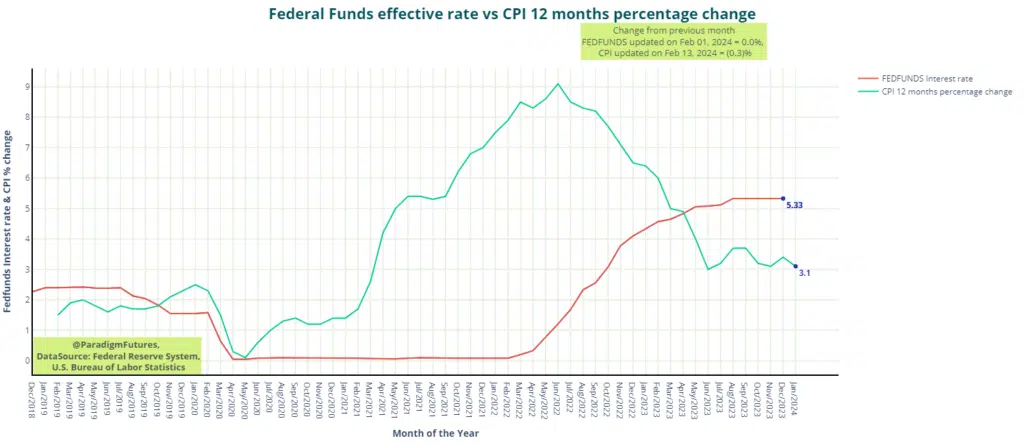

The recently released minutes from the Federal Open Market Committee’s (FOMC) meeting held on January 30-31 revealed that most Federal Reserve officials on the central bank’s monetary policy committee underscored the risks associated with moving too quickly to ease policy. While a couple of officials discussed the potential risks of keeping policy too restrictive for an extended period, there was no explicit discussion on the timing of reducing the current interest rate range of 5.25%-5.50%.

Key Points from the Minutes:

Risk Assessment:

The minutes highlighted the prevailing sentiment among committee members about the risk of a hasty move in policy easing. Most officials expressed concerns about potential consequences if policy adjustments were made hastily.

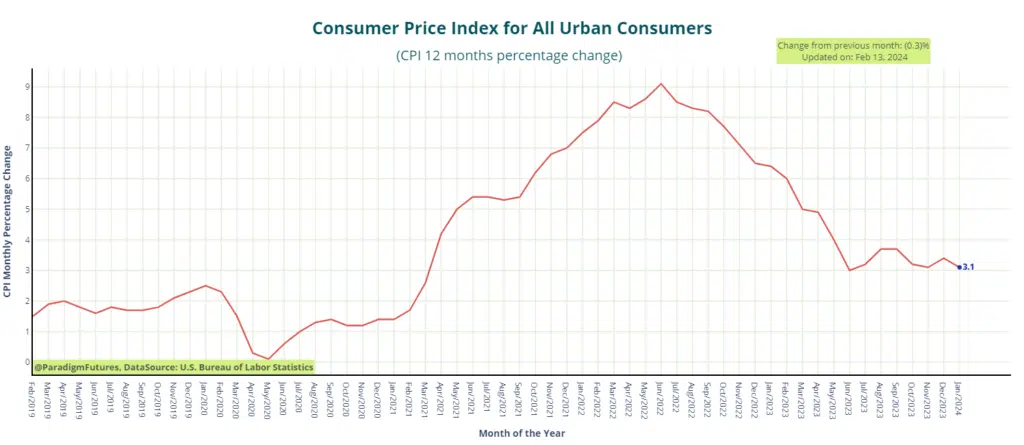

Inflation Monitoring: The FOMC emphasized the importance of monitoring incoming data to assess whether inflation continues to move toward the Fed’s 2% inflation goal. There was no specific discussion on when the committee might consider reducing interest rates.

Neutral Commentary:

Some commentary in the minutes remained fairly neutral regarding the next move in monetary policy. Officials indicated their readiness to adjust the stance of monetary policy if risks emerged that could impede the committee’s goals.

Balance Sheet Reduction:

The FOMC also discussed the process of reducing the size of the central bank’s balance sheet. With ongoing reductions in the usage of the overnight reverse repurchase (ON RRP) facility, many participants suggested it would be appropriate to initiate in-depth discussions on balance sheet issues at the Committee’s next meeting. The goal is to guide an eventual decision to slow the pace of runoff.

The minutes reflect a cautious approach by the FOMC, emphasizing the need for careful consideration of risks and a data-dependent approach to monetary policy adjustments. As discussions on the balance sheet reduction gain prominence, the committee is gearing up for a comprehensive evaluation of these issues in the upcoming meetings.

The Ides of March

March is set to be a pivotal month for the Fed as it contemplates its next move. With the January Inflation reports causing pause for many policy makers. Just over a week before the next FOMC Meeting will be the ending of its Bank Term Funding Program (BTFP). a lending program established in the wake of the banking crisis, to expire on March 11, 2024, rather than opting for a renewal.

The BTFP was instituted on March 12, 2023, following the collapse of Silicon Valley Bank due to a surge in customer withdrawals exceeding the bank’s available cash. The Federal Reserve introduced the program to provide additional funding, ensuring banks had the capacity to meet the needs of their depositors.

The Fed, in creating the BTFP, aimed to address unusual market conditions arising from the collapses of Silicon Valley Bank and Signature Bank. The program’s terms were structured generously to navigate these unique challenges.

As the FOMC approaches the decision on the fate of the BTFP, market analysts will closely monitor developments, anticipating the committee’s assessment of the current financial landscape and the necessity of such lending programs.