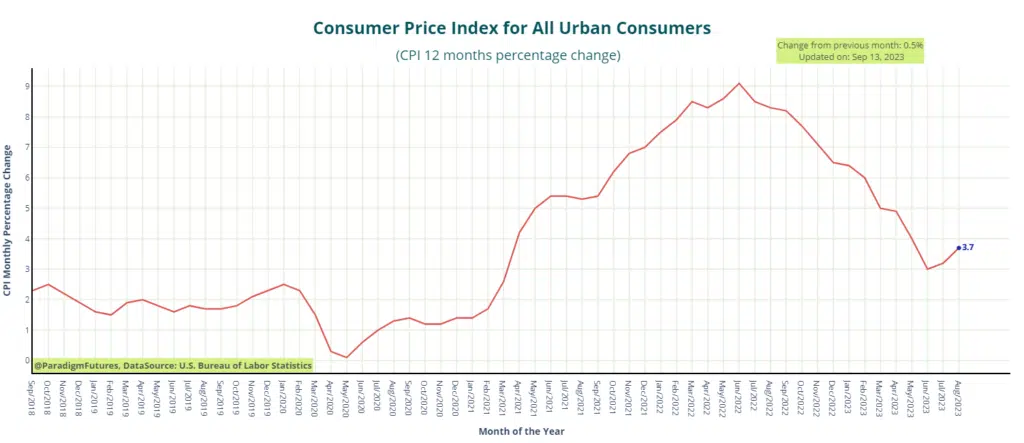

Consumer Price Index climbs again ahead of pivotal FED meeting.

August CPI

– MoM CPI: +.6%

– YoY CPI: +3.7%

– MoM Core CPI: +.3%

– YoY Core CPI: +4.3%

– CPI Energy Prices +5.6%

– Food Prices +0.2%

Core and Headline Inflation

In August 2023, rising energy costs and related services primarily drove the acceleration of Consumer Price Inflation for the 12 months ending, reaching 3.7%. However, the Federal Reserve prefers to exclude food and energy costs, which came in at 4.3%, continuing the disinflation trend in this series since March 2023. This rate remains well above the Fed’s 2% annual inflation target. The monthly inflation rate for August 2023 stood at 0.6% for headline inflation and 0.3% when excluding food and energy.

Some underlying trends in the CPI report may give JPOW some encouragement, the Fed may still be tempted to consider a further interest rate hike in 2023, possibly in November, to expedite the achievement of its 2% inflation goal. Another CPI report is scheduled for October 12, a few weeks before the Fed’s November 1 meeting. The Fed’s upcoming decision on September 20 is widely expected to maintain steady rates, in line with recent statements from Fed officials and interest rate futures forecasts.

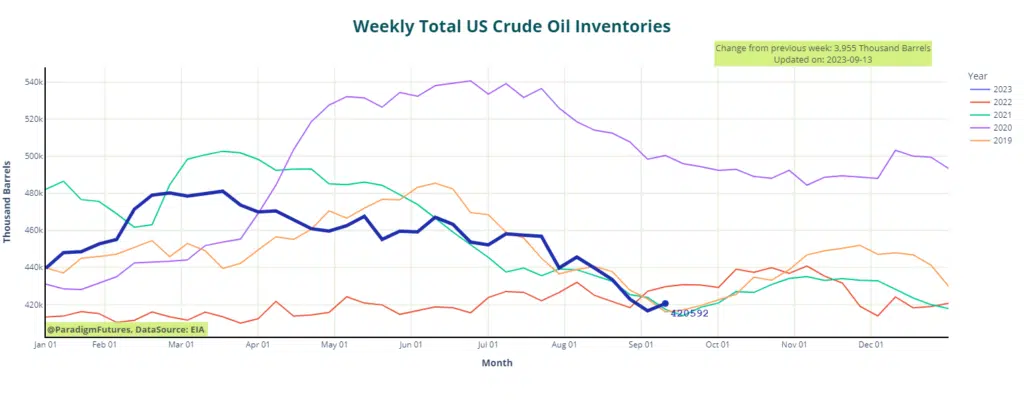

Rising Energy Prices

Higher energy costs drove the acceleration in headline inflation numbers, as energy commodities surged by over 10% in August. This trend likely influenced price increases in energy-intensive categories such as transportation services and airline fares. The continuity of this trend throughout September remains uncertain. However, recent developments, including OPEC’s announcement to uphold production cuts through December and the Biden Administration’s decision to cancel the seven remaining oil leases in Alaska, which would have increased production by an additional 180,000 barrels per day, may impact energy market dynamics and, consequently, inflation trends.

