Lean Hog Price Surges 5%

Lean Hog price surged 5% on Friday after hitting oversold levels on the Relative Strength Index. If you can spot the relation between the price chart and the RSI chart at the bottom of the chart you will notice a bullish divergence. As the price came down and made a low back on December 8th RSI was well below 30. Now as the price chart continues to make new lows the RSI is not. This would be considered a Bullish Divergence.

As a producer, it will be important to spot this, as well as the “gap” above 90.00 and at 79.00 below. It would be wise to utilize this rally and bullish divergence to consider getting protection on your production if prices can run and fill the gap above 90.00. Just a little bit above the gap is the down-trend line we have been struggling to overcome the past few months. Over time the market will want to try and fill the gap down at 79.00. So as a producer it will be important to recognize this risk.

One more thing to watch is the RSI. As the market attempts to fill the gaps on the chart it will be important to keep an eye on if the RSI is overbought (above 70) or oversold (below 30). When the market pushes too far in one direction, it pushes the risk higher.

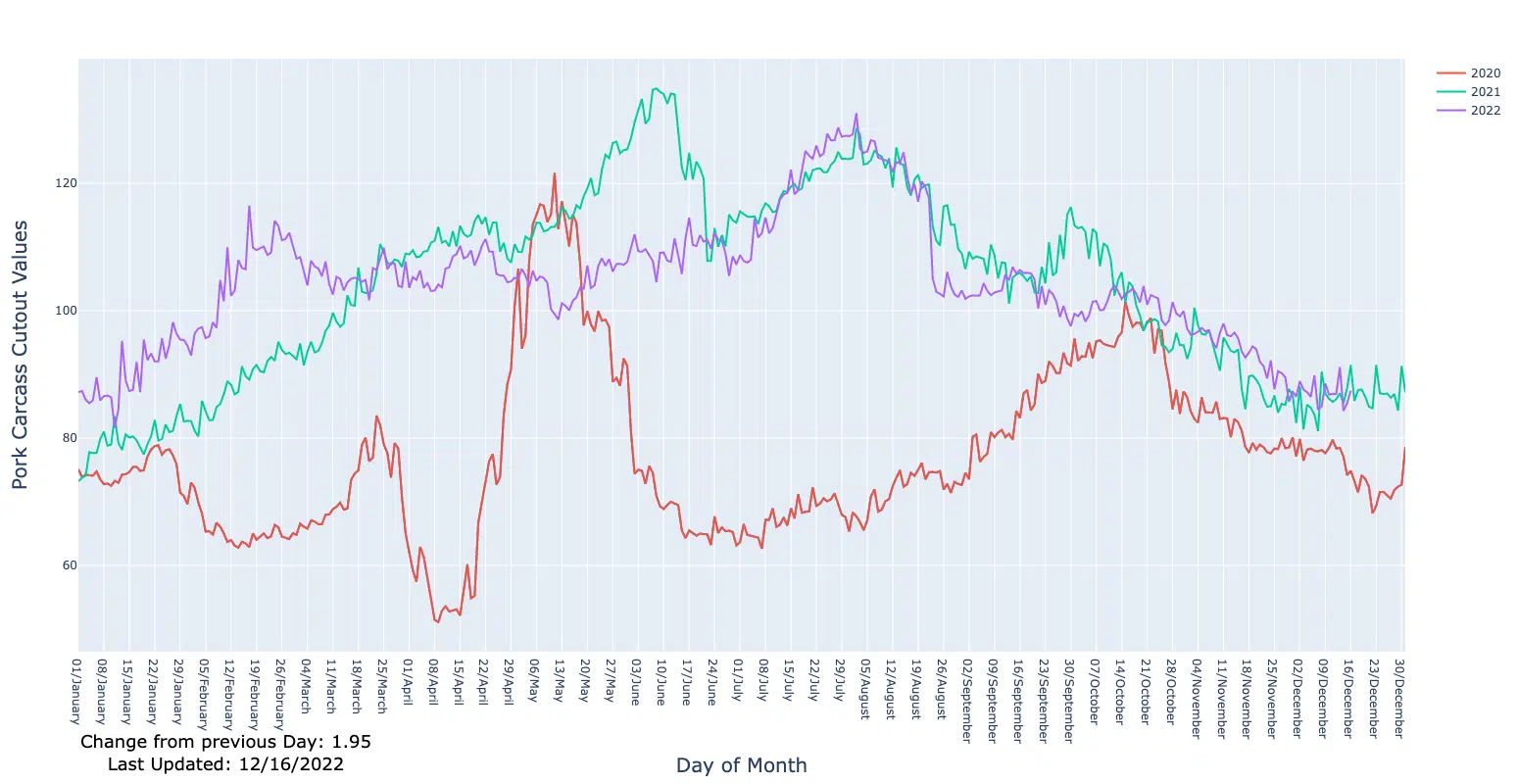

The second chart shows the cash market for lean hogs. As you can see there will still be a few more weeks of seasonal weakness in the cash markets.

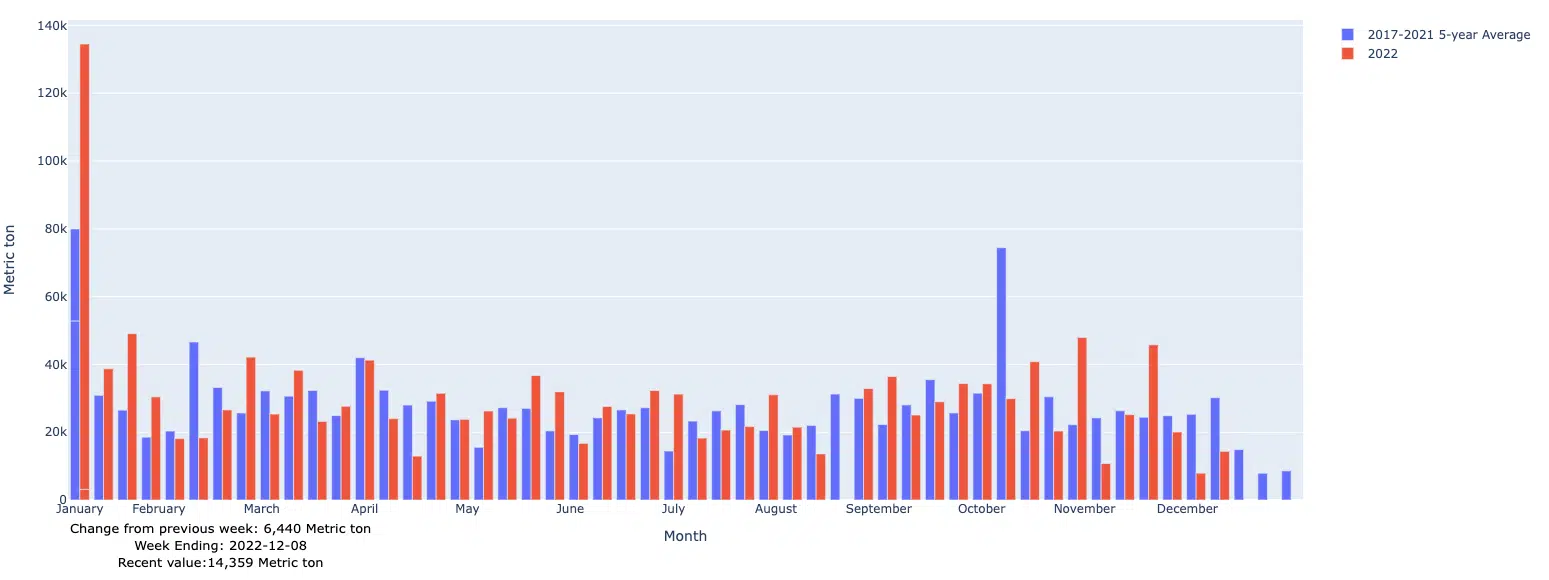

The third chart listed is the weekly export sales for pork. There has been a couple of weeks these past few months have been some pretty big sales with sales above 40,000 metric tons which have helped keep the average up.