Wholesale Inflation Falls to 6.2% Beating Estimates, Continuing the Decline Seen in the Last Half of 2022.

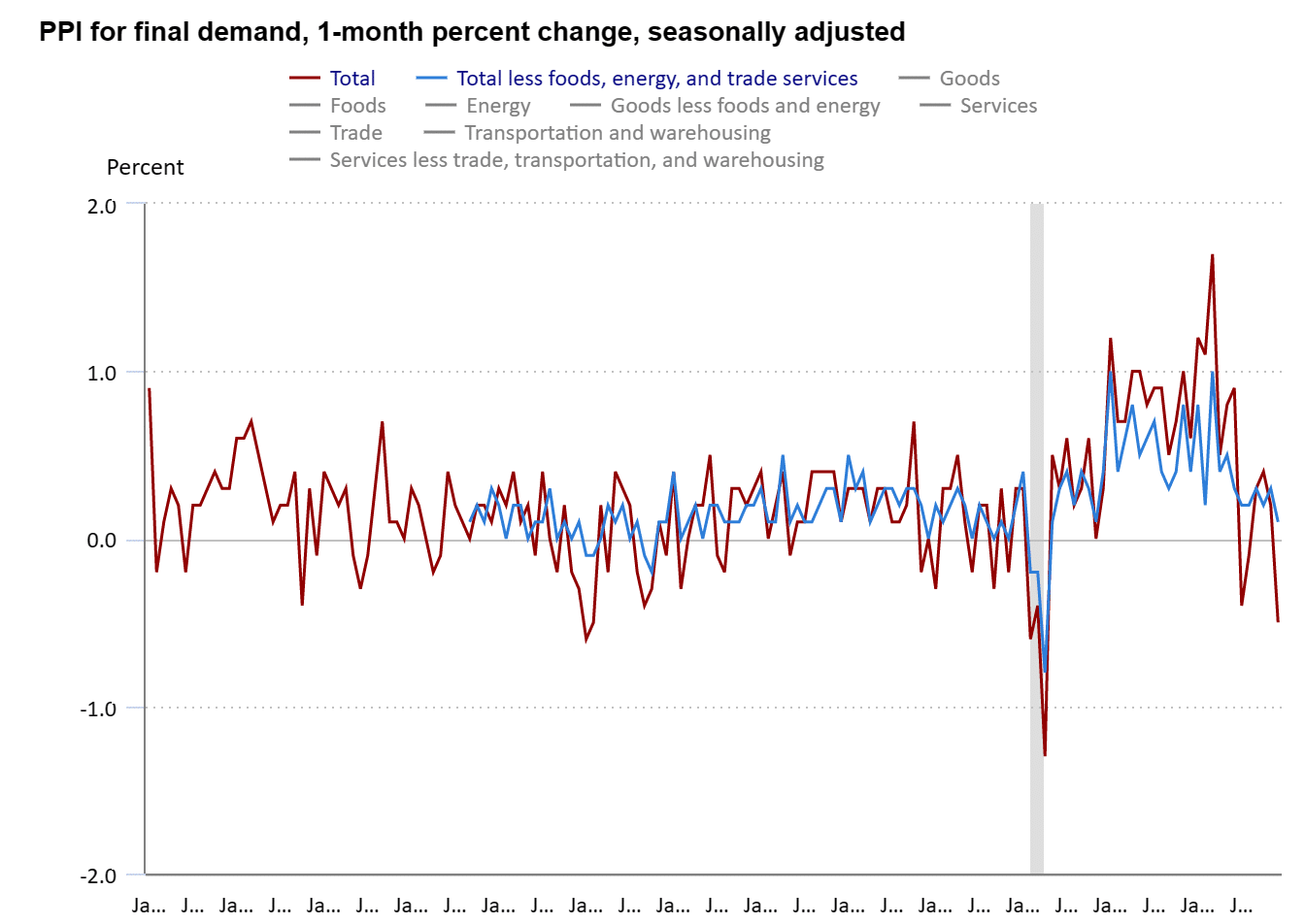

U.S. producer prices fell more than expected in December. Leading the decline was a drop in energy and food prices. December PPI final demand decreased 0.5%. Data for November was revised lower to show the PPI rising 0.2% instead of 0.3% as previously reported.

PPI increased 6.2% after climbing 7.3% in November. Forecasts from economists projected the PPI dipping 0.1% on the month and gaining 6.8% year-on-year.

Today’s report comes on the heels of news last week that monthly consumer prices fell for the first time in more than 2-1/2 years in December. Inflation is subsiding as the Federal Reserve’s fastest interest rate hiking cycle since the 1980s cools demand for goods.

Price of goods fell 1.6%, which gained 0.1% in November, were pulled down by a 7.9% plunge in energy and a 1.2% drop in food prices. However, as the saying goes, “The Devil is in the Details.”

Producers and consumers certainty welcome the decrease, especially when compared to the high of 11.7% in March. What remains is still a 7% increase to the cost of producing and delivering goods to the market. Taking a closer look, year over year PPI for final demand by individual category shows a 14.3% increase in food, a 37% jump in home heating oil, residential electricity, and natural gas were up 12.3 and 16.4%, respectively.

Historically, the PPI can provide an early sign of where consumer inflation might be headed. Understanding the costs charged to manufacturers, farmers and wholesalers, flows into the personal consumption expenditures price index closely watched by the FED

However, it is notable that the major areas affecting consumer perception, are still showing a drastic increase. Which can lead to a pullback in consumer spending.