USDA Grain Export Sales

-

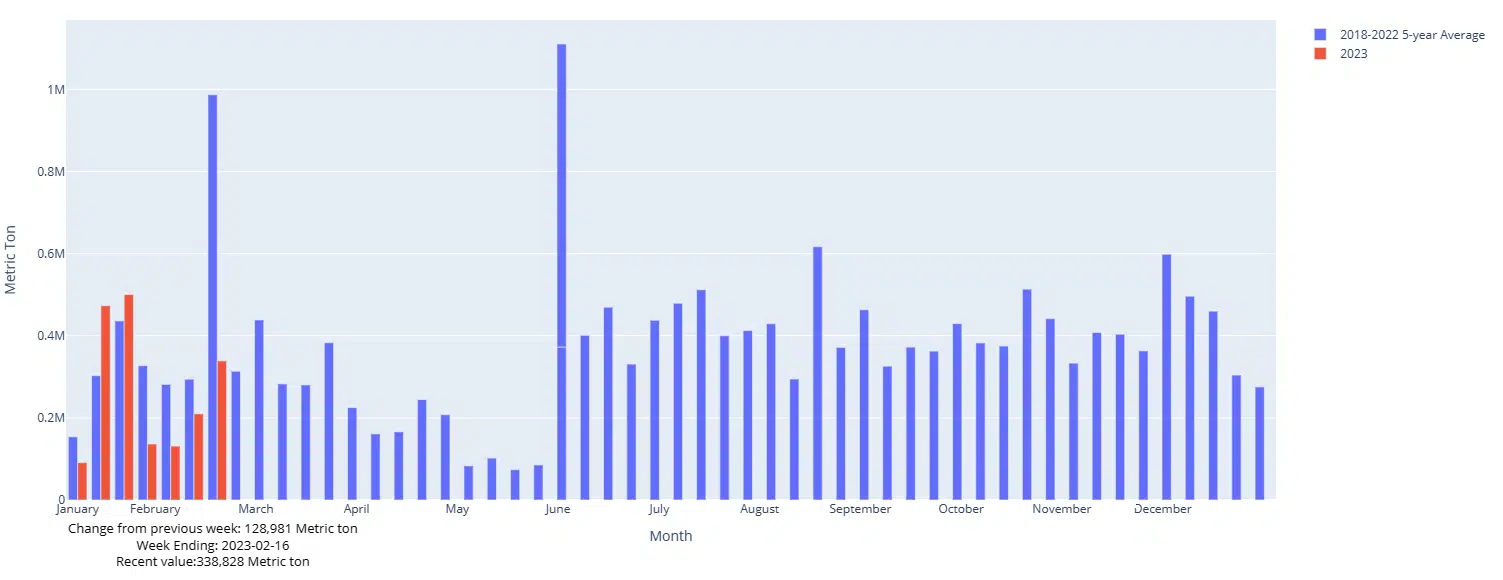

Corn Exports 💠 823,200 MMT

-

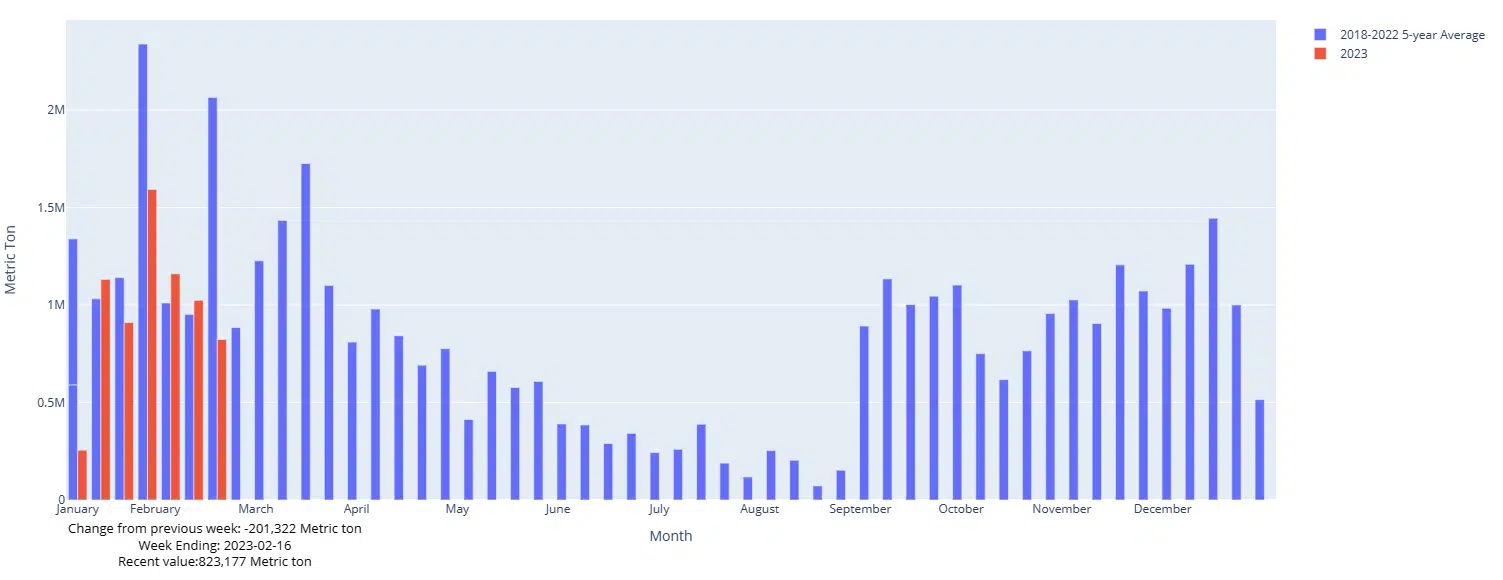

Soybean Exports 💠 544,900 MMT

-

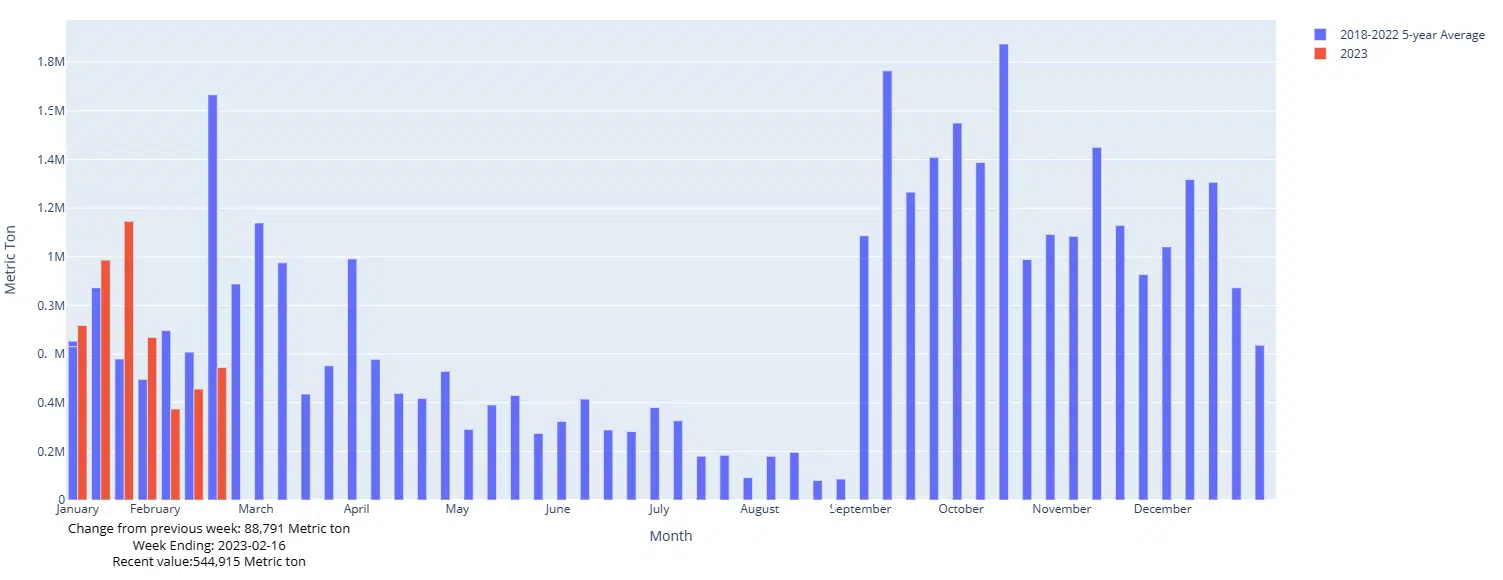

Wheat Exports 💠 338,800 MMT

Breakdown of the USDA Export sales, Week Ending 2/16/23

Corn

Exports of 687,400 MT were up 3 percent from the previous week and 7 percent from the prior 4-week average. The destinations were primarily to Mexico (272,300 MT), Japan (137,000 MT), Taiwan (83,600 MT), Export commitments are 39.8% behind a year-ago compared to 40.2% behind last week. USDA projects exports in 2022-23 at 1.925 billion bu., 22% below the previous marketing year.

Soybeans

Exports of 1,739,700 MT were down 6 percent from the previous week and from the prior 4-week average. The destinations were primarily to China (1,057,800 MT, including 16,000 MT – late), the Netherlands (125,200 MT), Germany (124,300 MT) Commitments are running 1.5% behind a year-ago, versus nearly even last week. USDA projects exports in 2022-23 at 1.990 billion bu., down 8.0% from the previous marketing year.

Wheat

Exports of 338,000 MT were down 32 percent from the previous week and 25 percent from the prior 4-week average. The destinations were primarily to China (68,300 MT), Japan (64,000 MT), Thailand (56,900 MT), Mexico (55,300 MT), and Taiwan (51,500 MT). Wheat Exports are running 2.0% behind a year-ago, compared to 5.5% behind last week. USDA projects exports in 2022-23 at 775 million bu., down 3.1% from the previous marketing year.