⛽EIA Energy Stocks🛢️

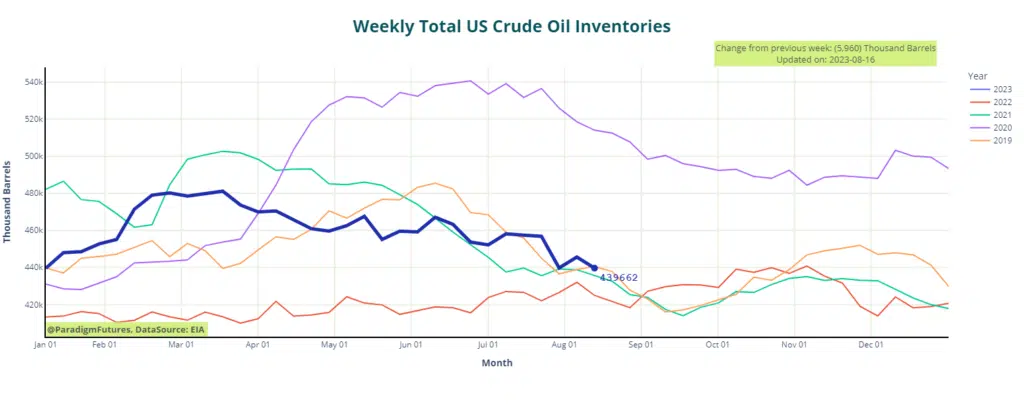

- Crude Inventories Down ⬇️ 6M bbl

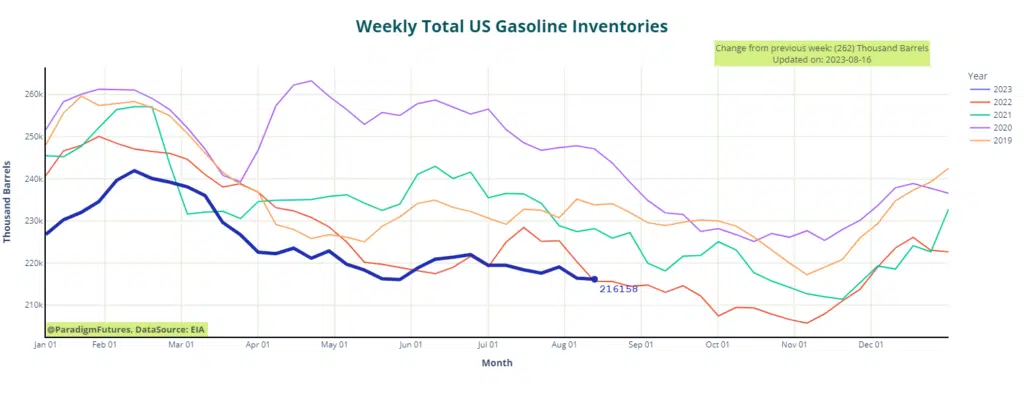

- Gasoline Down ⬇️300k bbl

- Distillates Up⬆️300k bbl

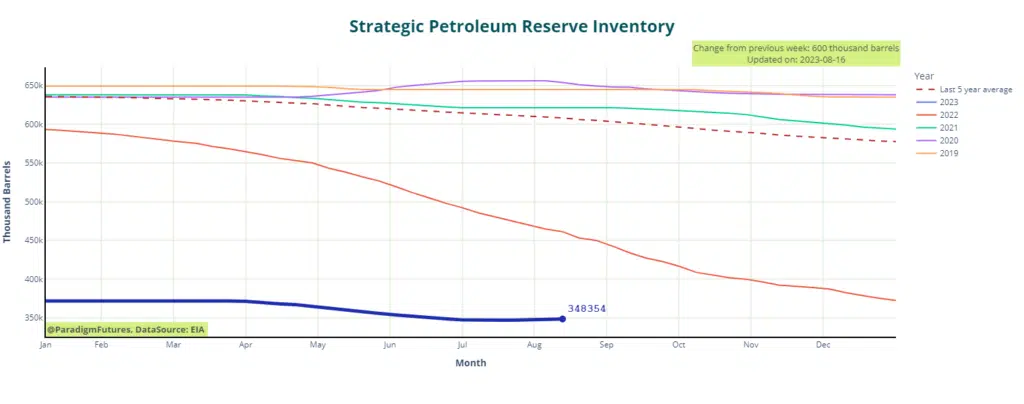

- SPR Up ⬆️600k bbl

- Domestic prod: 12.7MMbpd

- Ethanol up ⬆️555k bbl

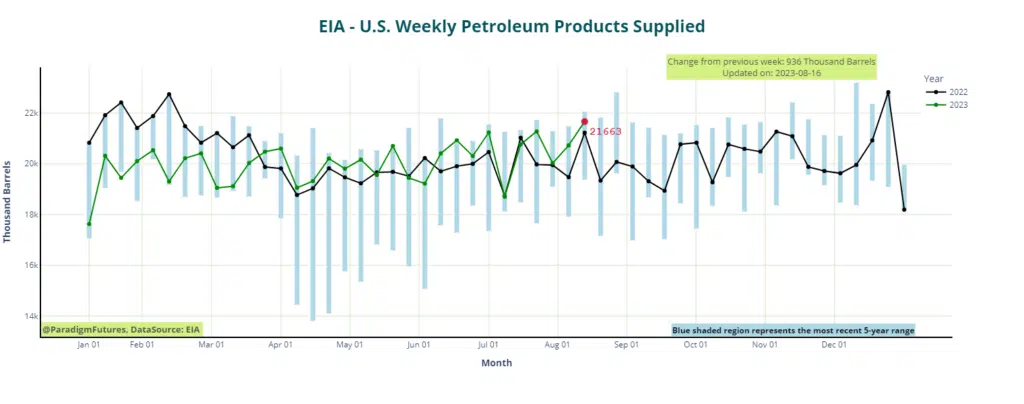

- Impd mogas demand 8.85Mbpd

- Refiner utilization: 94.7%

In early trading Crude oil prices experienced a slight decrease following the Energy Information Administration’s report of a 6 million barrel inventory decline for the week ending on August 11.

Energy Market, Prices, & Industry News Today – Paradigm Futures

This shift contrasts with the prior week’s increase of 5.9 million barrels, which followed an extraordinary inventory reduction of 17 million barrels during the final week of July. A day earlier, the American Petroleum Institute had projected a decrease of 6.2 million barrels in crude oil inventories for the week ending on August 11

Gasoline and Distillates

