PPI dips slightly for February, Beating Expectations.

Will the drop be enough to provide the Fed cover at next weeks FOMC meeting?

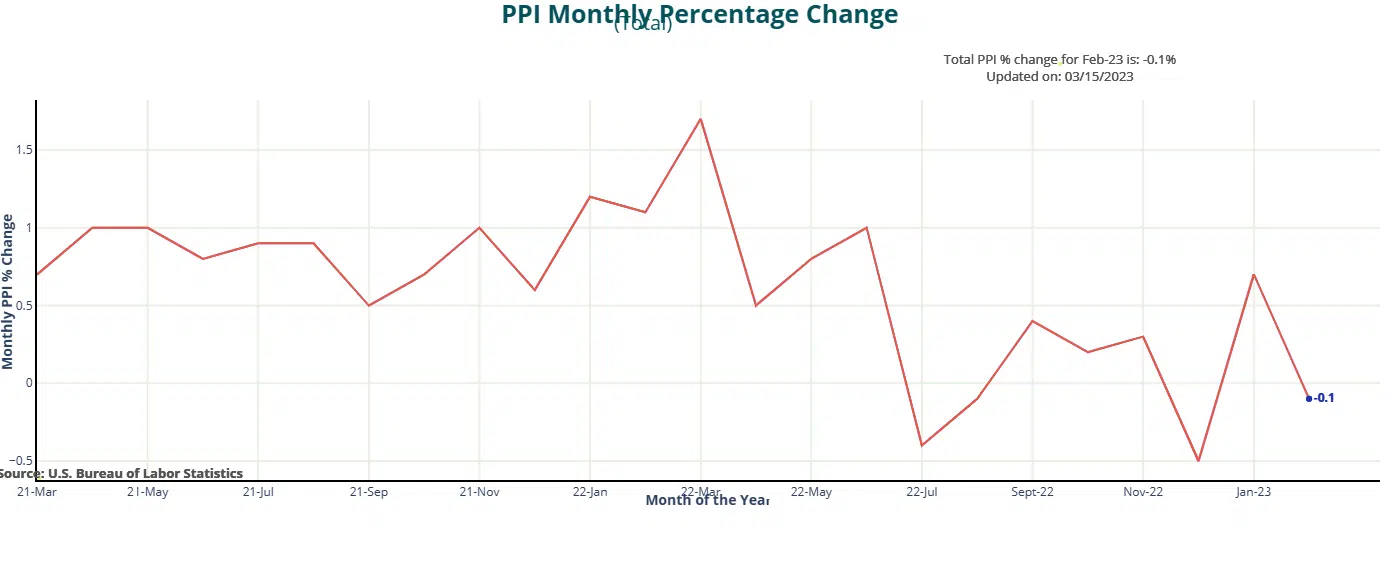

According to today’s PPI report released by the Labor Department, producer prices in the US unexpectedly dipped somewhat in February. The producer price index for final demand, according to the Labor Department, increased by a downwardly revised 0.3 percent in January but declined by 0.1 percent in February. Compared to the 0.7 percent increase that was first announced for the previous month, economists had anticipated a producer price increase of 0.3 percent. The survey also revealed that from 5.7 percent in January to 4.6 percent in February, the annual pace of growth of producer prices declined. It was anticipated that the rise over the previous year would moderate to 5.4%. Much of the monthly producer price decline was due to another sharp decline in food costs, which fell by 2.2 percent in February after slumping by 1.2 percent in January.

Energy prices also showed a modest pullback, dipping by 0.2 percent in February after soaring by 5.2 percent in January. The Labor Department also said prices for services edged down by 0.1 percent in February, matching the modest decrease seen in the previous month. Prices for transportation and warehousing services tumbled by 1.1 percent, while prices for trade services slid by 0.8 percent.

CPI, PPI, and the Fed

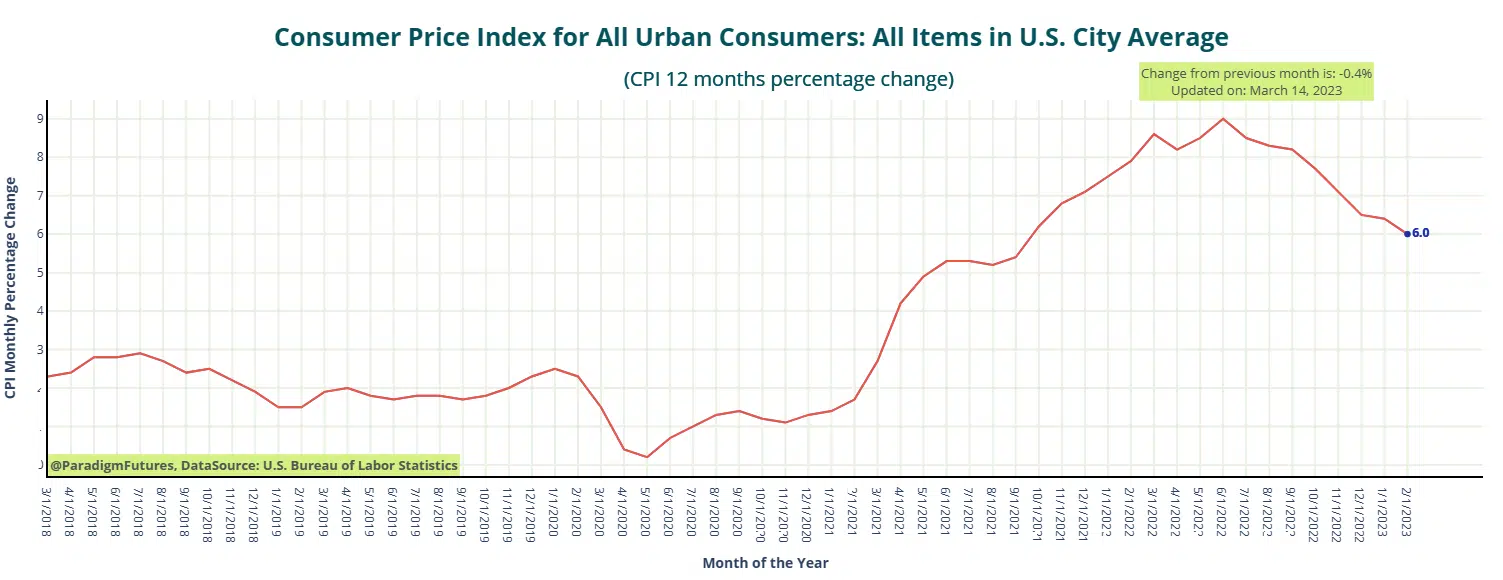

“The downward surprise to February’s PPI report is good news for the Fed, though with yesterday’s CPI report showing inflation is still sticky in the services sector it will figure little in next week’s decision to raise interest rates by 25bps,” said Matthew Martin, U.S. Economist at Oxford Economics. He added, “Still, the m/m decline in February together with the downward revision to January’s increase indicates that cooling demand is leading to a further slowdown in price increases, particularly in the goods sector.” On Tuesday, the Labor Department released a separate report showing consumer prices in the U.S. increased in line with economist estimates in the month of February.

The Labor Department said its consumer price index rose by 0.4 percent in February after climbing by 0.5 percent in January. The advance by the index matched expectations. Core consumer prices, which exclude food and energy prices, increased by 0.5 percent in February after rising by 0.4 percent in the previous month. Economists had expected core prices to rise by 0.4 percent. The report also showed the annual rate of consumer price growth slowed to 6.0 percent in February from 6.4 percent in January. The year-over-year growth, which was in line with economist estimates, marked the smallest 12-month increase since September 2021.