John Caruso

John Caruso

Senior Market Strategist

Market Risk:

*US Durable Goods (Monday) -4.5% yy – should see ATL GDP come down on this data

*BofA: The Fed might raise policy rates to 6%

Interest Rates: Every day I ask myself “Is today the day we make an allocation to the bond market” – and everyday my signal continues to tell me to wait. The 2yr often peaks somewhere in the neighborhood of where the Fed terminal rate ends up – and with the 2yr sitting at 4.79%, and the Fed now pricing in potentially 5.50% – you can clearly see why I have my reservations at the moment. That is assuming the Fed gets to 5.50% of course – we’ll see. The 2s v 10s spread is currently -86bps this morning….that’s a hefty inversion as we’ve noted multiple times.

Commodities: Last night I was looking at some of the Monthly charts of commodities, and honestly it looks like we could be at the beginning of an onslaught/wave of disinflation over the next 30-60 days.

Oil -3.34% mtd

Heating Oil -13% mtd

Silver -13.21% mtd

Platinum -7.8%

Copper -4.50% mtd

Corn -6% mtd

Wheat -5.52% mtd

Soybeans sub 15.00 now w/ momentum neutralizing

Markets such as Nat Gas and Oil have already crashed to cycle lows at -41% yy and -25% yy respectively. I think you want to be looking at markets that have not corrected yet, and those could be the grain and maybe softs markets for opportunities – in all fairness I haven’t had the chance to really do a deep dive on soft. I don’t have Gold in this category, because ultimately we view Gold as a currency – but of course is not impervious to a strong dollar and rising interest rates.

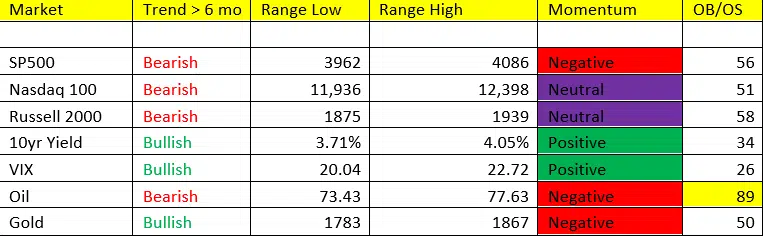

Gold: similar to bonds – I ask myself everyday if I should lift my exposure here, and everyday the signal tells me to wait. Ultimately, we expect Gold to perform very well over the back half of 2023 and into 2024 – I will be a big buyer here once again, but the signal while BULLISH trend, is remains bearish trade with the range low continuing to fall out and NOT signaling immediate OS = wait.

*VIX in a rising regime; sell stocks from either VIX range low, or top of the range in stocks – preferably if both signals line up

*Oil signaling immediate OB here with bearish trend and negative momentum

*10yr yield keeps putting in a higher high and higher low in range analysis

John Caruso

John Caruso