Concerning fuel inventories, the EIA provided estimates of varied changes in weekly levels. Gasoline inventories decreased modestly by 300,000 barrels during this reporting period, while production averaged 9.6 million barrels per day (bpd).

In comparison, the preceding week witnessed a drawdown of 2.7 million barrels in inventory. Accompanied by a daily production average of 9.9 million barrels.

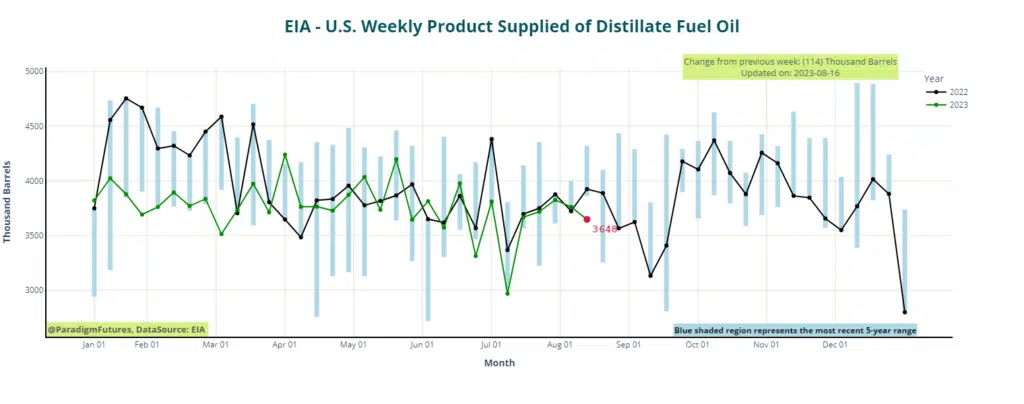

Moving to middle distillates, the EIA estimated an inventory increase of 300,000 barrels for the second week of August. Production averaged 4.7 million barrels daily.

This stood in contrast to the previous week’s inventory reduction of 1.7 million barrels, with middle distillate production averaging 4.9 million bpd.

Throughout this week, oil prices have shown a downward trend in response to the latest economic data from China. These figures, based on industrial production and retail sales data for July, suggest a slowdown in growth.

Simultaneously, refinery runs data from China further signal robust and growing demand for oil. Refiners have intensified processing rates in the past month, with the average daily figure surpassing both June’s and July 2022’s averages.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.