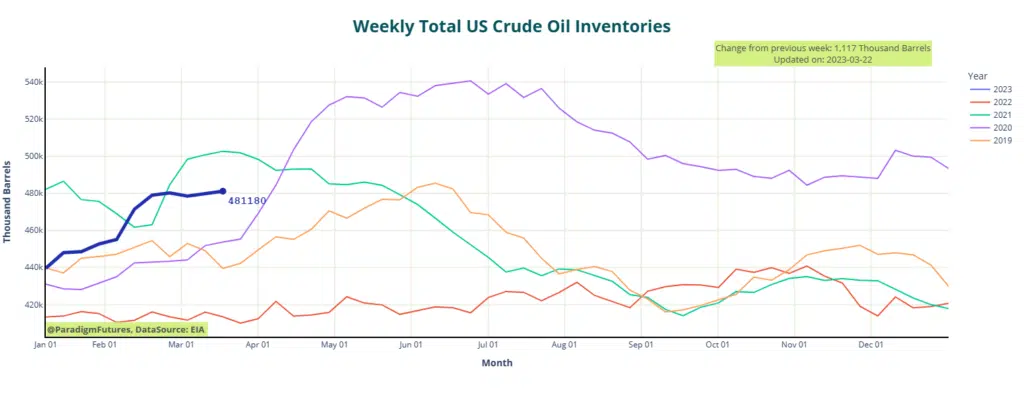

- Crude Inventories 🔺1.117 M

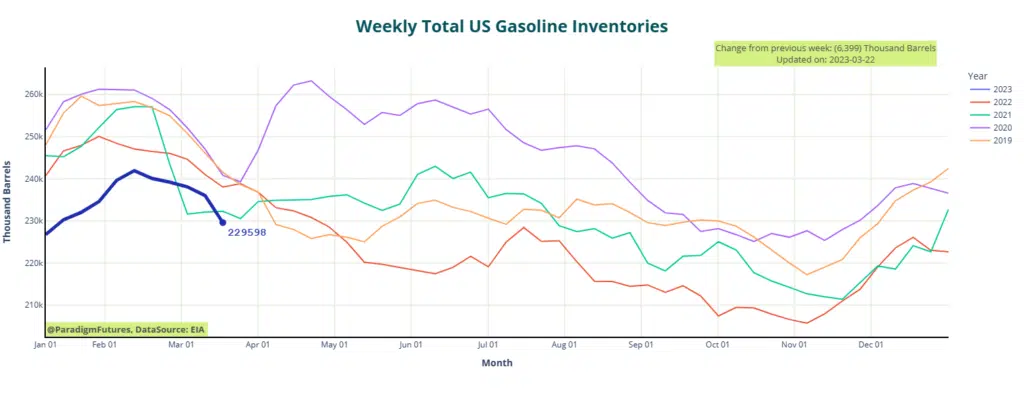

- Gasoline 🔽 6.4 M

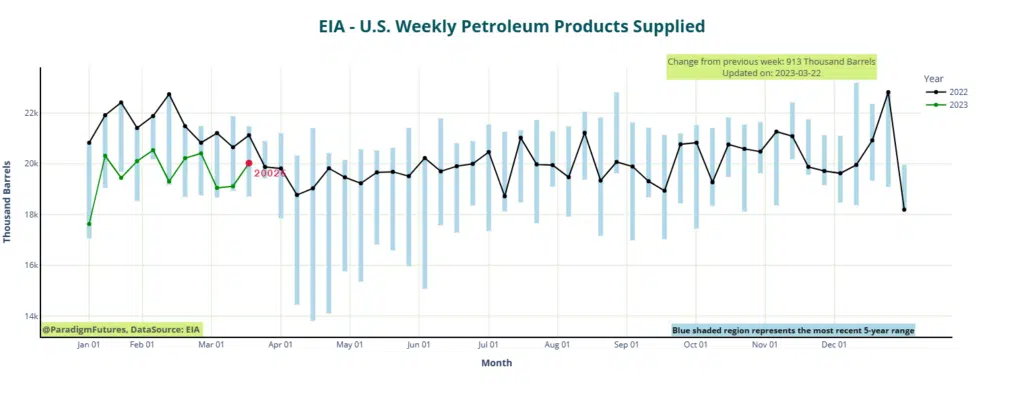

- Distillates 🔽3.3 M

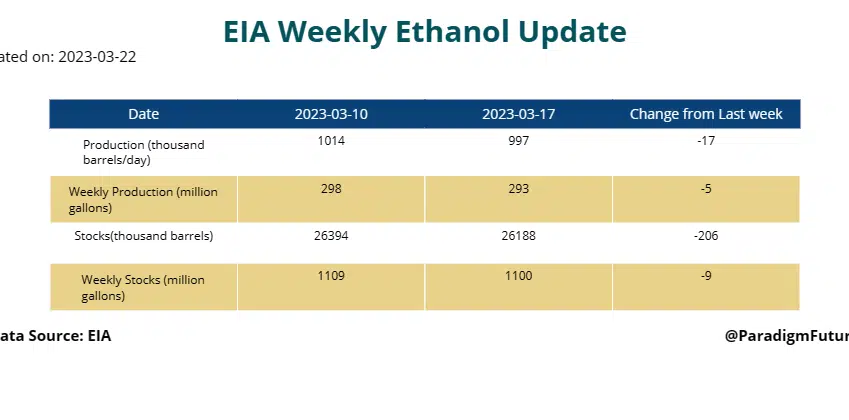

- Ethanol 🔽 216 K

- SBR ⛔No Change

U.S. Energy Information Administration reported another weekly build in crude oil inventories of 1.1 million barrels. That compared with a build of 1.6 Million for the previous week. EIA also reported major draws in fuel inventories for the week to March 17, with both gasoline and distillate fuel stocks down.

U.S. crude oil stocks stood at 481.2 million barrels at the end of last week, which was about 8 percent above the five-year average for this time of the year.

A day earlier, the American Petroleum Institute had estimated crude oil inventories had added some 3.3 million barrels in the week to March 17, which added to the pressure on prices. We will be looking to the next OPEC meeting to see if they will make any changes to current output.

In middle distillates, the EIA estimated an inventory draw of 3.3 million barrels for the week to March 17. Which compared with a draw of 2.5 million barrels for the previous week.

Middle distillate production averaged 4.5 million barrels daily last week. Opposed to the 4.4 million bpd for the previous week.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.