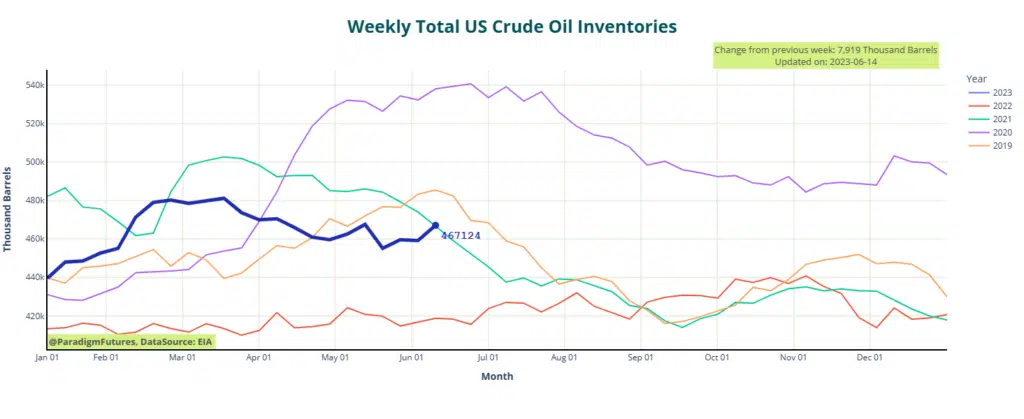

- Crude Inventories up🔺 7.9M bbl

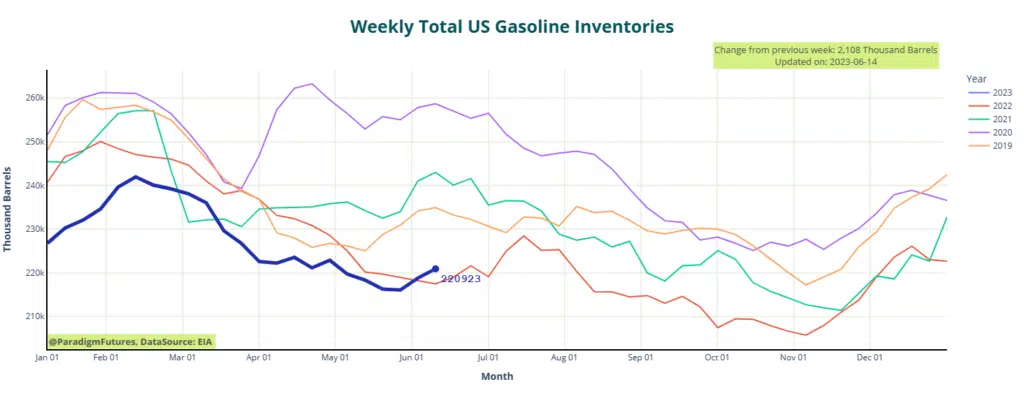

- Gasoline up 🔺2.1M bbl

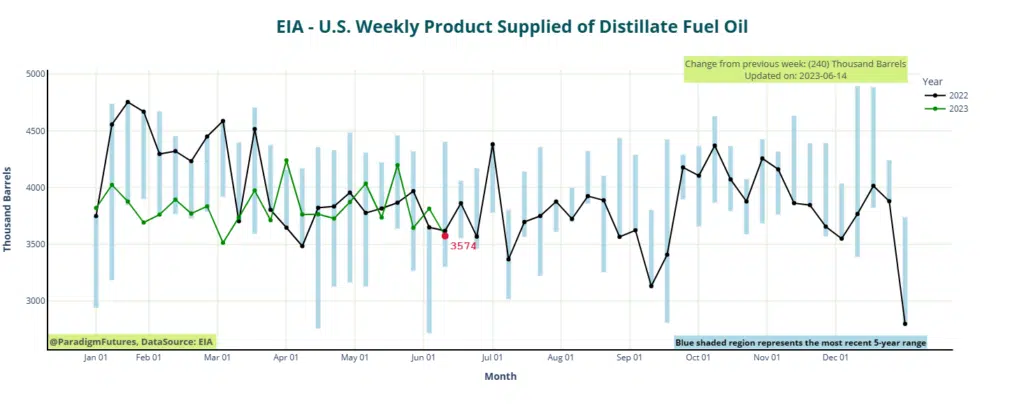

- Distillates up 🔺2.1M bbl

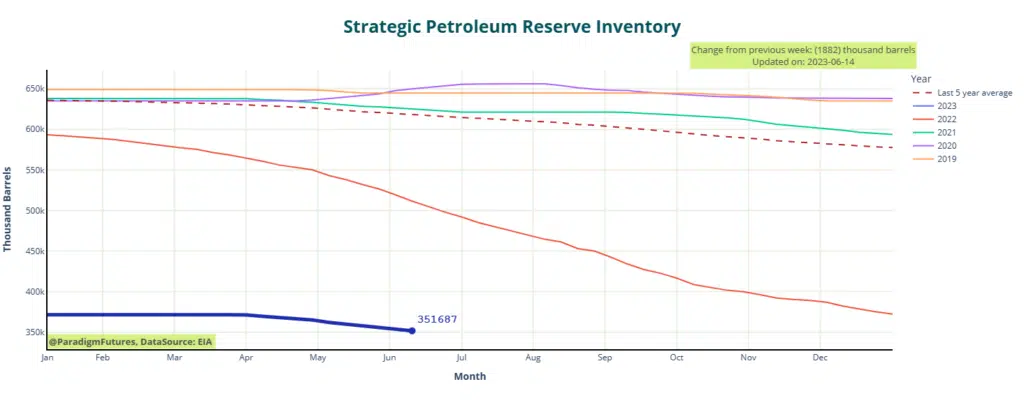

- SBR down 🔽 500k bbl

- Domestic prod: 12.4 MMbpd

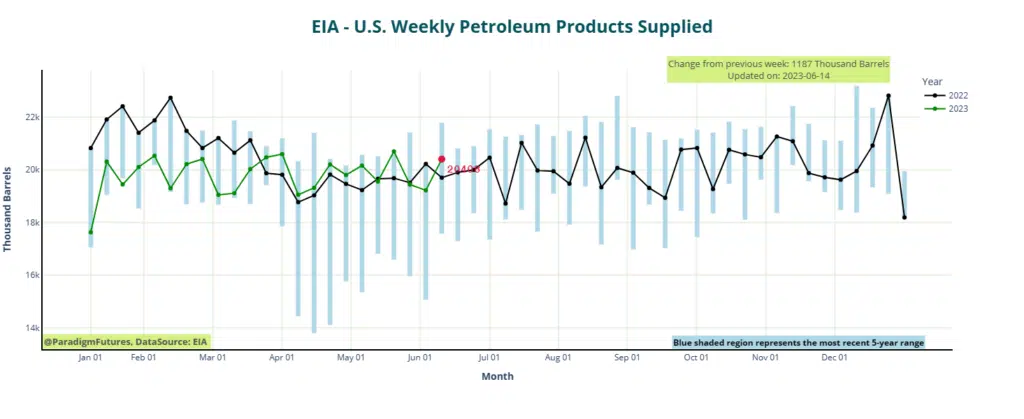

- Impld gas demand: 9.19 Mbpd

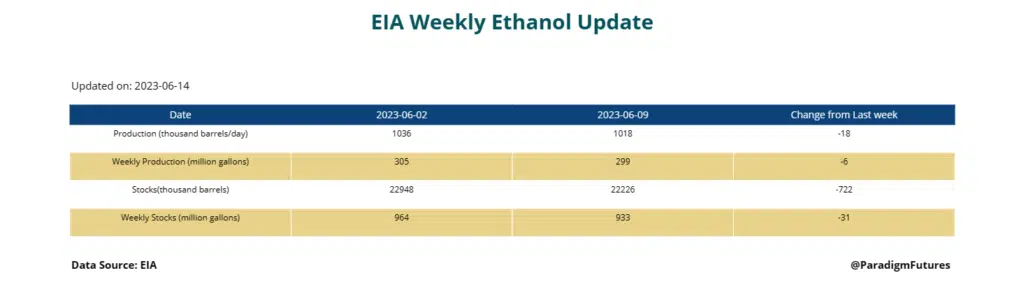

- Ethanol 🔽 down 722k bbl

The Energy Information Administration reported that the week to June 9 saw an estimated inventory build of 7.9 million barrels. This is in contrast to a modest inventory draw of half a million barrels in the previous week. Additionally, the American Petroleum Institute had reported an estimated build of just over 1 million barrels for the week to June 9, as announced on Tuesday.

Gasoline and Fuels

The EIA estimated an inventory increase of 2.1 million barrels for gasoline during the week to June 9, with daily production averaging 10.2 million barrels. This contrasts with the previous week’s inventory build of 2.7 million barrels, when production averaged 10.1 million barrels daily.

In the middle distillates category, the EIA reported an inventory build of 2.1 million barrels for the same week, with production averaging 5 million barrels daily. This is in comparison to the previous week’s inventory rise of 5.1 million barrels, when production averaged 5.2 million barrels.

Meanwhile, following the decline in consumer price inflation to 4% annually and a modest 0.1% monthly in May, prices have shown signs of recovery, leading to hopes that the worst of the price increases may be over and stimulating higher energy demand. Today, oil started trade relatively stable as traders awaited the conclusion of the Fed’s latest meeting. Expectations predominantly anticipate a pause in rate hikes, which is expected to positively impact oil benchmarks.

It appears that short-term speculators are hesitant to drive prices higher at the moment, given the upcoming key data and events such as China’s industrial production, retail sales, and the housing price index for May tomorrow, as well as today’s FOMC’s latest dot-plot projections.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.