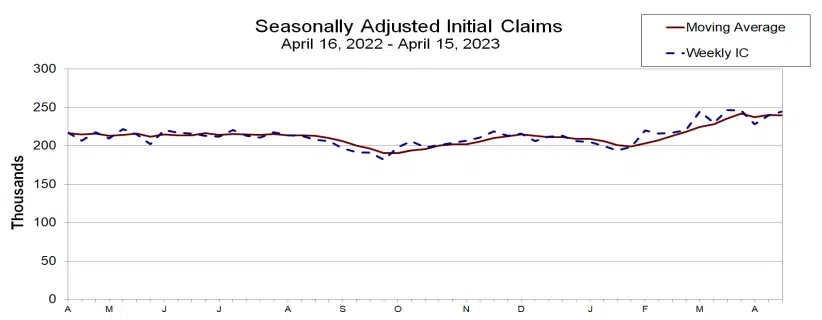

Initial Jobless Claims 245,000.

The rise in claims last week may be partially accounted for by the combination of spring breaks, which temporarily left some school district support staff unemployed, slowing discretionary spending leading to fewer new hires and layoffs in retail, and laid-off individuals who have exhausted their severance packages in technology and interest rate sensitive sectors.

The labor market is slowing, current claim levels suggest that employment growth is still strong enough to allow the Federal Reserve to raise interest rates once more next month, before pausing its monetary policy tightening campaign – the fastest since the 1980s.

In its Beige Book released on Wednesday, the Fed noted that job gains had “moderated somewhat” in early April, as several districts reported slower growth than in previous reports. The labor market was also becoming less tight, with a small number of firms reporting mass layoffs that were centered at a subset of the largest companies.

Although the Beige Book indicated that several districts reported banks tightening lending standards, this has not yet been reflected in economic data, including claims. Tighter credit conditions generally act with a lag on the economy, and economists predict that the effects will be felt in the coming months, with many forecasting a recession by the second half of 2023.

The claims data covers the period during which the government surveyed households for the nonfarm payrolls portion of April’s employment report. Claims remained largely unchanged between the March and April survey weeks. In March, the economy created 236,000 jobs, more than double the amount needed to keep up with growth in the working-age population.

Data next week on people receiving benefits after an initial week of aid, a proxy for hiring, will offer further insight into the state of the labor market in April. The number of continuing claims increased by 61,000 to 1.865 million during the week ending April 8th, according to the claims report.

Historically, continuing claims remain low, as many laid-off workers quickly find employment. In February, there were 1.7 job openings for every unemployed person.