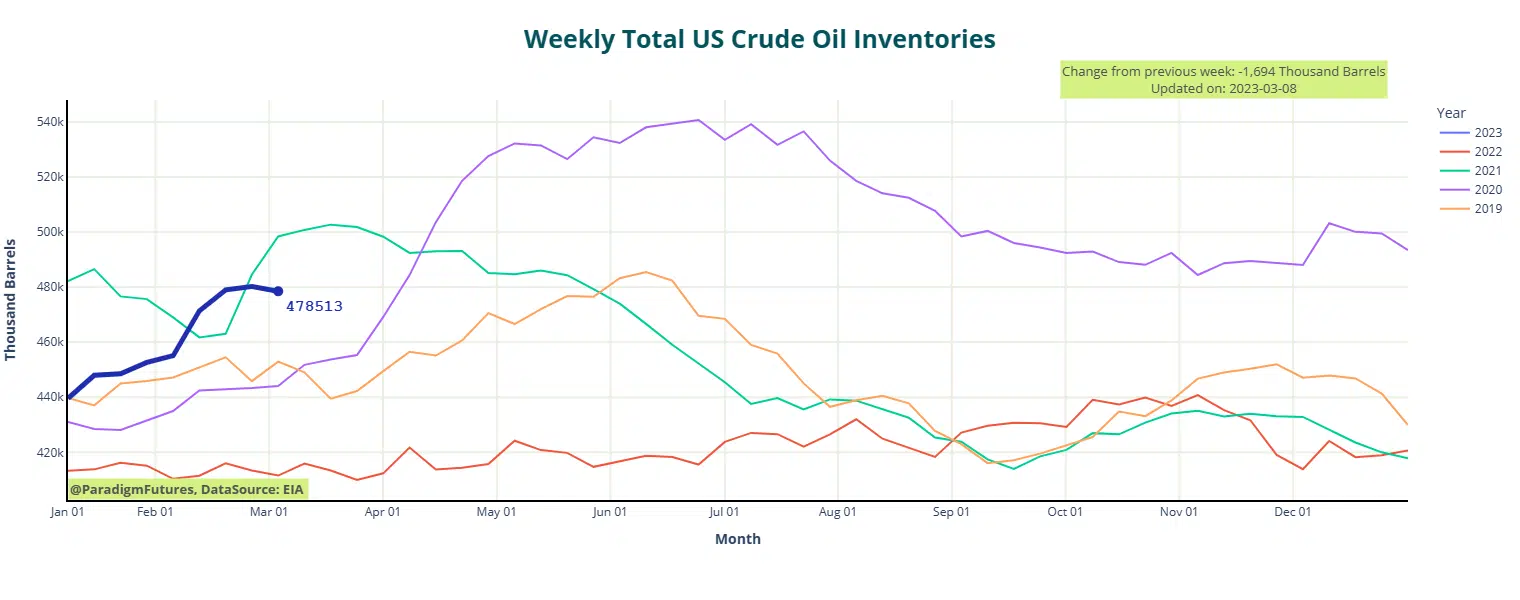

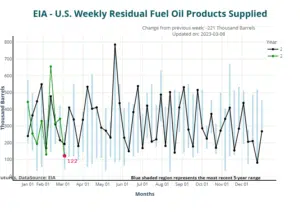

After more than 2 months of increases, Crude Inventories Drop.

- Crude Inventories🔽 1.694 million barrels

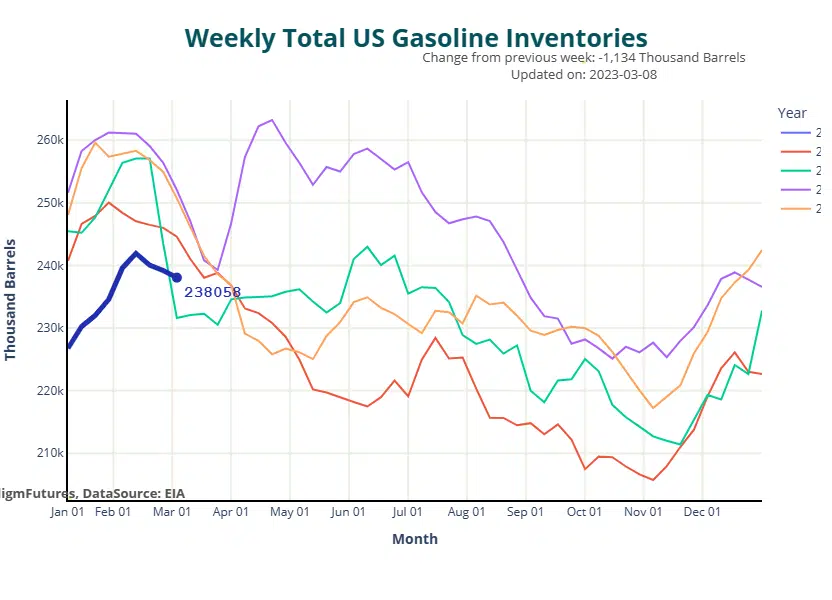

- Gasoline 🔽1.134 million barrels

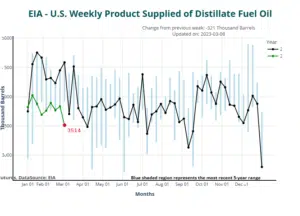

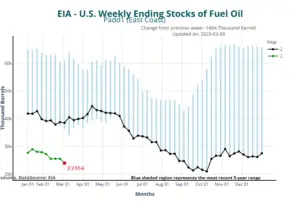

- Distillates 🔺138,000 barrels

- Ethanol 🔺545,000 barrels

- SBR ⛔NC

During the week ending March 3, the U.S. Energy Information Agency predicted an inventory draw of 1.7 million barrels.

In contrast, the prior week’s build was 1.2 million barrels. The five-year seasonal average for crude oil inventories is 478.5 million barrels, which is 7 percent higher.

The most recent estimate comes after a streak of sizable inventory builds that put pressure on prices and were attributed by the EIA to underreporting of production by the industry and crude oil blending. In order to correct the situation, the government announced that it would modify its surveys and alter how it accounted for blended crude.

In contrast to the previous week’s decrease of 900,000 barrels, the EIA anticipated a draw of 1.1 million barrels in gasoline stockpiles.

Gasoline production averaged 9.6 million barrels daily last week, which compared with 9.7 million barrels daily a week earlier.

In middle distillates, the EIA estimated an inventory increase of 100,000 barrels for the week to March 3. This compared with a modest build of 200,000 barrels for the previous week.

Middle distillate production averaged 4.5 million bpd last week, which compared with 4.6 million bpd a week earlier.

Meanwhile, the EIA has forecast that U.S. crude oil production will hit 12.44 million barrels daily this year, rising by 590,000 barrels daily. Production growth next year, however, is seen much weaker, at 190,000 bpd to 12.63 million barrels daily.

As regards demand and supply, the oil market appears to be well balanced for the time being, according to industry executives, who gathered this week in Houston for the CERAWeek industry conference.

However, this balance is precarious and could be easily disturbed due to limited global oil production spare capacity and the possibility for production disruptions related to the war in Ukraine.

j