MASSIVE Build for Crude in EIA report.

- Crude Oil Inventory Build 16,283,000 barrels 🔻

- Gasoline Inventory Build of 2,316,000 barrels 🔻

- Distillates Inventory Decline of 1,300,000 barrels ✅

- Ethanol Inventory Build of 922,000 barrels 🔻

- Strategic Petroleum Reserve inventory NC

EIA report released today showed a huge increase far outpacing the estimated build.

Crude Inventory

The week ending February 10 saw the U.S. Energy Information Administration report an inventory build of 16.3 million barrels. This extends a string of weekly builds. Some of them quite sizeable, which have pushed inventories above the five-year seasonal average. The energy information authority estimated an inventory increase of 2.3 million barrels in gasoline for the same period, compared with a build of 5 million barrels in the previous week. Gasoline production remained almost unchanged on the prior week, averaging 9.1 million barrels daily. In middle distillates, the EIA estimated an inventory draw of 1.3 million barrels for the week to February 10, with production down on the week, averaging 4.5 barrels daily. Production was at 4.7 million bpd for the previous week, which saw an inventory increase of 2.9 million barrels.

Gasoline

Markets Take Notice.

Oil prices had dropped a day before the EIA reported its weekly inventory estimates, following the American Petroleum Institute’s inventory estimate, which saw a sizeable build of more than 10 million barrels. The Energy Information Administration’s figures came as no surprise after the API report, although the size of the estimated build was the largest in more than a month. At the time of writing, Brent crude was trading at $84.70 per barrel, and West Texas Intermediate was changing hands for $77.95 per barrel, both down by more than a percentage point from opening. The federal government’s announcement of a sale from the strategic petroleum reserve, which is already at a 40-year low, could have constrained the drop. Additionally, the latest CPI report from the Bureau of labor Statistics showed the rise in prices had slowed down. Quenching fears of continued rate hike aggressiveness from the Federal Reserve.

Demand.

The IEA Estimated that rising fuel consumption in Asia would propel worldwide oil demand to a record high of 101.9 million barrels per day (bpd) this year. The figure represents an increase of 200,000 bpd compared to the IEA’s forecast last month. The Asia-Pacific region is expected to lead the demand growth, with an estimated 1.6 million bpd increase, driven by China’s growth of 900,000 bpd from last year and the resurgent demand for air travel. The report also states that jet fuel and kerosene demand is expected to increase by 1.1 million bpd to 7.2 million bpd, which is 90% of 2019 levels.

On the supply side, the IEA estimates that global oil production remained largely unchanged at around 100.8 million bpd in January, following a sharp 1.2 million bpd decline at the end of 2022 led by the U.S. and Saudi Arabia. The IEA expects global output to grow by 1.2 million bpd in 2023, driven by non-OPEC+ producers.

Regarding Russia, the IEA estimates that crude oil exports remained largely steady at the start of 2023, rising to 8.2 million bpd in January ahead of the EU embargo and G7 price cap on refined products. Despite a further 450,000 bpd decline in shipments to the EU. Crude oil exports increased by nearly 300,000 bpd month-on-month, while product loadings held steady at around 3.1 million bpd.

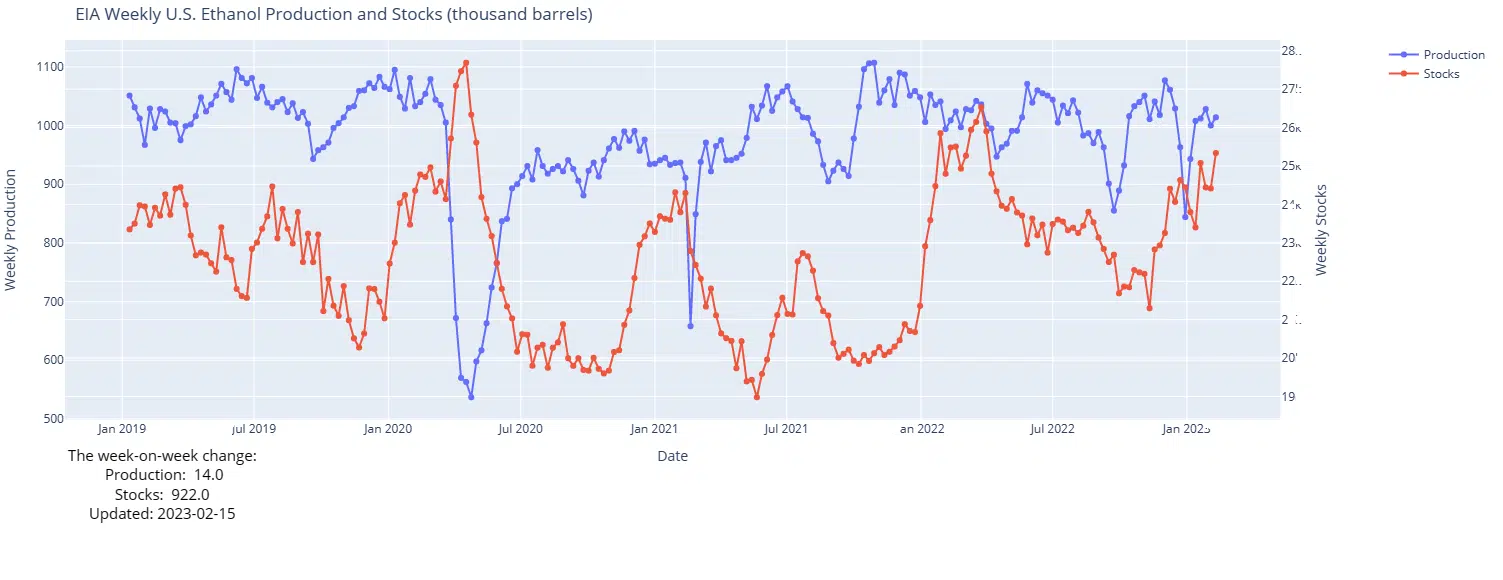

Ethanol.

According to EIA data analyzed by the Renewable Fuels Association for the week ending February 10. Ethanol production increased 1.4% to 1.014 million b/d, equivalent to 42.59 million gallons daily. Production was 0.5% above the same week last year and 0.9% more than the five-year average for the week. The four-week average ethanol production rate ticked 0.2% higher to 1.014 million b/d, equivalent to an annualized rate of 15.54 billion gallons (bg).

Ethanol stocks expanded 3.8% to a 45-week high of 25.3 million barrels. Stocks were 0.6% less than a year ago. Yet 4.5% above the five-year average. Inventories built in the Gulf Coast (PADD 3)—spiking 22.8%. West Coast (PADD 5) but thinned across the other regions.