Crude Oil Prices Respond to Inventory Fluctuations, Shipping Challenges, Production Estimates.

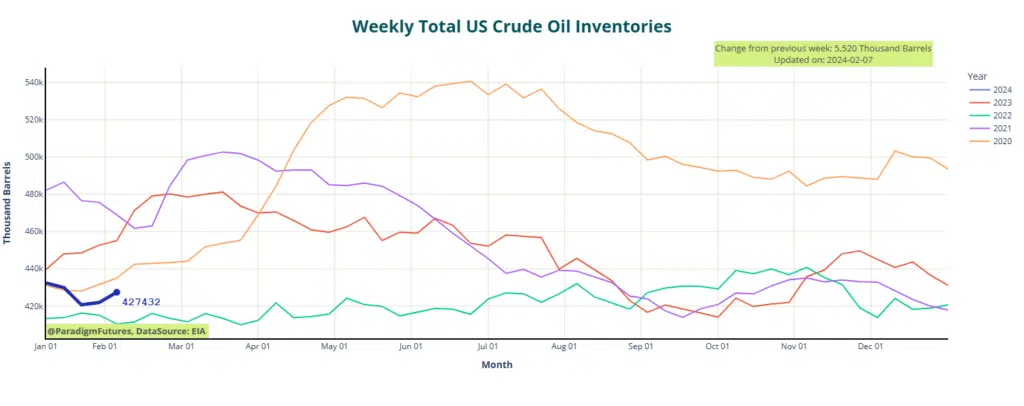

Crude oil prices witnessed a surge today following the Energy Information Administration’s (EIA) report, revealing a significant inventory increase of 5.5 million barrels for the week ending February 2. This notable uptick contrasts with the prior week’s build of 1.2 million barrels, which had previously exerted downward pressure on oil prices.

Adding to the complexity, the American Petroleum Institute (API) offered a more conservative estimate on Tuesday. The API suggested a modest addition of 674,000 barrels to crude oil inventories during the same week, significantly below the 2.13 million barrels anticipated by industry analysts.

Fuel Dynamics: Gasoline and Distillate Stocks in Focus

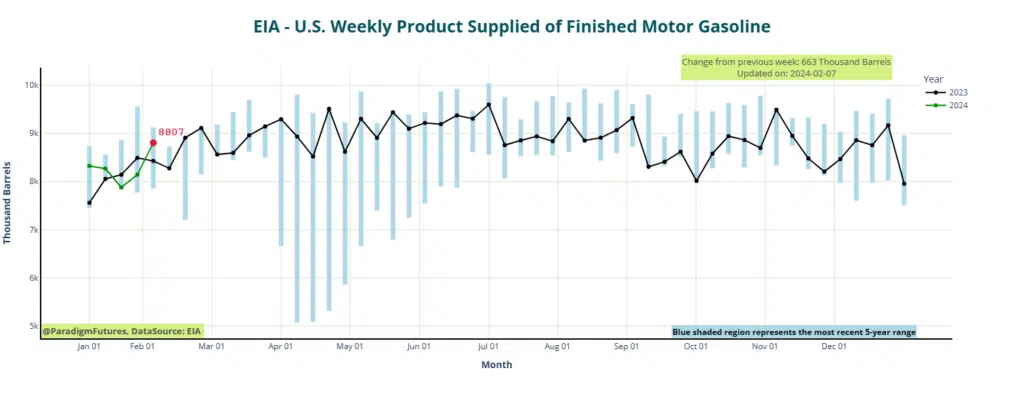

Turning our attention to the fuels sector, the EIA disclosed a noteworthy decline in both gasoline and distillate stocks. Gasoline stocks experienced a substantial reduction of 3.1 million barrels for the week ending February 2, marking a sharp contrast to the 1.2 million barrel build observed in the preceding week. The production of gasoline averaged 9 million barrels per day, reflecting a decline from the 9.3 million barrels daily the week prior.

In the realm of middle distillates, the EIA estimated a draw of 3.2 million barrels for the week ending February 2, compared to the 2.5 million barrel draw reported the prior week. The production of middle distillates remained relatively stable at an average of 4.4 million barrels per day.

In contrast, the API reported a gasoline stock build of 3.65 million barrels and a 3.7-million-barrel draw in middle distillate inventories for the week ending February 2.

Navigating Risk: Impact on Shipping and Trade

Shifting gears to the maritime industry, a separate development has seen ships associated with U.S., British, and Israeli companies facing heightened war risk premiums—up to 50%—for navigating the Red Sea. This surge in premiums is a direct response to the persistent threat of attacks by Yemen’s Houthis, who claim to act in solidarity with Palestinians amid the ongoing conflict in the Gaza Strip.

The repercussions are substantial, with companies forced to make difficult decisions on rerouting ships through southern Africa, incurring higher costs. Despite these challenges, some vessels continue to traverse the Red Sea and Suez Canal. War risk premiums for Red Sea voyages have spiked to around 1% of a ship’s value, up from the previous 0.7%, resulting in considerable additional costs for a seven-day voyage.

Marcus Baker, global head of marine and cargo with Marsh, highlighted the introduction of “exclusionary language” in insurance coverage involving U.S., U.K., and Israeli interests. Despite counterstrikes by the U.S. and British navies, Yemeni rebels persist in attacking commercial ships. In response, ships are now publicly indicating their lack of connections to U.S., U.K., or Israeli companies in tracking profiles to mitigate risks. This evolving situation underscores the intricate challenges facing the global shipping industry.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.