EIA Energy Report

⛽EIA Energy Stocks🛢️

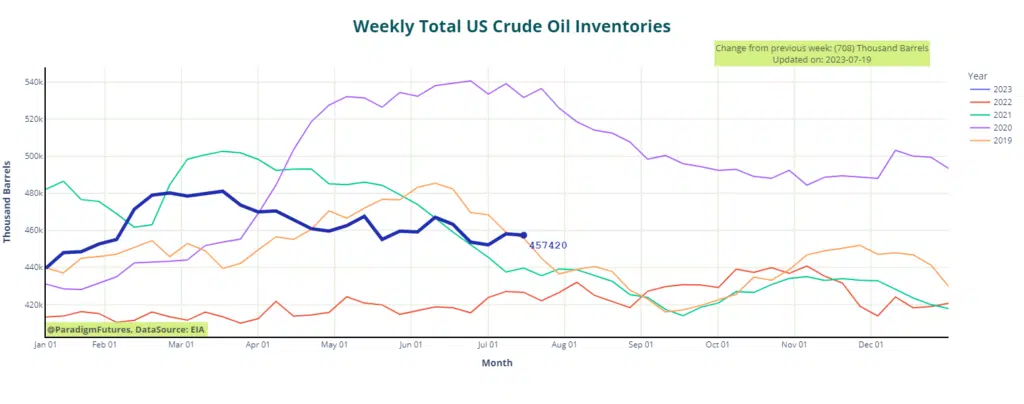

- Crude Inventories Down ⬇️ 709k bbl

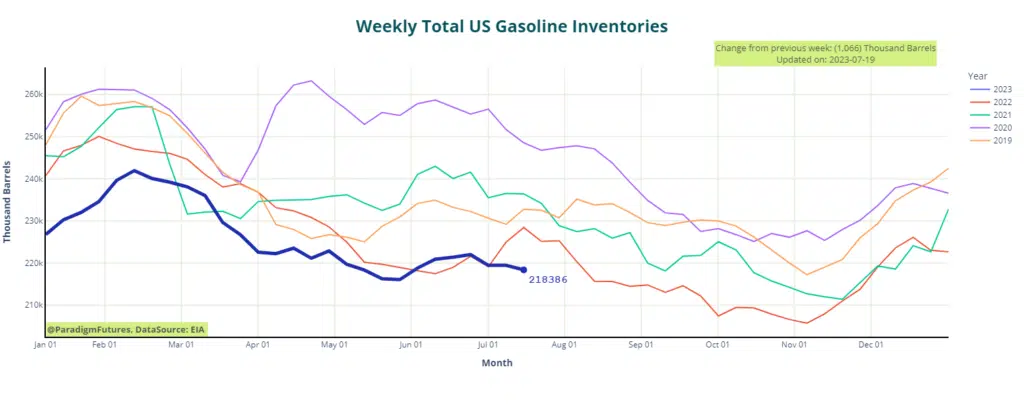

- Gasoline Down ⬇️ 1.1M bbl

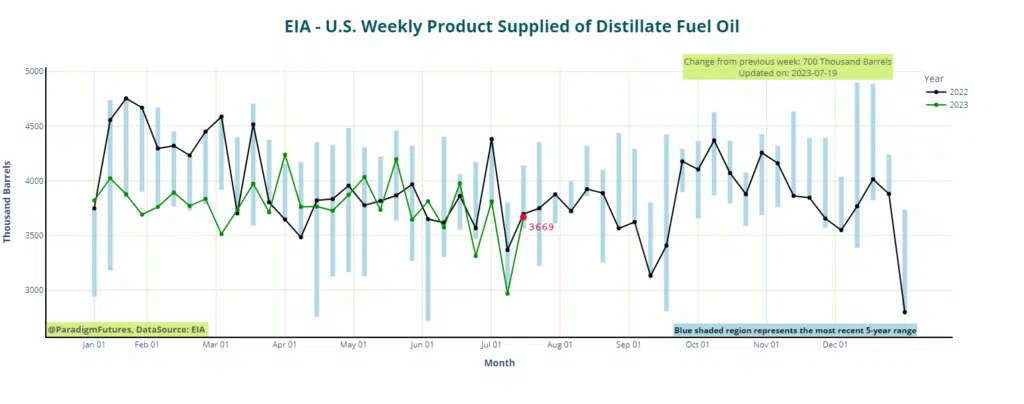

- Distillates up⬆️ 700k bbl

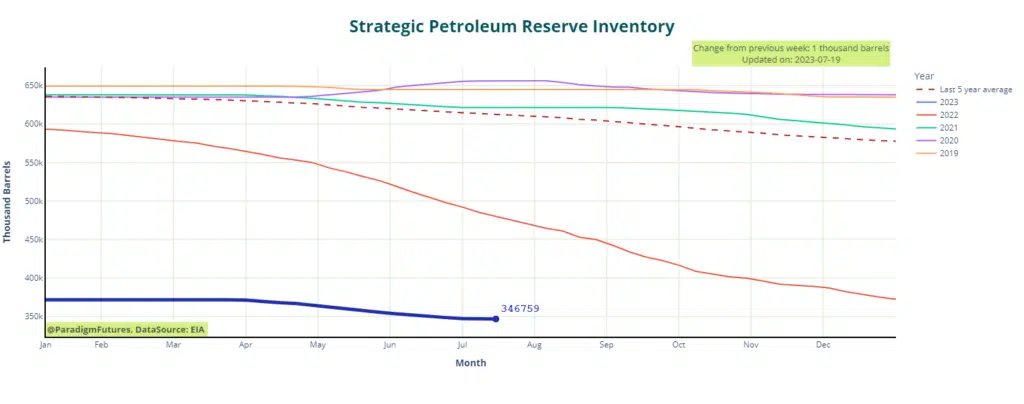

- SPR No CHange ⛔

- Domestic prod: 12.3MMbpd

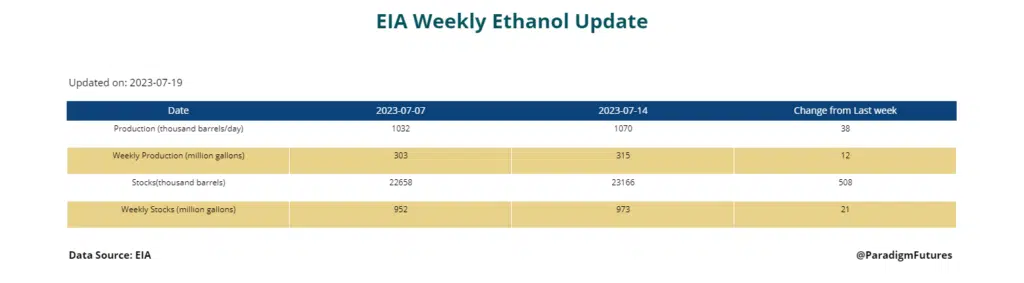

- Ethanol up⬆️508k bbl

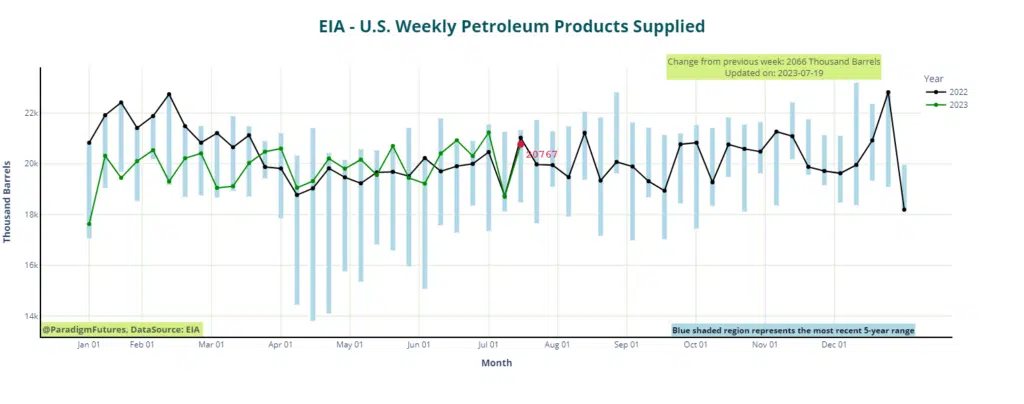

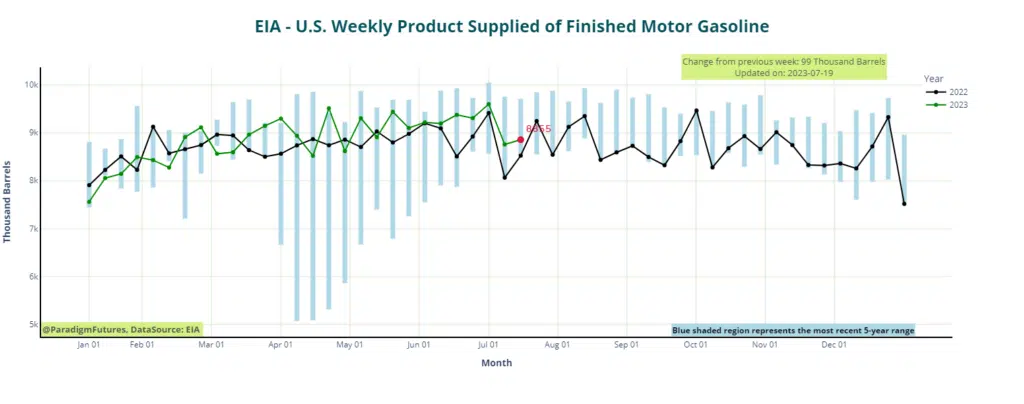

- Impd mogas demand 8.82Mbpd

- Refiner utilization: 94.3%

The Energy Information Administration reported that U.S. commercial crude inventories experienced a decrease of 700,000 barrels for the week ending on July 14. According to API estimates, the report was expected to show a decline of 2.25 million barrels, but the actual figure was lower.

Gasoline and Distillates

The EIA report also disclosed a 1.1 million-barrel reduction in gasoline supplies, while distillate stockpiles remained nearly unchanged for the week. Analysts had predicted a weekly decrease of 900,000 barrels for gasoline and no change in distillate stocks.

Moreover, the EIA stated that crude stocks at the Cushing, Okla., Nymex delivery hub fell by 2.9 million barrels for the week.

Following the release of the supply data, oil futures continued to trade higher. Specifically, August West Texas Intermediate crude rose 58 cents, or 0.8%, reaching $76.33 a barrel on the New York Mercantile Exchange. Prior to the supply data, prices were trading at $76.65