EIA Weekly Oil Inventory Shows Modest Increase.

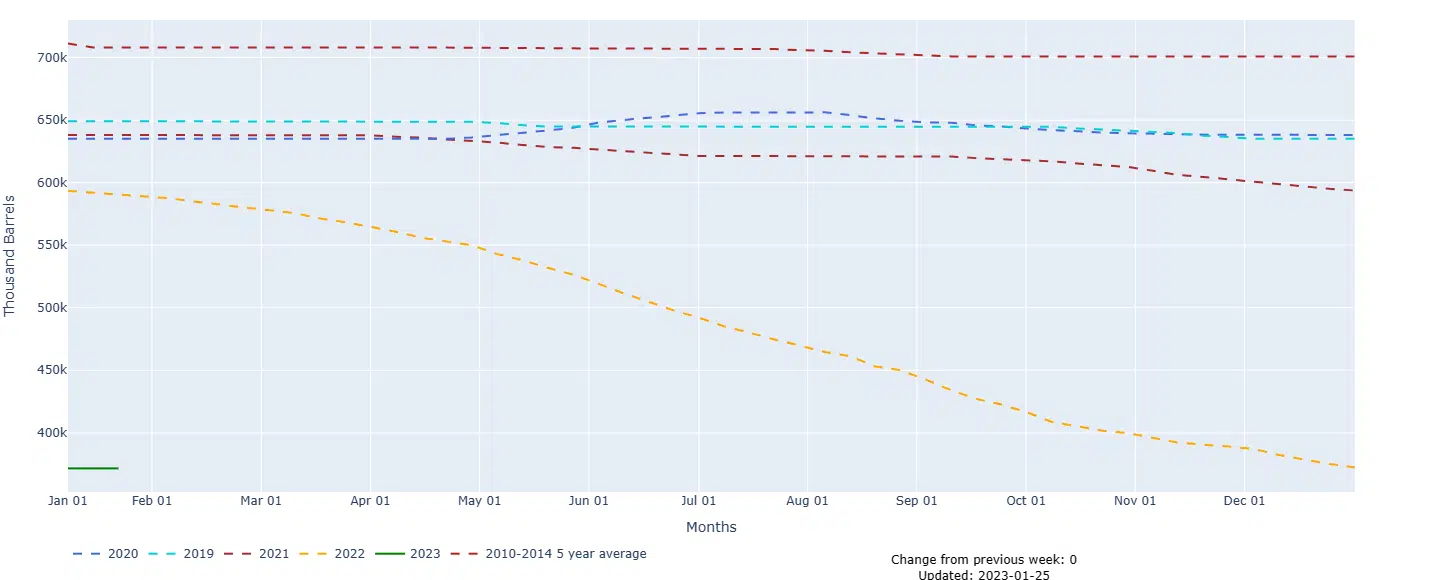

The U.S. Energy Information Administration (EIA) reported a build of 500,000 barrels of oil inventory for the week ending January 20.

This comes after two previous sizeable builds of 8.4 million and 19 million barrels for the second and first weeks of January, respectively. Currently, crude oil inventories in the United States stand at 448.5 million barrels, 3% above the five-year average for this time of year.

The EIA also reported mixed changes in fuel inventory, with an increase of 1.8 million barrels in gasoline and a draw of 500,000 barrels in middle distillates. Early trading on Wednesday steadied Oil, after a fall in the previous session. A rise in U.S. crude inventories and global recession worries countered optimism for a demand recovery in China.

Thus far 2023 has rallied global benchmark Brent crude topping $89 a barrel this week for the first time since early December. Mostly on the ending of China’s COVID-19 controls and hopes that rises in U.S. interest rates will soon taper off. However, it remains to be seen if oil will continue its climb to highs seen in 2022. Much of that will depend on how quickly China’s economy can bounce back and begin to increase demand.

US Inputs and Imports

US crude oil refinery inputs averaged 15 million barrels per day, up by 127,000 barrels per day from the average recorded the week prior. Refineries operated at 86.1% of their capacity. Gasoline production decreased to an average of 8.8 million barrels per day. Imports of crude oil into the US averaged 5.9 million barrels per day, 956,000 barrels per day fewer compared to the previous week. Total commercial petroleum inventories increased by four million barrels. Inventory Stocks at the Strategic Petroleum Reserve were unchanged and remain at historic lows.

Looking Ahead

Special attention should be paid next week to the OPEC meeting February 1st. The panel is scheduled to meet and is likely to endorse the current output policy. While the demand from China is leading a price rally. Apprehensions over inflation and slowdown in several economies are limiting further increase in the price. Discussions Wednesday about how to scale the demand from China and balance the recent builds in US inventories. Some policy advisors have recently made cryptic comments regarding further cuts to output. Cuts that could be financially beneficial to OPEC members.