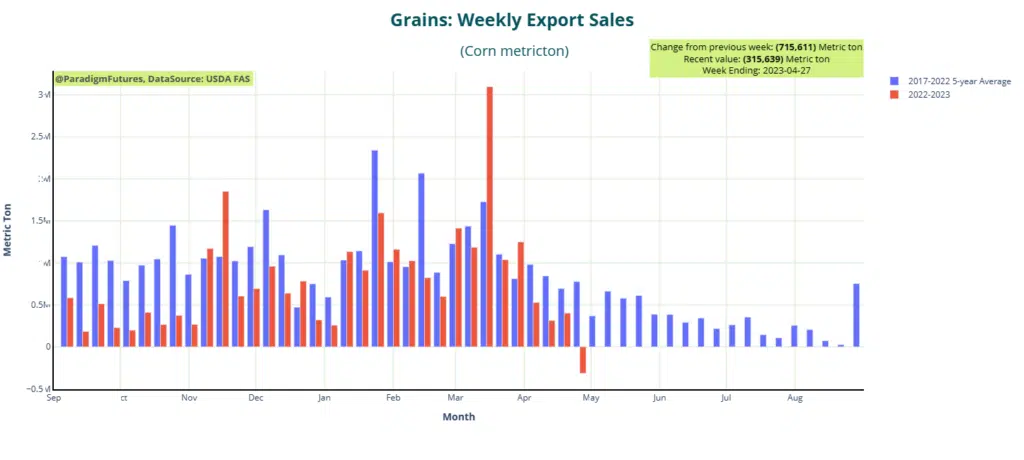

Corn💠-315,639 MT

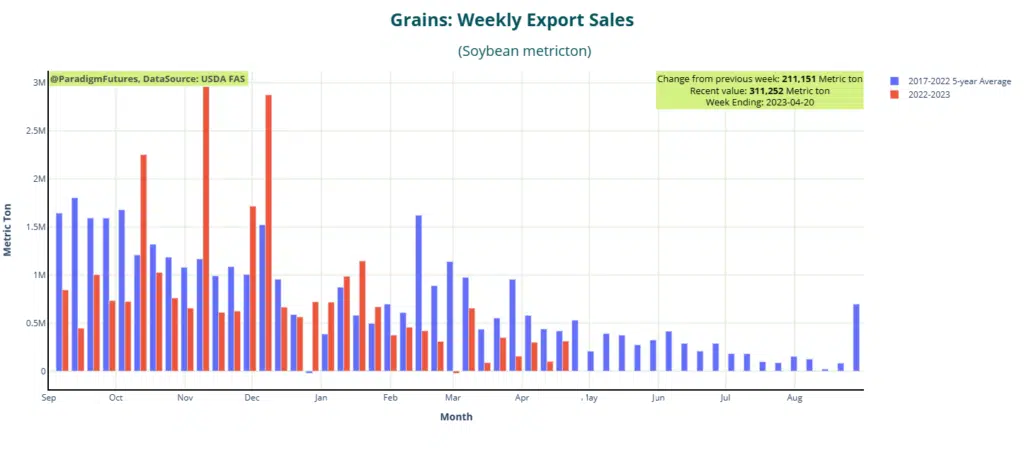

Soybeans💠289,730 MT

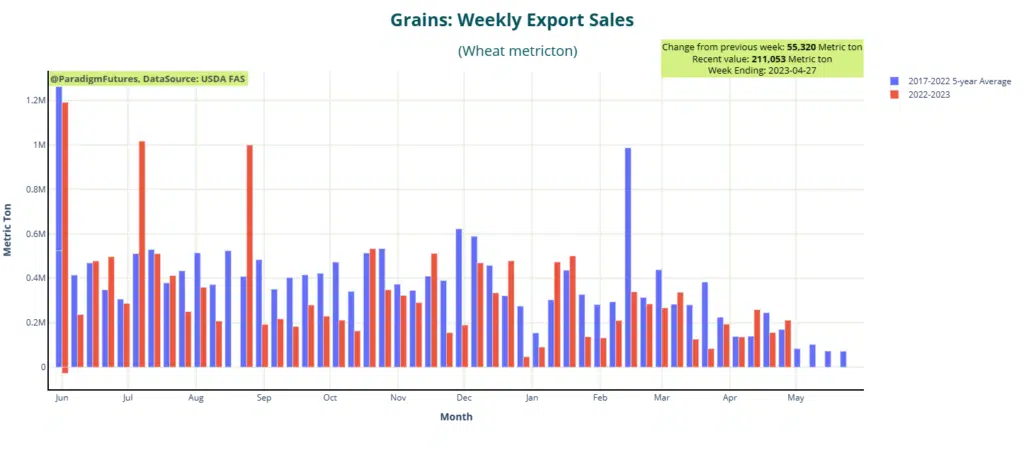

Wheat 💠211,053 MT

Net sales reductions of 315,600 MT for 2022/2023–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Japan (193,300 MT, including 88,500 MT switched from unknown destinations and decreases of 2,300 MT), Taiwan (74,400 MT, including 70,000 MT switched from China)

Export commitments are 37% behind a year-ago compared to 33.1% behind last week. USDA projects exports in 2022-23 at 1.850 billion bu., 25.1% below the previous marketing year. |

Exports of 561,200 MT were up 24 percent from the previous week and 12 percent from the prior 4-week average. The destinations were primarily to China (190,800 MT), Germany (128,300 MT)

Exports of 288,900 MT were down 5 percent from the previous week, but up 17 percent from the prior 4-week average. The destinations were primarily to Egypt (55,000 MT), Japan (43,600 MT)

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.