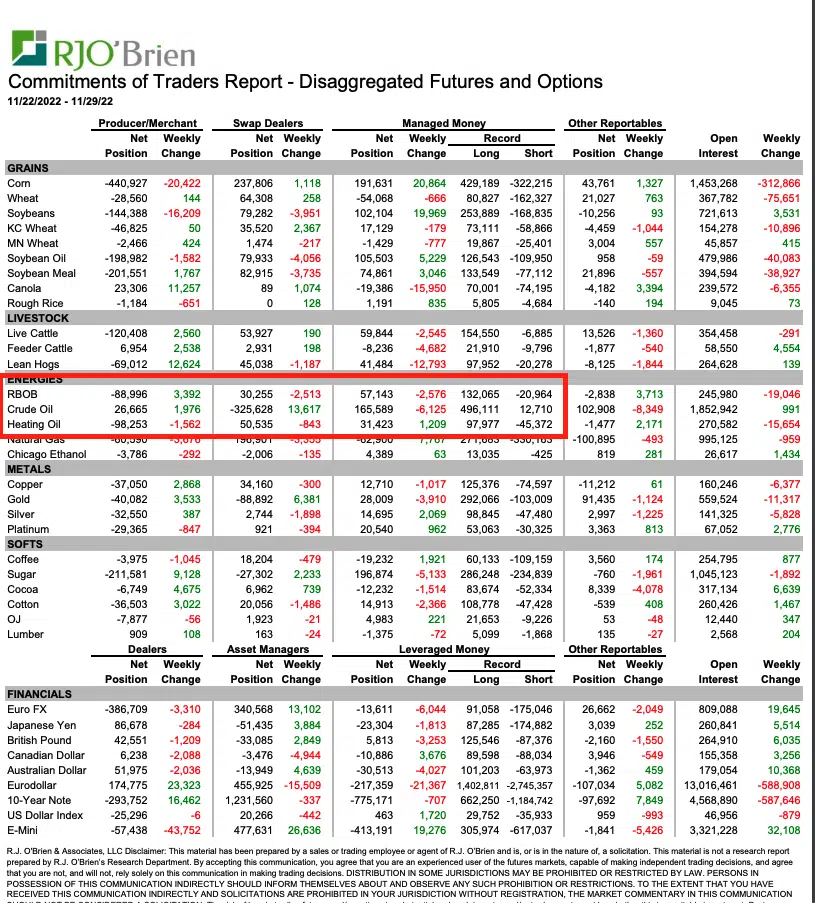

In the face of declining inventories of Crude Oil in the U.S. Energy markets are again under pressure. Today the finished product charts broke old lows put in this fall. This opens the door on the charts pretty far, couple with a Managed Money position that is long and wrong we could see continuation.