Federal Reserve Maintains Interest Rates

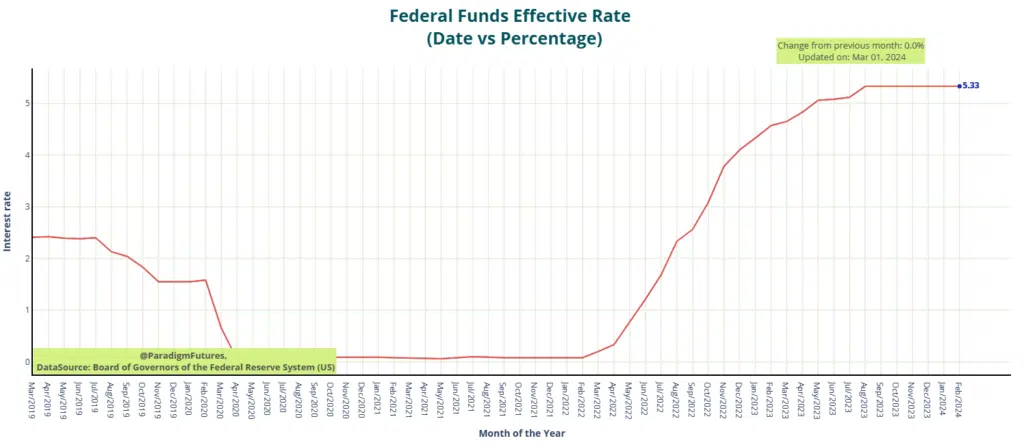

The Federal Reserve (FOMC) announced on Wednesday its decision to keep interest rates steady, opting to maintain high rates amid stalled progress toward lower inflation. This delay pushes back expected rate cuts anticipated later this year, with the Fed sticking to its projection of three rate reductions by 2024-end. “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” stated the FOMC.

Open a Trading Account – Paradigm Futures

Delaying Rate Cuts Amid Uncertainty

This decision allows the Fed more time to monitor price movements before proceeding with interest rate cuts. Federal Reserve Chair Jerome Powell reiterated the intention to lower rates this year but emphasized the need to see inflation decline first. “The economic outlook is uncertain, and ongoing progress toward our 2% inflation objective is not assured,” Powell told lawmakers.

Continued Caution Despite Economic Strength

The Fed’s decision marks the fifth consecutive meeting without rate changes, signaling a prolonged pause in the aggressive rate-hiking cycle. Despite persistent inflation, the economy has defied slowdown expectations. However, areas like the housing market have cooled due to soaring mortgage rates, averaging 6.74% for a 30-year fixed mortgage. Despite these challenges, Powell reaffirmed the Fed’s commitment to lowering inflation to 2%.

Treasury Yields Decline as Chair Powell Reiterates Inflation Goal

Chair Powell’s reaffirmation of the 2% inflation target prompts a drop in Treasury yields. The FOMC maintains its projection for the median fed fund rates at 4.6% by year-end, implying three 25-basis-point cuts. On the CME’s FedWatch tool, odds of another hold in May remain at 91%, while the likelihood of an initial cut in June rises to 62% from 56% yesterday. Fed fund futures for December align with the FOMC’s 4.6% forecast. Weekly jobless claims, expected to increase, are on the horizon for tomorrow. Today, the 10-year yield decreases by 0.025 percentage point to 4.271%, and the two-year falls by 0.088 p.p. to 4.604%.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.