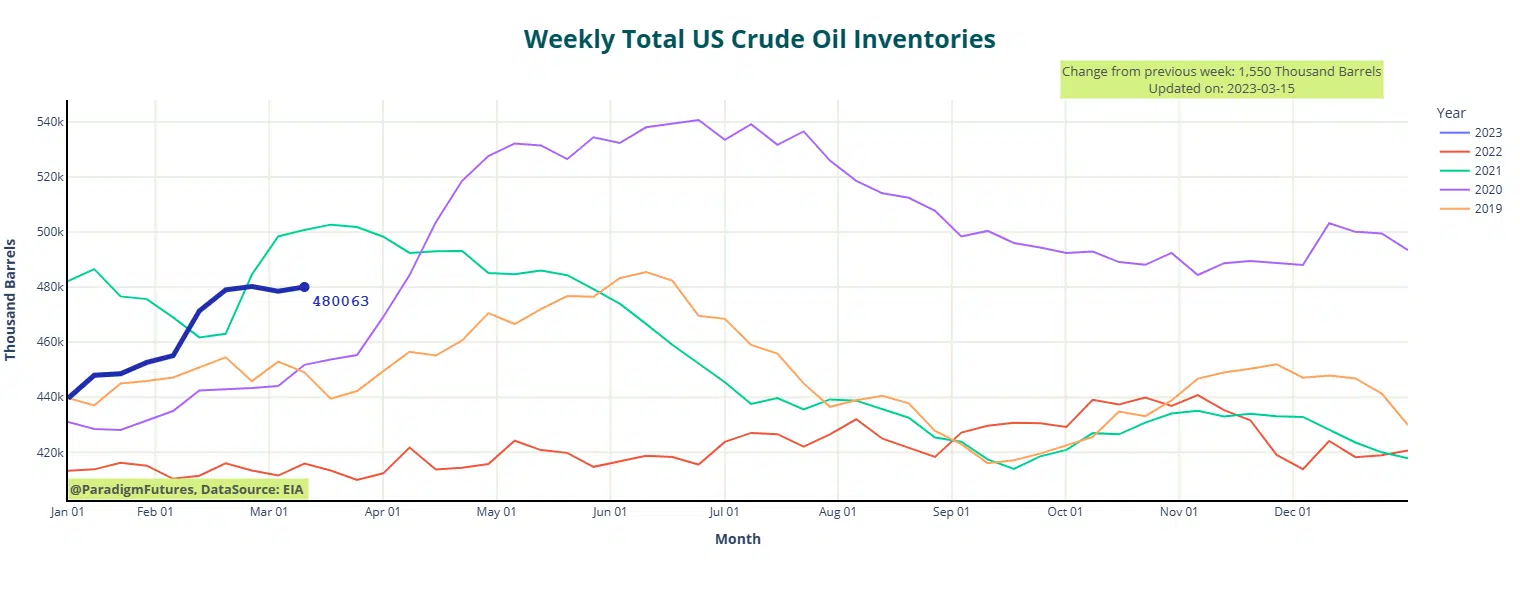

Crude Build Returns, After last week’s drawdown.

