USDA Grain Export Sales week ending July 27th.

Corn🔹107,512 MT

Soybeans🔹90,595 MT

Wheat 🔹421,282 MT

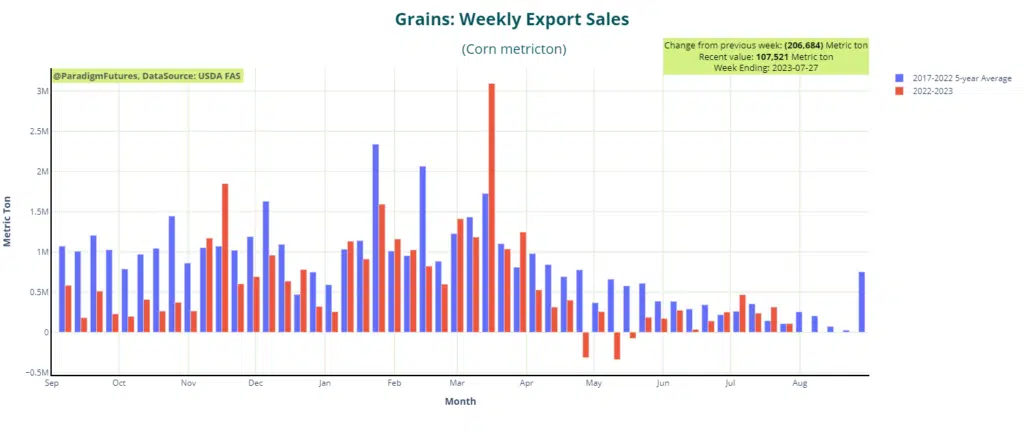

Corn

net sales of 107,500 MT were down 66 percent from the previous week and the prior 4-week average. The decrease was mainly due to reductions in unknown destinations, Canada, Israel, Honduras, and the Dominican Republic. However, there were increases in sales for Japan, Egypt, Jamaica, Mexico, and Nicaragua.

For 2023/2024, net sales of 348,900 MT were primarily driven by sales to Honduras, Mexico, Canada, Japan, and unknown destinations.

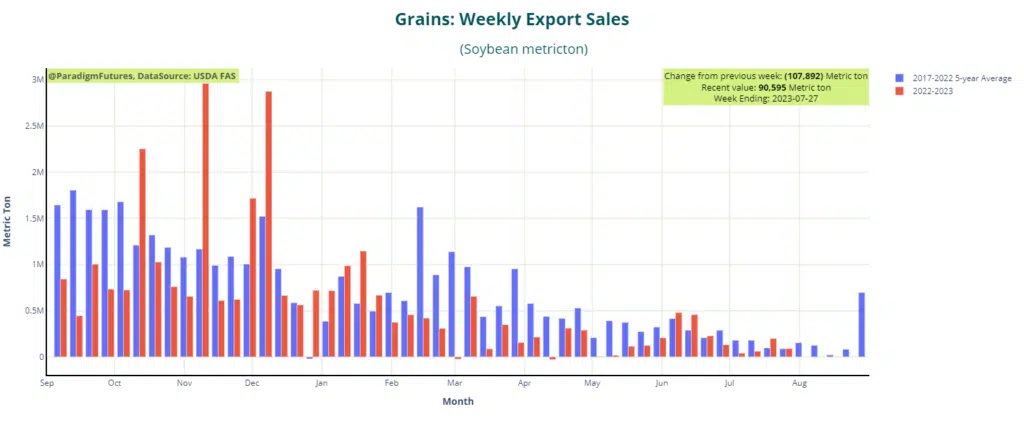

Soybeans

Net sales of 90,600 MT were down 54 percent from the previous week and 16 percent from the prior 4-week average. The increase in sales was mainly driven by the Netherlands, Mexico, Indonesia, Spain, and China, while reductions were observed for Japan, unknown destinations, and South Korea.

For 2023/2024, net sales of 2,630,700 MT were primarily for unknown destinations, China, Mexico, Indonesia, and Taiwan. However, there were reductions in sales for Japan.

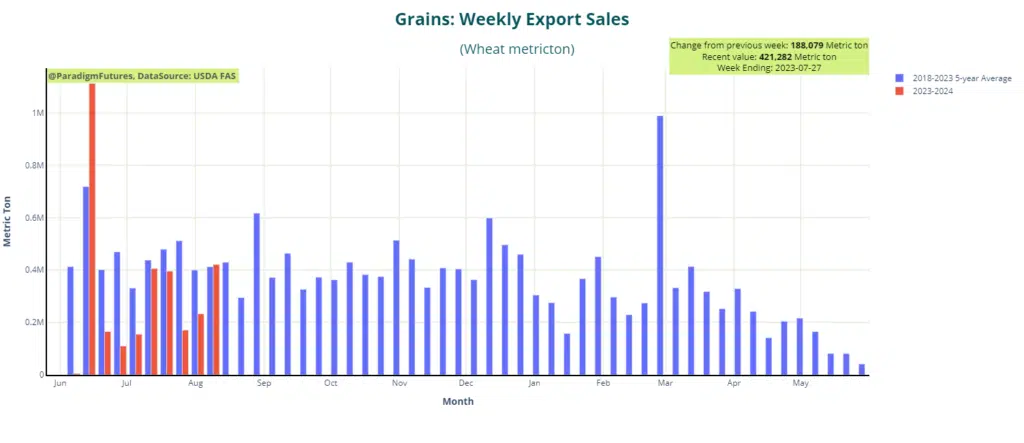

Wheat

Net sales of 421,300 metric tons (MT) significantly increased, rising by 81 percent from the previous week and 40 percent from the prior 4-week average. The higher sales were driven by increased demand for China, Mexico, the Philippines, Taiwan, and Panama. Notably, China experienced a substantial increase, including a significant volume that switched from unknown destinations.

However, there were reductions in net sales for unknown destinations, South Korea, Nigeria, Guatemala, and the Dominican Republic.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.