Today’s EIA report did show a break in the recent trend of the previous 4 reports, with inventory builds in all major categories. The Energy Information Administration reported a 4-million-barrel inventory build for the week ending September 8. This contrasts with the previous week’s 6.3-million-barrel draw, following a significant 10.6-million-barrel decline.

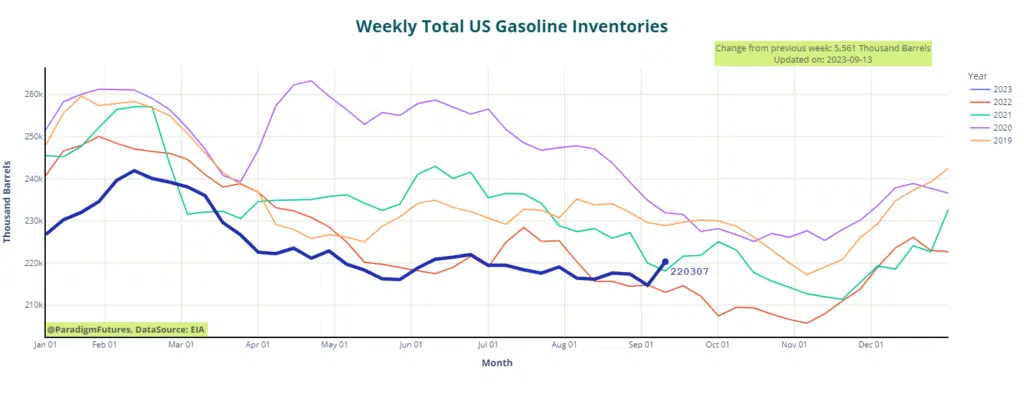

In the fuels category, the EIA estimated a gasoline build and a middle distillate stock increase. This compares to the previous week’s 2.7 million barrel draw and a daily production rate of 9.8 million barrels.

For middle distillates, the EIA reported a 3.9-million-barrel inventory build for the week ending September 8, with production at 5 million bpd. This contrasts with a modest 700,000-barrel inventory build in the previous week, with production remaining at 5 million barrels daily.

Oil prices have reached a 10-month high as traders shift their focus to supply concerns, with worries about demand slowdown in major consumers taking a back seat.

Alongside recent production control announcements from Russia and Saudi Arabia, the shutdown of oil terminals in Libya due to a storm has contributed to the perception of tighter supply.

Home Price Disinflation?

While shelter costs in the August CPI data continued to rise, the rate of increase was slower than in previous periods. This should provide some comfort to the Fed, although this trend aligns with expectations based on past movements in home prices.

Shelter costs hold significant importance in the CPI due to their substantial weighting. If this trend continues, it may contribute to lowering inflation. However, it is worth noting that shelter costs typically follow home prices with a time lag. The Fed has expressed concerns regarding home prices, as despite their decline in late 2022 and early 2023, they have rebounded overall since spring. Therefore, this favorable trend in core inflation may not be sustainable.

Services Costs

The August CPI data revealed some concerns for the Fed regarding services prices. While many categories exhibit month-to-month volatility, both medical and transportation services experienced price increases compared to recent months. The Fed closely monitors this category, and the most recent data did not indicate significant disinflation, despite more favorable trends in previous months.

Muddy Waters Ahead:

Uncertainty looms over several key developments and the impact they will ultimately have on the broader economic picture and energy demand.

Tomorrow, the FOMC will have more data to consider, as the PPI and job data are set to be released at 8:30 CDT on September 14th. As we approach the end of the week, there is also the looming possibility of a UAW Auto Workers Strike, which could have a significant temporary impact on the US economy. This could affect vendors and suppliers, potentially causing substantial disruptions.

Analysts have projected that a mere 10-day strike could inflict a significant $5.6 billion blow to the economy. Moreover, should US automakers acquiesce to the union’s demands, it will usher in additional costs surpassing $80 billion for each of the major automakers, primarily in terms of labor expenses. This exacerbates the predicament facing the US industry, which is already grappling with stringent regulations and an unrealistic push towards “green energy” and the unprofitable production of electric vehicles.

Looking ahead to the upcoming month, the resumption of US student loan payments is poised to impact consumer spending, particularly in discretionary categories. This development coincides with the alarming rise in US consumer debt to an all-time high. The potential strike and the ensuing downturn in consumer spending raise significant questions about their broader repercussions. It remains uncertain how this will affect the overall economic landscape. However, most scenarios suggest a high probability of increased prices and greater challenges for the Federal Reserve.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.