Grains Test Support Levels; Eyes on Jan 12th Report

Grains Test Support Levels today. Markets started the day on their heels as the jobless claims came in lower than what the market expected (204,000 actual), and an ADP employment report showed an increase in employment for the private sector. This is viewed by the market as a reason for the Federal Reserve to keep its restrictive stance on monetary policy.

Grains and Energy Futures were positive before the news and ended up falling after the Economic data dump.

We talked about the support and resistance lines in the Corn Price Chart Update for 12.30.22

In my view, Corn has been a follower of Energy and Wheat this week. With Crude being down 9% in the first two days of the week it seems easy for corn to run and find the support line that it has maintained since July.

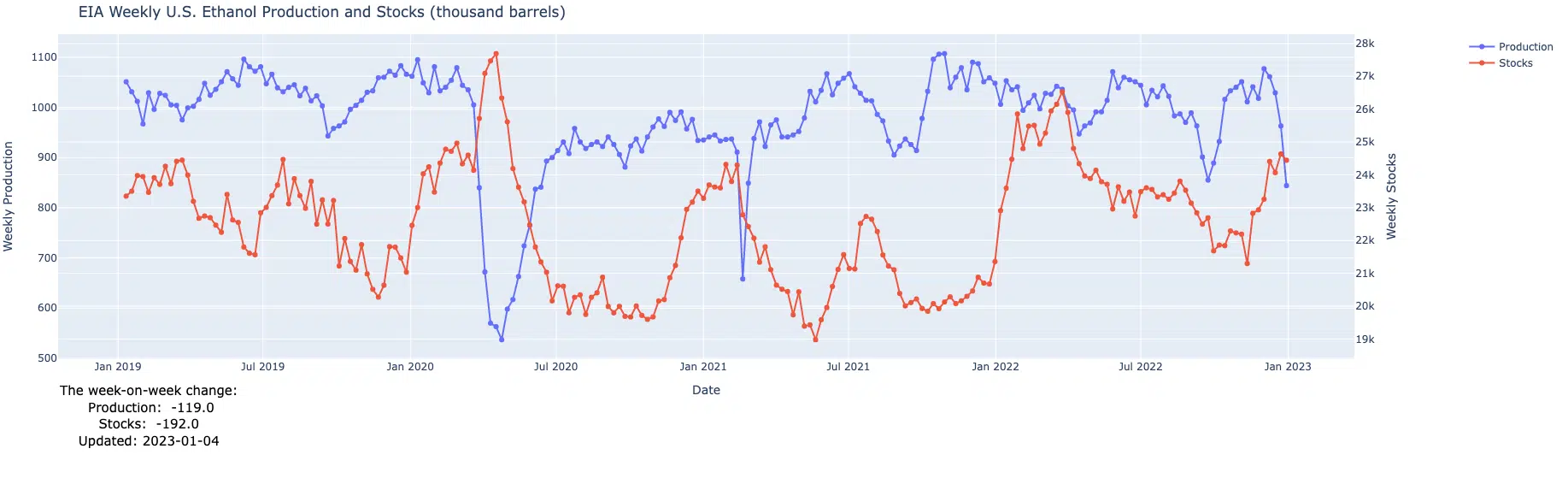

Ethanol

One thing to note from today’s trade was the weekly EIA report showed a massive reduction in ethanol production. This was due to the adverse weather that hit the Central U.S. the past 7 days. By the time the EIA report data came out, the market seemed to have already run out of sellers. With a bearish ethanol production number that came out, it seemed the market had already absorbed the negative news.

I suspect corn could have a rebound for tomorrow’s trade. A few traders took profit on sold call positions today as we were filtering with the July support line. With intentions to put these back on if we happen to test the resistance one more time before the report. Corn will likely stay within these lines until the January 12th report when the final yield numbers get reported for the 2022 crop.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.