CPI

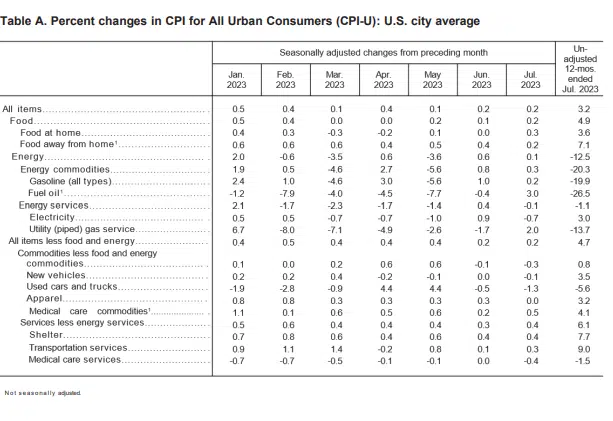

- US CPI MoM: 0.2% [Est. 0.2%]

- US Core CPI MoM: 0.2% [Est. 0.2%]

- US CPI YoY: 3.2% [Est. 3.3%, Previous 3.0%]

- US Core CPI YoY: 4.7% [Est. 4.8%]

U.S. Initial Jobless Claims

- 248K, [Est: 230K]

- Prev: 227K

Continuing Jobless Claims

- 1.684M vs. [Est.1.710M]

- 1.692 Previous (revised from 1.700M).

Real average hourly earnings for all employees increase 0.3% in July.

Economic Futures Data & News – Paradigm Futures

Consumer Price Index

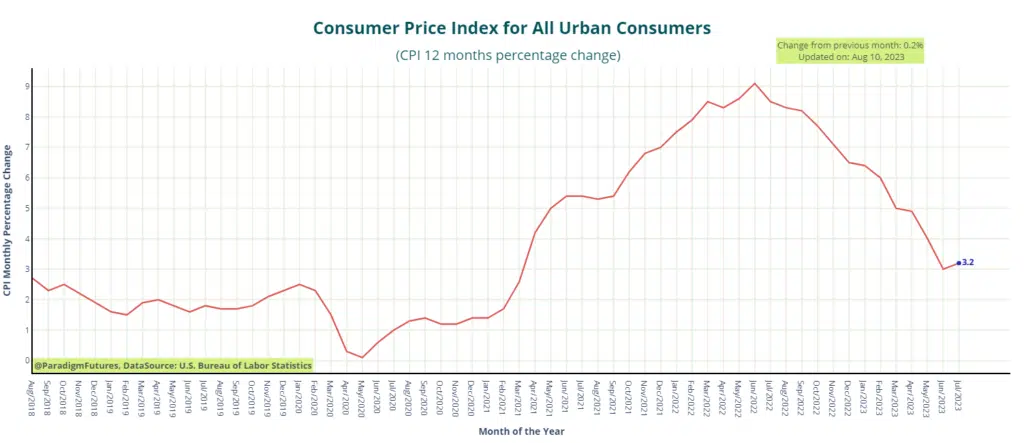

The Bureau of Labor Statistics published its CPI Report, revealing that the Consumer Price Index experienced a 3.2% year-over-year increase in July.

Anticipation surrounded the acceleration of inflation, as measured by the CPI. The forecast predicted a year-over-year CPI of 3.3% for July, following a 3.0% shift over the previous 12 months in June.

The Core CPI, excluding food and energy, exhibited a 4.7% rise over the 12 months leading up to July. This increase closely aligned with the projected year-over-year growth of 4.8%. In June, Core CPI had surged by 4.8% on a year-over-year basis. Notably, the percent changes in year-over-year Core CPI had been gradually cooling in the months preceding the latest data release.

When considering seasonally adjusted month-over-month data, it was observed that Core CPI had risen by 0.2% from June to July. This mirrored the 0.2% increase that had occurred in June.

In response to the ongoing struggle against inflation, the Federal Reserve had raised interest rates by 25 basis points in July, resuming action after a pause in June. This move was just one among several actions taken by the Fed in its fight against inflation.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.