FOMC Minutes Preview

What to watch in early markets ahead of the FOMC Minutes Release

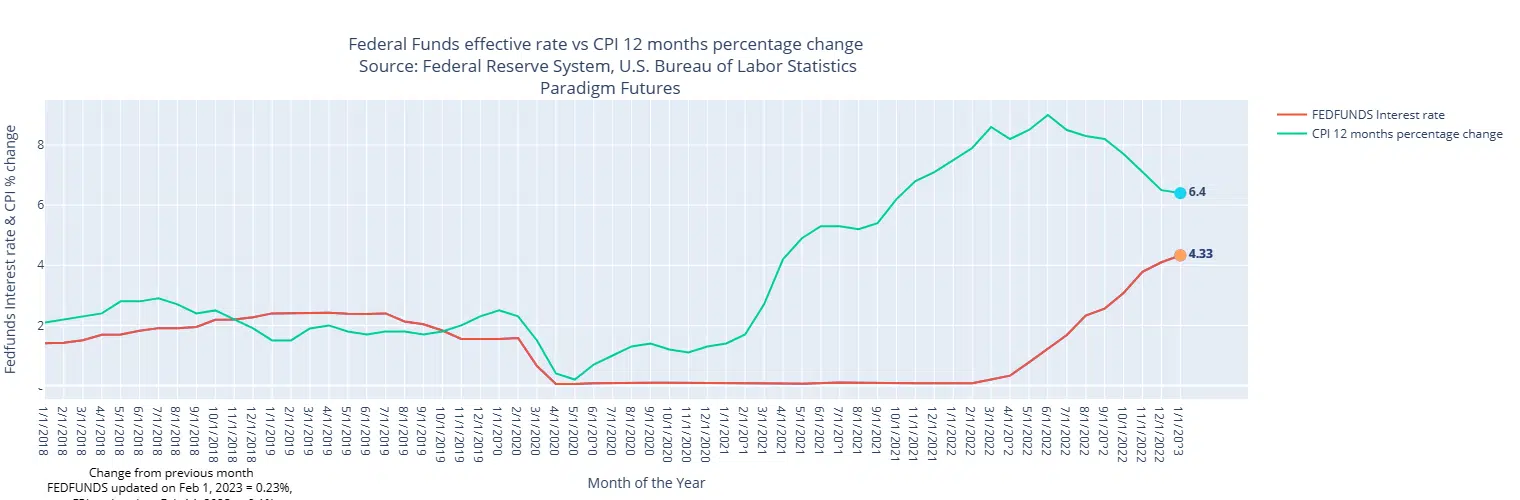

The Federal Open Market Committee (FOMC) decides the federal funds rate, which directly impacts interest rates and serves as the Fed’s primary tool for correcting inflation. In their last meeting, the FOMC’s twelve members dialed down the rate of hikes for the second time in a row, lowering it to 0.25% after a previous hike of 0.5% and four consecutive hikes of 0.75%. The current rate ranges between 4.5% and 4.75%.

Economists forecast further hikes of 0.25%, although investors hope the Fed will begin to dial back on the federal funds rate. The S&P 500 opened on Tuesday with a nearly 2% drop following the holiday weekend, as investors anticipate the minutes from the meeting to provide insight into future Fed policy. It should be noted that the market responded positively to the last release of FOMC minutes, with a 4.5% climb in the ten days following the release. That would be a welcome outcome after witnessing the DJI give back all of its gains from the year and the S&P 81.75 to the downside.

The Fed is attempting to balance economic growth to reduce inflation while avoiding a recession. In the latest release of minutes, which were published in January and detailed December’s meeting, Fed officials acknowledged that a less hawkish approach to hikes was necessary. However, they were concerned that financial markets might interpret this as a signal that the agency’s commitment to reducing inflation was faltering.

How the Release Can Impact You, and Your Portfolio

As the Fed publishes the minutes at 2 p.m. ET on Wednesday, investors will keep an eye on companies impacted by interest rate changes, known as interest-sensitive stocks. The banking sector is the first to be affected by changes in the federal funds rate, but banking ETFs have demonstrated strength following recent Fed catalysts. When Fed Chair Jerome Powell announced the latest interest rate hike on Feb. 1, Invesco KBW Regional Banking ETF (NASDAQ:KBWR) jumped 6.8% between the two days leading up to the announcement and the day after. The same ETF decreased slightly after the previous meeting’s minutes went live in early January but was up 2.4% two days later.

The impressive January jobs report and the hawkish Fed commentary that followed the report have driven the US Dollar’s upbeat performance in February. The US Dollar Index is up nearly 2% this month and is on track to snap a four-month losing streak. Therefore, it’s reasonable to say that the Fed’s publication is unlikely to offer any fresh insights into the policy outlook and is likely to be outdated.

Last week, Cleveland Fed President Loretta Mester said that she saw a “compelling case” for a 50 bps rate hike at the last policy meeting. Similarly, James Bullard, the St. Louis Federal Reserve, said, “I was an advocate for a 50 bps hike, and I argued that we should get to the level of rates the committee viewed as sufficiently restrictive as soon as we could.”

Although Mester and Bullard are not voting members this year, it will be interesting to see if policymakers discussed a return to 50 bps rate increases if inflation softness proved to be temporary or if labor market conditions suggested that the economy could handle bigger hikes. If so, investors may consider the possibility of a 50 bps hike at the next meeting. According to the CME Group FedWatch Tool, the odds of a 50 bps hike in March currently stand at around 20%, suggesting that an extended USD rally may occur if the Fed’s publication opens the door to such a decision

Other banking ETFs, such as First Trust NASDAQ ABA Community Bank Index Fund (NASDAQ:QABA) and SPDR S&P Regional Banking ETF (NYSE:KRE), exhibited the same trends. Mortgage stocks, such as Rocket Companies (NYSE:RKT) and UWM Holdings Corp (NYSE:UWMC), were unaffected by the last minute’s release but have been trending downward since Feb. 1, as the Fed continued to increase interest rates.

Similarly, some auto dealers, such as Vroom (NASDAQ:VRM), began a downward trajectory after the latest Fed decision but were unaffected by the FOMC minutes, although this trend was not universal throughout the sector.

Data and reports can be found here, once they go live (After 2pm EST release)