Key Factors Impacting the Market Today

- GDP – Revised Down 2.7%

- Jobless Claims – 192,000

- PCE Core Revised – 4.3%

Important Notes for Today.

- Atlanta Fed President Bostic comments today.

- US Treasury sells 7yr notes.

- G20 Finance Ministers meet.

GDP Revised

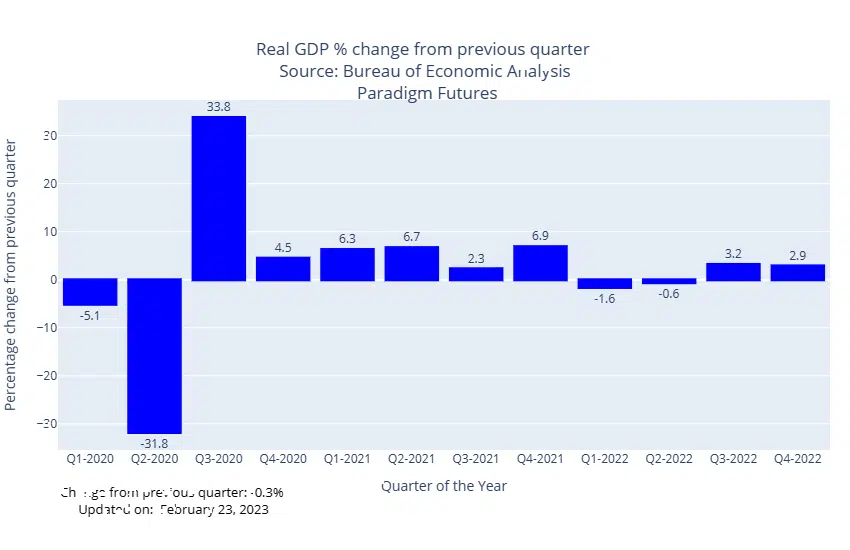

The Bureau of Economic Analysis reported on Thursday that the economy showed resilience in the face of economic challenges and expanded by 2.7% in the fourth quarter of last year. The revised estimate indicated that the gross domestic product numbers, adjusted for inflation, had been revised down from the previous estimate of 2.9%. This report is the second of three estimates of GDP.

The economy grew 2.1% for all of 2022, which was marked first by recession fears and then by the biggest surge of inflation in decades. This prompted the Federal Reserve to launch an intense campaign to ease price pressures through interest rate hikes.

Last year’s GDP growth followed 2021’s gangbuster 5.9% GDP growth, which was unusually high due to the year of reopening and economic recovery from the lows of the pandemic. The year 2022 began with negative GDP growth in the first two quarters, causing alarm among economists, as two consecutive quarters in the red typically indicate a recession. However, GDP growth resumed in the second two quarters, and growth on the year was positive.

While there was talk of a recession in the first part of last year, the most notable economic trend of 2022 was the rise of rip-roaring inflation, which lowered the standards of living for households across the country. Driving inflation down to healthy levels may still involve a recession. Inflation stood at 6.4% for the year ending in January, according to the consumer price index, far above the Fed’s target of roughly 2%. Inflation also only declined by a tenth of a percentage point last month, meaning that inflation is proving to be stickier than expected.

The Fed’s rate hikes are designed to slow the economy and thus demand, causing prices of goods and services to fall. One obstacle that is proving unexpectedly difficult to overcome is that the Fed hopes that the labor market will cool off a bit, but it keeps remaining strong.

In January, the economy gained 517,000 jobs, smashing expectations. The unemployment rate at 3.4% is also the lowest it has been since 1969.

Economists will closely watch GDP reports for this year as a gauge of how much the Fed’s historic tightening is damaging the economy. The Atlanta Fed’s “GDP Now” tracker is currently predicting that GDP growth in the first quarter will rise by 2.5%, which shows that the U.S. does not appear to be heading for a recession in the early part of 2023.

Jobless Claims

The unexpected decrease in the number of Americans filing for state unemployment benefits in the previous week caused U.S. stock index futures to pare gains.

The data revealed that in the week ended Feb. 18, 192,000 Americans filed for state unemployment benefits, compared to 195,000 the week before. Analysts had expected 200,000 new claims.

*The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.