- Crude Inventories down 🔽1.508M bbl

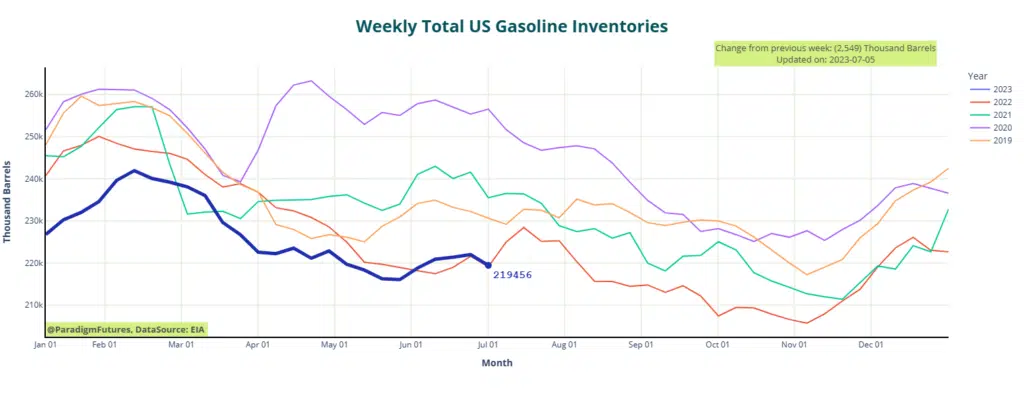

- Gasoline down 🔽 2.54M bbl

- Distillates down 🔽1.045M bbl

- SPR down 🔽 1.5M bbl

- Domestic prod: 12.4 MMbpd

- Ethanol down 🔽719k bbl

- Impd mogas demand 9.6Mbpd

- Refiner utilization: 91.1%

The U.S. Energy Information Administration (EIA) reported a decline of 1.5 million barrels in the estimated inventory for the week ending July 1. This decline contrasts with the substantial drawdown of 9.6 million barrels in the previous week, which temporarily pushed prices higher.

According to the EIA, U.S. crude oil inventories stood at 452.2 million barrels, approximately equal to the five-year average for this time of the year.

Despite the EIA’s recent upward revision of fuel demand figures for April, surprising at least one bank with a total upward revision of 350,000 bpd, demand concerns continue to exert pressure on prices.

However, the market has disregarded or overlooked this news, instead focusing on rate hikes and GDP numbers.

Meanwhile, the EIA reported declines in fuel inventories for the week ending July 1.

Fuels

Gasoline inventories decreased by 2.5 million barrels during the reporting period, with production averaging 10.3 million bpd. This contrasts with a build of 600,000 barrels in the previous week and production rates of 10.1 million bpd.

In middle distillates, the EIA estimated a decline of 1 million barrels in inventories, with production averaging 4.9 million barrels per day. This compares to a modest build of 100,000 barrels in inventories and production levels averaging 4.7 million bpd a week earlier.

In the meantime, the oil price surge that followed the news of Saudi Arabia’s extension of voluntary output cuts and Russia’s reduction in exports faded away in less than a day.

Oil prices declined earlier in the week as traders remained fixated on interest rates and the possibility of a global economic slowdown. Today, prices stabilized, and analysts warned of tighter supplies during the second half of the year.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.