- Crude Inventories 🔺 UP 1.6 M

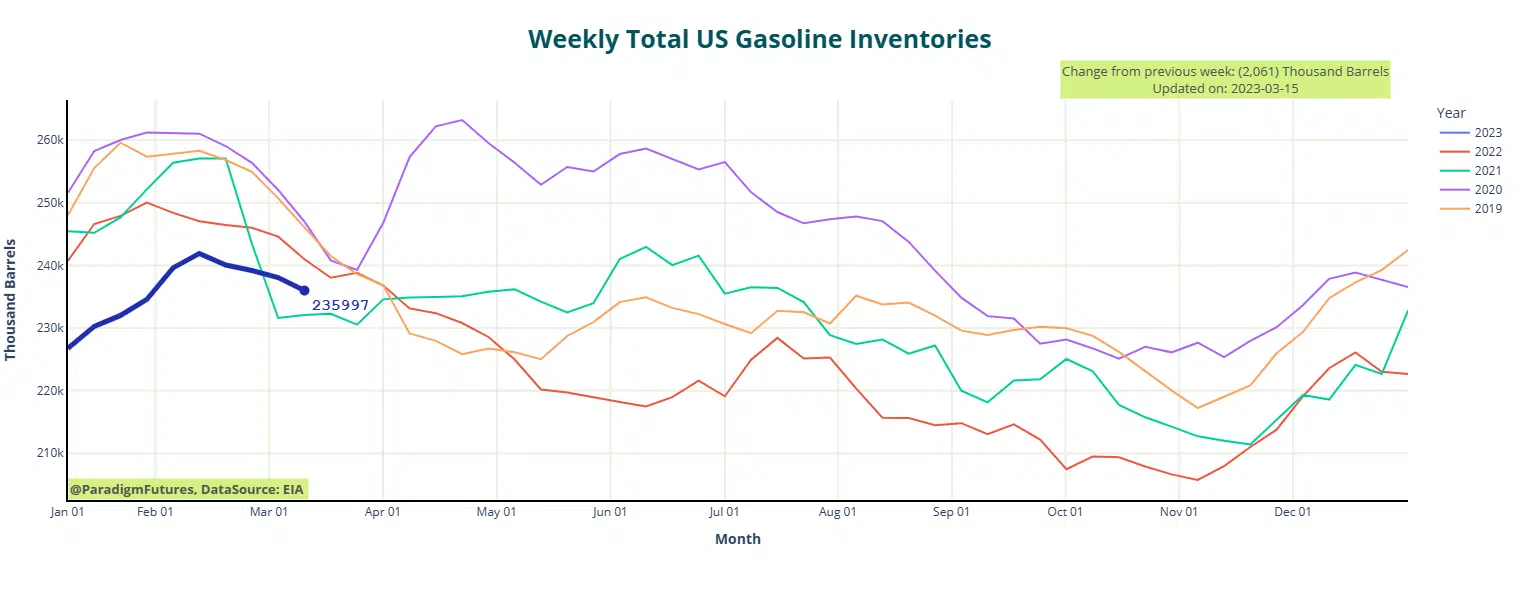

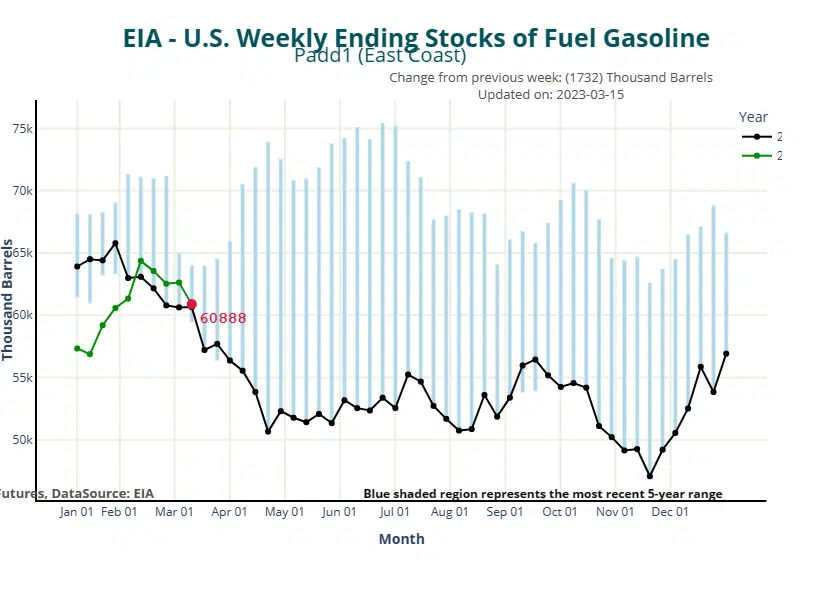

- Gasoline 🔽 down 2.1 M

- Distillates 🔽 down 2.1M

- Ethanol 🔺UP 1.07 M

- SBR ⛔No Change

U.S. Energy Information Administration reported an inventory build of 1.6 million barrels for the week to March 10.

This compared with an inventory decline of 1.7 million barrels estimated for the previous week and the first decline in crude oil inventories since the start of the year.

At 480.1 million barrels, crude oil inventories are 7 percent above the five-year seasonal average, the EIA said.

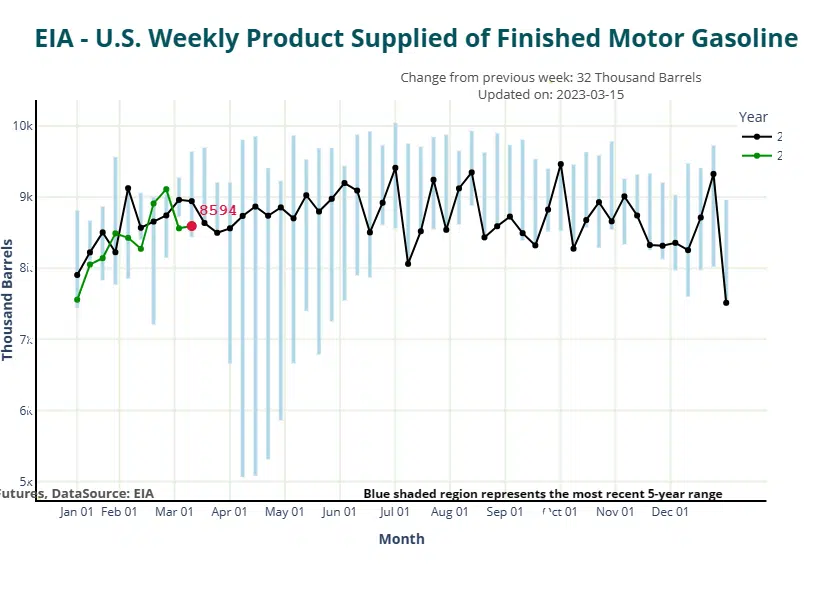

In gasoline, the EIA estimated an inventory draw of 2.1 million barrels for the week to March 10, with production at 9.1 million barrels per day.

This compared with an inventory draw of 1.1 million barrels for the previous week and average daily production of 9.6 million barrels.

In middle distillates, the EIA reported an inventory decline of 2.5 million barrels for the week to March 10, with production averaging 4.4 million barrels daily.

In contrast, the week leading up to March 3 saw a minor increase in inventories of 100,000 barrels and an average daily production of 4.5 million barrels.

After hearing about Silicon Valley Bank’s failure at the end of last week and another bank following suit, oil prices fell earlier this week. Both Brent crude and West Texas Intermediate fell below $80 per barrel as a result of concerns about inflation in the United States, which also had an impact on benchmarks.

Nevertheless, early today, prices started to rise again as OPEC provided an update on Chinese oil demand. The cartel predicted that this year’s demand for crude oil from China will increase by 710,000 barrels per day. This was a revision to a demand increase prediction of 590,000 bpd for China in OPEC’s last month report.

However, OPEC also issued a warning against overestimating oil demand, stating that “the quick rises in interest rates and global debt levels could entail major negative spillover effects and may significantly damage the global growth dynamic.”