At 11:20 a.m. CT, corn futures surged approximately 15 cents, soybeans saw gains of 1 to 3 cents. Winter wheat markets rose by 10 to 15 cents. Spring wheat climbed 4 to 6 cents, following the release.

Prospective Plantings Report Highlights

- Corn: The USDA estimates corn plantings at 90.036 million acres, down 4.6 million acres (4.9%) from last year and lower than traders’ expectations of 91.776 million acres.

- Soybeans: Soybean acres are projected to rise to 86.510 million acres, matching pre-report expectations, and increasing by 2.9 million acres from last year.

- All Wheat: Expected wheat plantings stand at 47.498 million acres, down 2.1 million acres from last year but higher than traders’ expectations of 47.330 million acres.

- Cotton: Cotton plantings are estimated to increase to 10.673 million acres, slightly lower than traders’ expectations but up by 443,000 acres from last year.

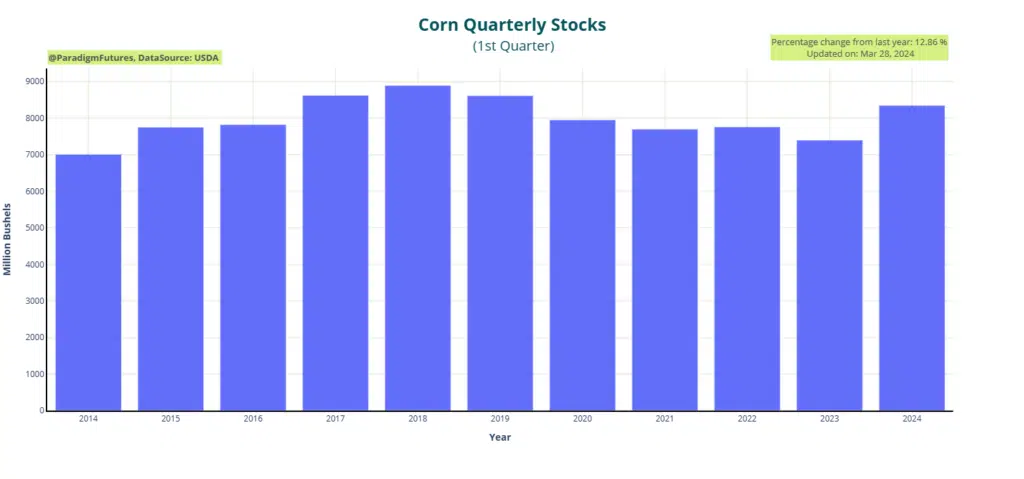

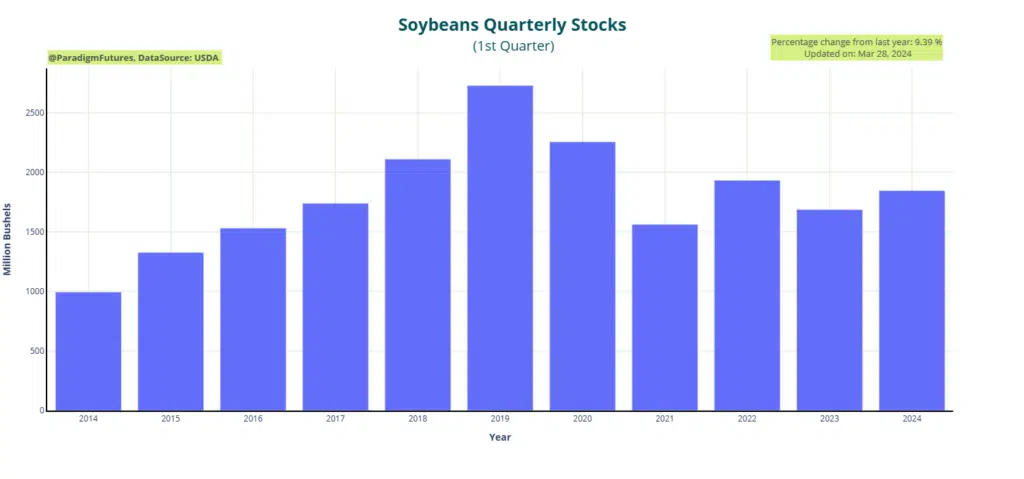

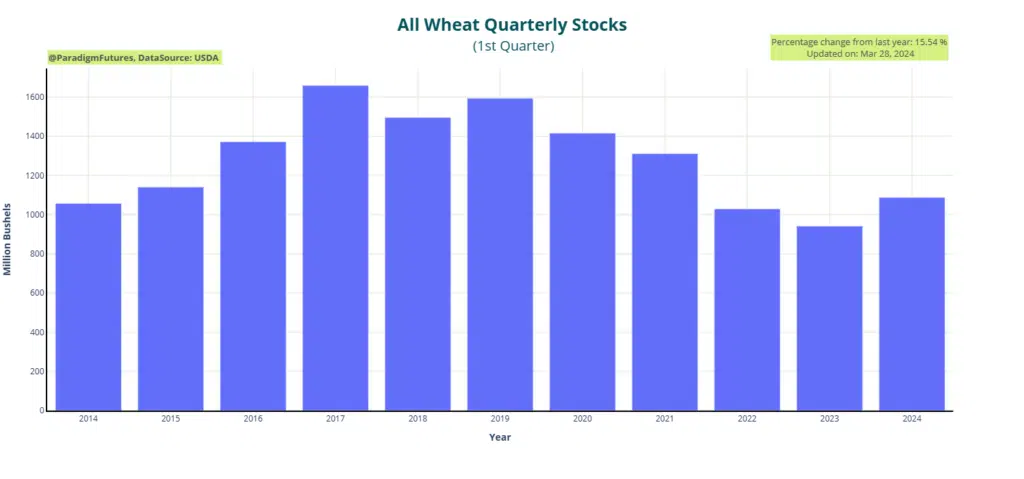

Quarterly Grain Stocks Report Findings

Corn Stocks: Total corn stocks on March 1 were up 951 million bushels from last year. Coming in at 8.347 billion bushels, slightly below the average pre-report trade estimate.

Soybean Stocks: Soybean stocks on March 1 increased by 158 million bushels from last year. Reaching 1.845 billion bushels, slightly above the average pre-report trade estimate.

Wheat Stocks: Wheat stocks on March 1 rose by 146 million bushels from last year. With a total of 1.087 billion bushels, slightly above the average pre-report trade estimate.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.