John Caruso

Senior Market Strategist

Market Risk:

*China PBOC injected > $1T yuan in three days to alleviate cash squeeze

*Japan’s Finance Minister Suzuki: Both the government and the BoJ continue to face fiscal issues in Japan. Inflation has yet to consistently and sustainably reach BoJ’s 2% target.

*US Initial Claims 196K vs 190K exp vs 183K previous; Continuing claims rise to 1.688M

SP500 -0.84%, Nasdaq -0.85%, Russell 2000 -1.3%

As FOMO and 0DTE has been the story of 2023 to date alongside the fed pivot/pause/soft landing/beginning of a new secular bull (we’ve heard it all in the last 4 weeks) = buy stocks …. I should remind you of this ….

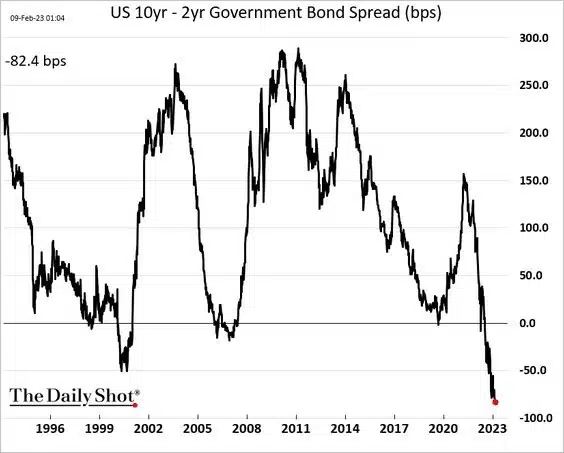

Yield Curve comparisons … 2001/2008/2023 – yes, we’re more upside down now than in those 2 previous cycles declines

I’ll also note that when the yield curve begins to finally un-invert or flatten – that’ll likely be your sign of a pivot by the Fed and likely real trouble for the economy. We’re not quite there yet.

Also, noteworthy-

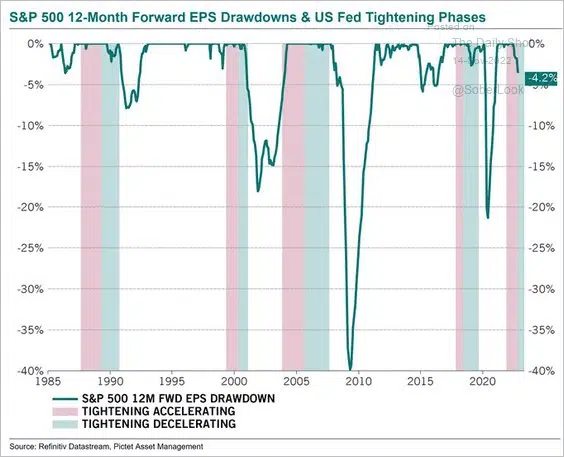

This chart shows that real earnings declines don’t really begin until the FED SLOWS or PAUSES its pace of hikes…. So yes, be careful chasing the Fed Pause narrative.

(Red shaded area is accelerating Fed Tightening – Green shaded area is decelerating tightening)

The Fed appears to be “data dependent” at the moment, but seemingly willing to raise the bar if necessary. The next major data point we’ll get is next Tuesday’s CPI.

*Everything on my board either signaling immediate OS or OB

*Stocks OS with VIX OB – but the VIX bottom is right on time – I’m staying with core shorts on Equities despite a likely bounce.

*Gold now signaling a lower low and lower high – there’s still likely another long side trade on the way here though – I’ll probably make a move again here.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment.