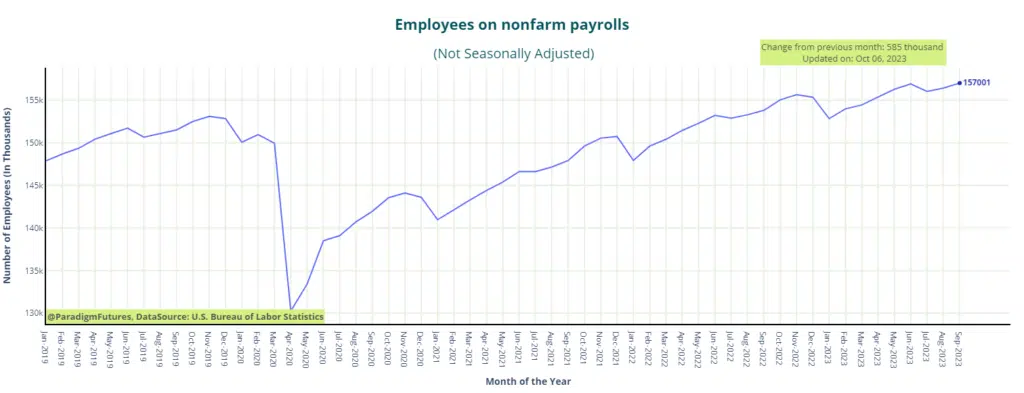

U.S. Nonfarm Payroll Employment Rises by 336,000 in September

The U.S. Bureau of Labor Statistics reported a noteworthy increase in nonfarm payroll employment, rising by 336,000 in September. The unemployment rate held steady at 3.8 percent. Job gains were observed in several sectors, including leisure and hospitality, government, health care, professional, scientific, and technical services, as well as social assistance.

Household Survey Data

- The unemployment rate remained at 3.8 percent in September, with approximately 6.4 million unemployed persons.

- Unemployment rates showed minimal change across different demographic groups.

- Long-term unemployment remained stable at 1.2 million, accounting for 19.1 percent of all unemployed individuals.

- Labor force participation and the employment-population ratio remained unchanged.

- About 4.1 million individuals were employed part-time for economic reasons.

- Roughly 5.5 million people not in the labor force expressed a desire for employment.

- The number of marginally attached individuals to the labor force was little changed, as was the number of discouraged workers.

Establishment Survey Data

- Total nonfarm payroll employment increased by 336,000 in September, surpassing the average monthly gain of the previous 12 months.

- Job growth was notable in leisure and hospitality, government, health care, professional, scientific, and technical services, and social assistance.

- Leisure and hospitality added 96,000 jobs, with employment in food services and drinking places returning to pre-pandemic levels.

- Government employment increased by 73,000, primarily in state government education and local government, excluding education.

- Health care saw an increase of 41,000 jobs, with growth in ambulatory health care services, hospitals, and nursing and residential care facilities.

- Professional, scientific, and technical services added 29,000 jobs.

- Social assistance employment increased by 25,000, with growth in individual and family services.

- Employment in other major industries remained relatively stable.

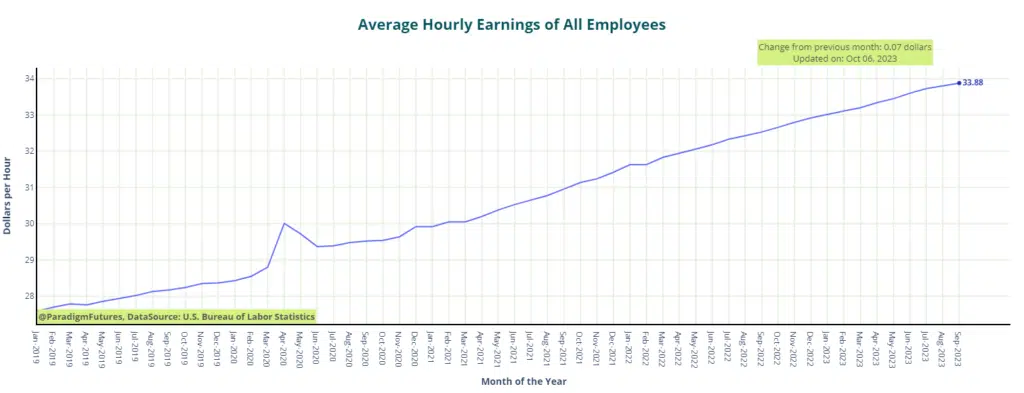

- Average hourly earnings for all employees rose by 7 cents to $33.88, with a 4.2 percent increase over the past year.

- The average workweek remained unchanged at 34.4 hours, with manufacturing and overtime also showing little change.

These figures reflect the most recent labor market data, with revisions indicating an overall positive trend in employment numbers.

Inflation still looms large for many consumers, and the FED.

September’s Robust Job Growth Stirs Uncertainty in Financial Markets

In a surprising turn of events, the U.S. labor market delivered a significantly stronger performance in September than expected. According to the Bureau of Labor Statistics, the economy added an impressive 336,000 jobs, nearly doubling the forecasted 170,000 predicted by economists.

However, the enigmatic realm of persistent inflation introduces a challenge for investors in the face of this robust job market. The concern now centers on the possibility of enduring high-interest rates, a departure from earlier forecasts.

The scorching labor market could potentially embolden the Federal Reserve to maintain its assertive approach to interest rate hikes. This strategy builds upon a series of rate increases over the past year aimed at curbing inflation and moderating economic growth. In response, investors are undergoing a recalibration of their interest rate expectations for the remainder of the year. According to the CME FedWatch tool, there is currently a 45% probability that interest rates will conclude the year higher than their current level, a notable uptick from the 33% probability recorded the day before.

Good News is Bad News

The immediate market response to the September jobs report was palpable. Major stock indexes experienced declines, with the Dow Jones Industrial Average shedding approximately 200 points. Simultaneously, Treasury yields surged, with the yield on the 10-year U.S. Treasury note climbing by 14 basis points to 4.849%, marking its highest level in 16 years. This followed a slight decline earlier in the week.

Friday’s job report suggests to many analysts that the labor market remains very strong and cements the case for an additional Fed rate hike this year, and it also likely delays the pace of eventual rate cuts. Investors will need to get used to the higher-for-longer narrative on interest rates given the strength of the economy.

The ramifications of higher rates and elevated bond yields are multi-faceted, impacting not only stocks but also bonds and the broader economy. Of particular note is the surge in the 10-year yield, which has become a focal point of concern for investors.

Eyes Turn to Next Months FED Meeting

Adding to the complexity is the New York Fed’s suggestion of a 56% chance of a U.S. recession by September of the following year. Meanwhile, certain key bond yield curves that had been inverted for a substantial part of the past year have started to revert to their more traditional shapes. For instance, the 2-10 Treasury yield curve, often regarded as a harbinger of recession, typically normalizes when a downturn is anticipated in the near future.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.