EIA Shows Second Consecutive Large Build, as Opec Set to Meet Sunday.

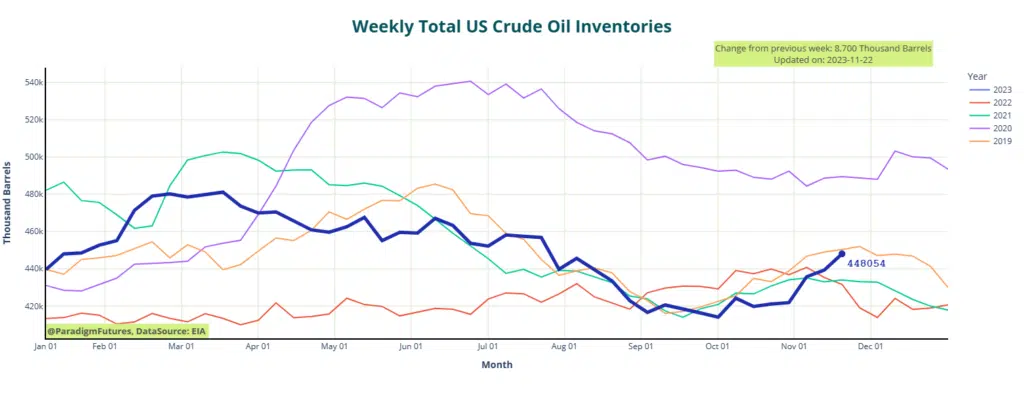

Crude oil prices faced downward pressure today following a substantial inventory build of 8.7 million barrels reported by the U.S. Energy Information Administration for the week ending November 17. This stark increase contrasted with the 3.6 million barrels added the previous week (ending November 10) and surpassed the estimated 9 million barrel build reported by the American Petroleum Institute for the same period.

Gasoline and Distillates.

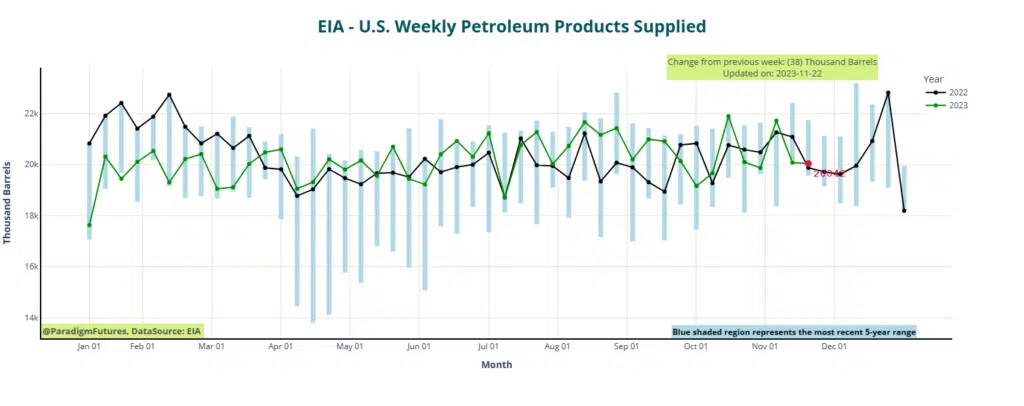

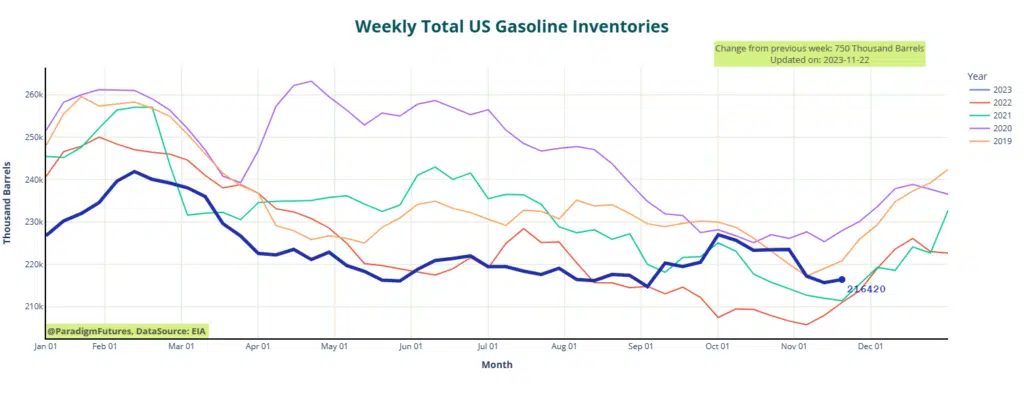

In the realm of fuels, the latest EIA data indicated mixed inventory changes. Gasoline stocks saw an addition of 700,000 barrels in the seven days leading up to November 17, with daily production averaging 9.4 million barrels. This marked a shift from the prior week, which experienced a drawdown of 1.5 million barrels and the same production average.

Moving to middle distillates, the EIA estimated a drawdown of 1 million barrels for the week ending November 17, with production averaging 4.9 million barrels per day. This contrasted with the previous week’s drawdown of 1.4 million barrels and an average daily production of 4.8 million barrels.

The API report on Tuesday played a role in pushing oil prices lower, and this trend continued as market participants awaited the OPEC+ meeting scheduled for the upcoming weekend. Andrew Lipow of Lipow Oil Associates noted, “Going into the long weekend, the market would rather be a little bit long than short,” emphasizing the cautious sentiment prevailing in the market.

Awaiting OPEC Decision.

The OPEC+ meeting on Sunday holds significance as market observers anticipate potential production cuts in response to weaker benchmark prices. Meanwhile, the International Energy Agency’s projection of an oversupplied oil market in 2024 persists, even if OPEC+ extends its current production cuts. The dynamics of the oil market continue to evolve, influenced by both domestic inventory data and global considerations.

Natural Gas

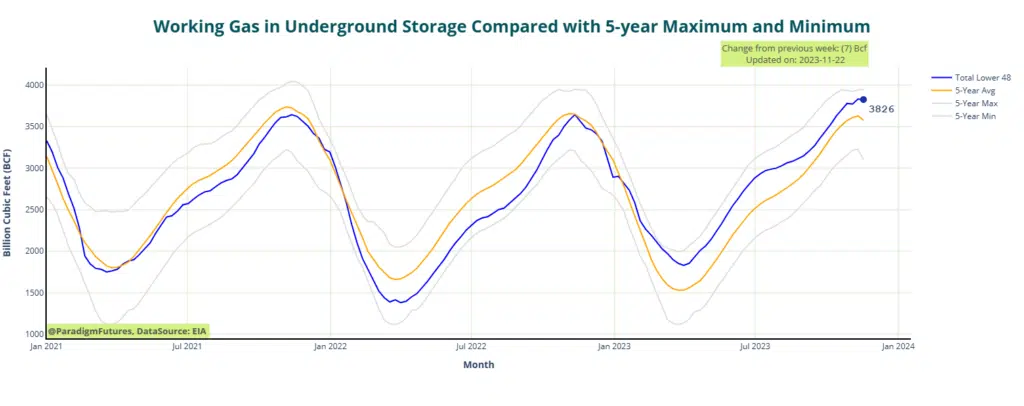

In the latest release from the U.S. Energy Information Administration (EIA), the working gas in storage stands at 3826 billion cubic feet (BCF). This reflects a net decrease of 7 BCF from the previous week’s figures. Despite this decline, it’s noteworthy that current stocks remain above the five-year average, which stands at 3577 BCF.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.