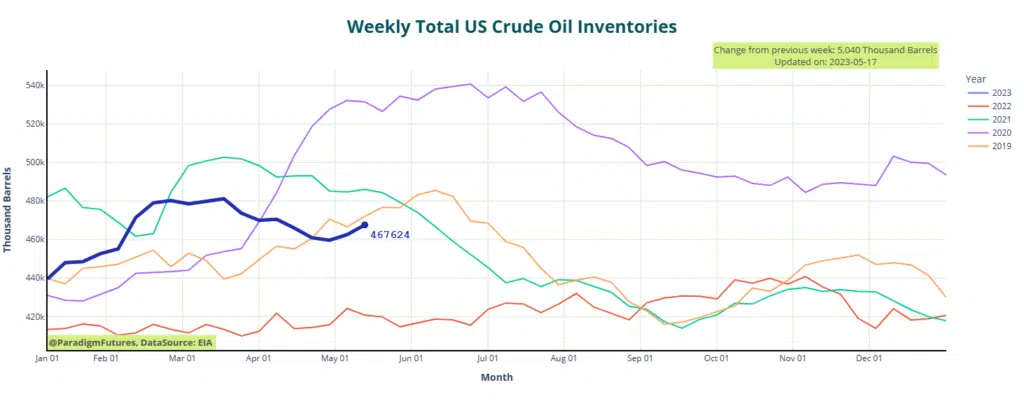

U.S. Energy Information Administration reported an inventory build of 5 million barrels for the week to May 12, causing crude oil prices to move lower today.

- Crude Inventories up🔺5,004,000 bbl.

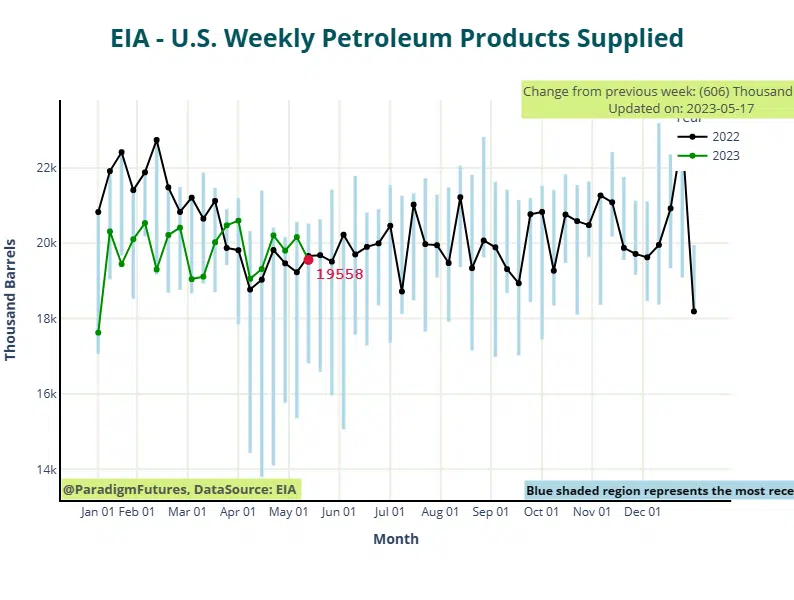

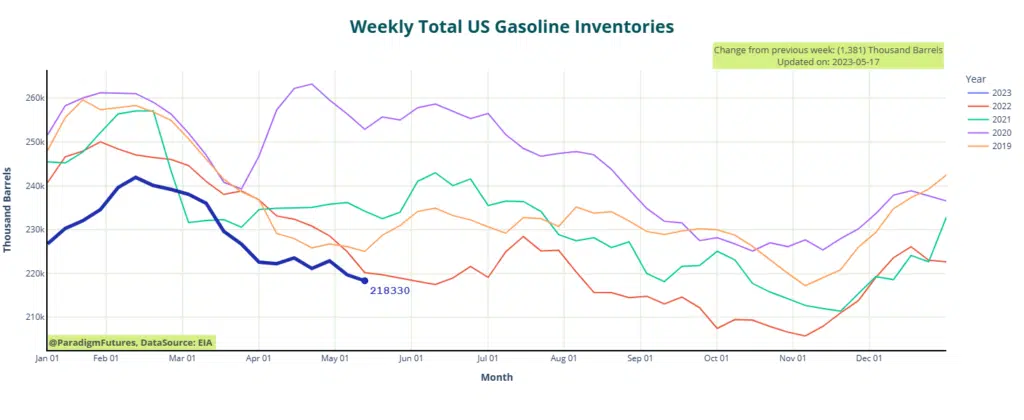

- Gasoline down 🔽 1,400,000 bbl.

