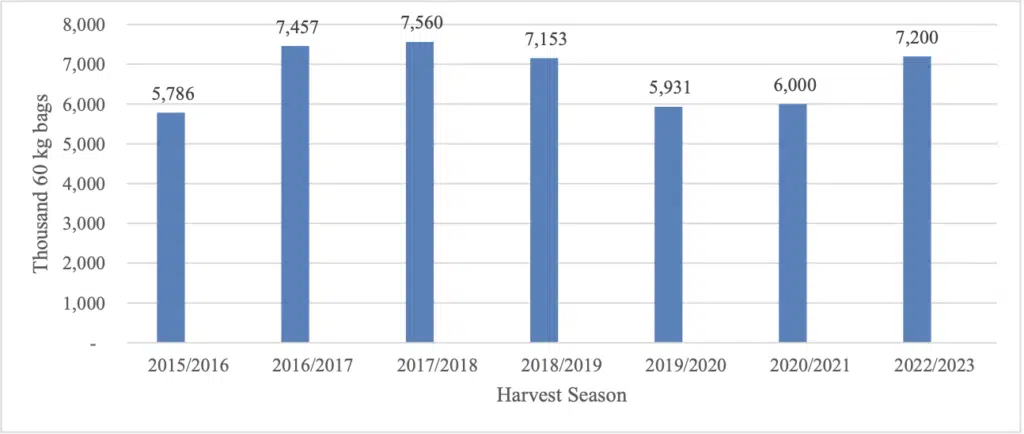

For the second time this month, coffee prices have had bearish reports printed from the USDA Foreign Ag Service. Yesterday the FAS reported that Honduras’ coffee production is expected to grow to 7.2 million 60-kg bags in the 22/23 marketing year. Earlier this month USDA FAS posted their annual Brazil Coffee update that projected that Brazil’s coffee production is expected to increase by 3.8 million bags.

Below is a clip from the report prepared by Juan Fiallos from the June 12th, Honduras annual coffee update.

Report Highlights: Honduras coffee production is expected to reach 7.2 million 60-kilogram bags in the marketing year 2022- 23, a thirty-three percent increase from the previous year. Favorable weather conditions with more and better rain distribution and a lower incidence of leaf rust and coffee drill bit are expected to improve coffee production. COVID-19 incidence has decreased in Honduras, and post-hurricane coffee farms rehabilitation and farm renewal efforts have been implemented. Consequently, MY2022/23 export forecast is 5.5 million bags, up 8% vs. MY2021/22.

Coffee represents 30% of the agriculture GDP of Honduras and about 5% of the overall GDP. In 2022 Honduras was the world’s 8th largest coffee producer, following Brazil, Vietnam, Colombia, Indonesia, Ethiopia, Uganda, and India. Honduras Produces Arabica coffee beans.

Coffee Prices:

The July futures contract for Coffee closed today down 1.51% and settled below the 50-day moving average and above the 100-day and 200-day moving averages. From the high made last Friday morning, coffee futures are down nearly 7%. Last week Thursday and Friday were the highest prices for coffee since April. If the Bulls want to keep the uptrend in tack, they must avoid spending too much time below the 200-day and, better yet avoid breaking last week’s low at 179.35.

The 100-day is above the 200-day for the first time since last summer, and the 50-day is above both the 100-day and the 200-day and is pointed higher. The bulls still have a few technicals on their side, but and the end of the day, price action trumps everything else, and this week the price action has been favoring the bears.

If you are a coffee producer or end-user or want to trade coffee futures, feel free to reach out to one of our brokers by clicking here, and we would be happy to assist you in tailoring strategies to your risk profile.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that (Insert IB Name) believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.