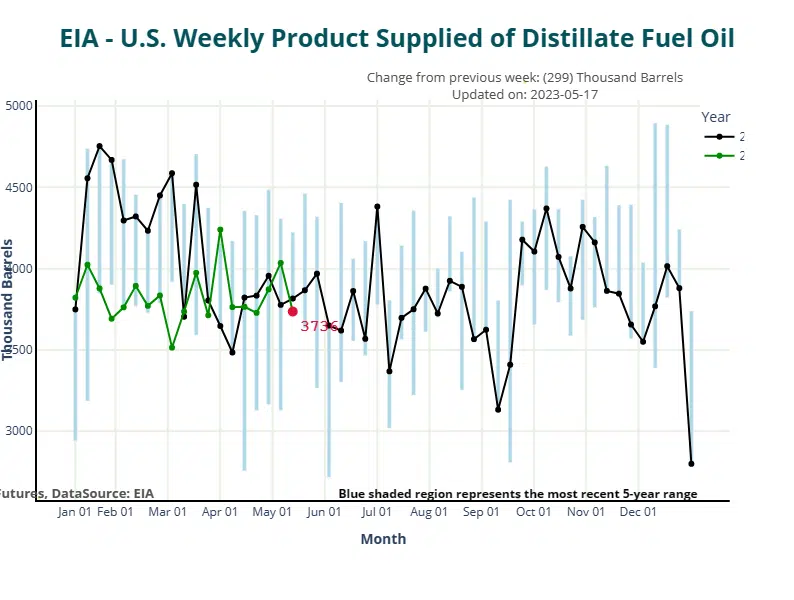

- Distillates up🔺100,000 bbl.

- Ethanol down 🔽219,000 bbl.

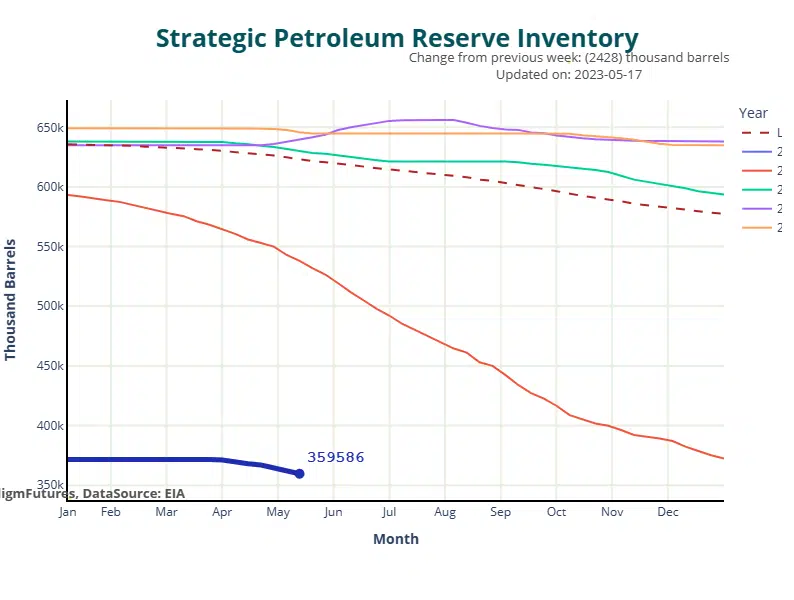

- SBR down 🔽 2,400,000 bbl.

The EIA stated that crude oil inventories currently stand at 467.6 million barrels, slightly below the five-year average for this time of the year.

One day earlier, the American Petroleum Institute estimated an inventory increase of 3.7 million barrels, which was significantly higher than analyst expectations for a draw of approximately one-third of that amount.

Last week, the EIA predicted a build of 3 million barrels for crude oil inventories, following a weekly draw of 1.3 million barrels in the previous week.

During the reporting period, gasoline inventories decreased by 1.4 million barrels, contrasting with a draw of 3.2 million barrels in the previous week.

Last week, gasoline production averaged 9.5 million barrels per day (bpd), down from 9.8 million bpd the previous week.

As for middle distillates, the EIA reported an inventory increase of 100,000 barrels for the week ending May 12, in contrast to a draw of 4.2 million barrels in the previous week.

Middle distillate production averaged 4.9 million barrels per day last week, up from 4.6 million barrels per day the previous week.

Despite the International Energy Agency revising its global oil demand growth forecast to anticipate stronger growth than previously expected, oil prices continue to remain weak.