Ending Stocks

Corn💠2,222 MMT (est 2105M; prev 1342M)

Soybeans💠335 MMT (est 292M; prev 210M)

Wheat 💠556 MMT (est 608M; prev 598M)

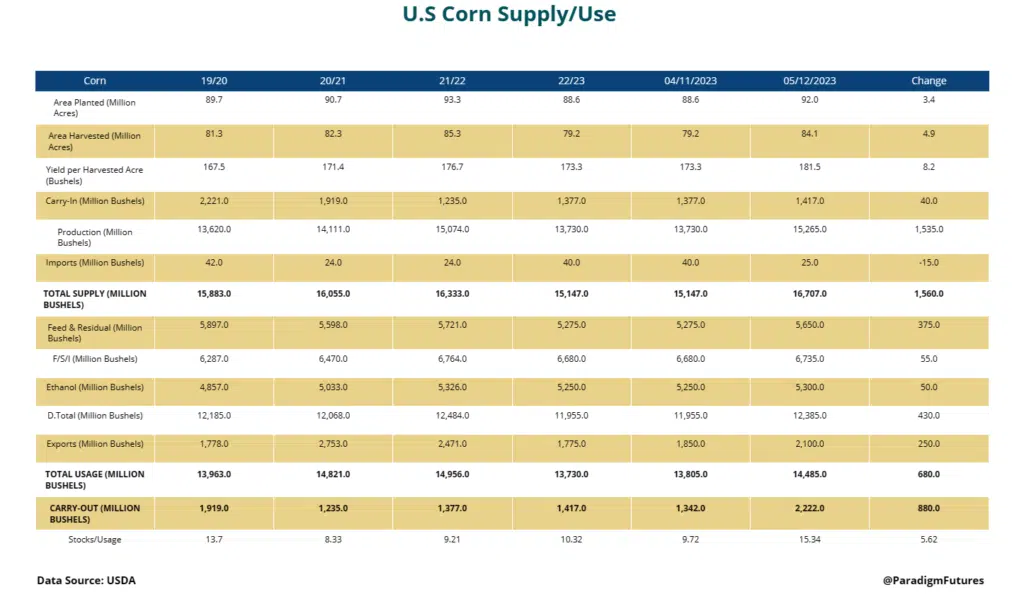

CORN

USDA has released its initial production forecast for the 2023-24 new crop corn, projecting a record production of 15.265 billion bushels. This would surpass the previous record set in 2016. The USDA expects farmers to plant 92 million acres with a record yield of 181.5 bushels per acre.

The 2023-24 ending stocks of corn are estimated at 2.222 billion bushels, which represents the largest ending stocks in the last five years.

In terms of demand, the USDA anticipates a Food, Seed, and Industrial use of 6.735 billion bushels for 2023-24, with ethanol use forecasted at 5.3 billion bushels. The total domestic use of corn is projected to be 12.385 billion bushels, while exports for the new crop are pegged at 2.1 billion bushels.

The projected farmgate price for the 2023-24 crop stands at $4.80 per bushel.

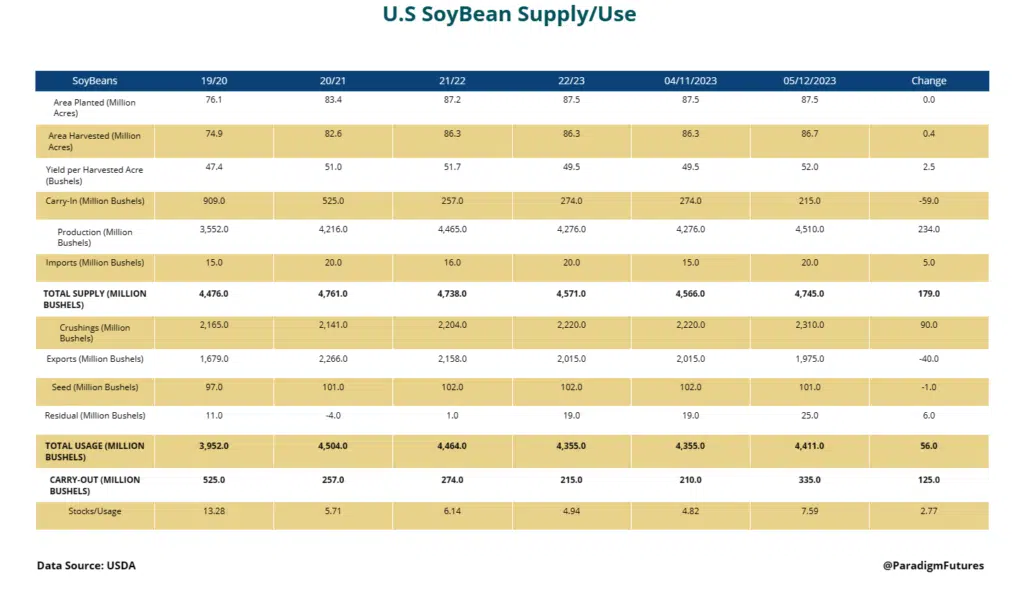

SOYBEANS

The USDA estimates that farmers will produce 4.51 billion bushels (bb) of soybeans in the new-crop marketing year, based on an acreage estimate of 87.5 million and yield estimate of 52 bushels per acre.

For the 2023-24 marketing year, the USDA predicts ending stocks to grow to 335 million bushels (mb). The first forecast for new-crop crush demand is 2.31 bb; exports, 1.975 bb; seed, 101 mb, and residual, 25 mb. The total usage is projected to be 4.411 bb. The USDA reports that favorable crush margins for biofuel production will increase crush demand, but South American competition in the export market will reduce U.S. sales oversees compared to the current season. The national average farm gate price for soybeans is forecast at $12.10.

For the old-crop, or 2022-23, ledger, the USDA estimates ending stocks at 215 mb, which is up by 5 mb from last month. The shift is due to a 5 mb increase in imports. The national average farm gate price has been lowered by 10 cents to $14.20.

Globally, most traders and farmers follow the old-crop marketing year estimates, as South America is finishing up its harvest. For the 2022-23 season, the USDA adjusted the world ending stocks higher by 0.75 million metric tons to 101.04 million metric tons (mmt). Brazil’s production forecast was increased by 1 mmt to 155 mmt, while Argentina’s was left unchanged at 27 mmt.

Looking ahead to the 2023-24 season, the USDA forecasts ending stocks at 122.5 mmt. Crops in Brazil and Argentina are both predicted to be larger at 163 mmt and 48 mmt, respectively, but those crops will not be planted until fall. The USDA predicts China’s import demand will increase by 4 mmt to 100 mmt.

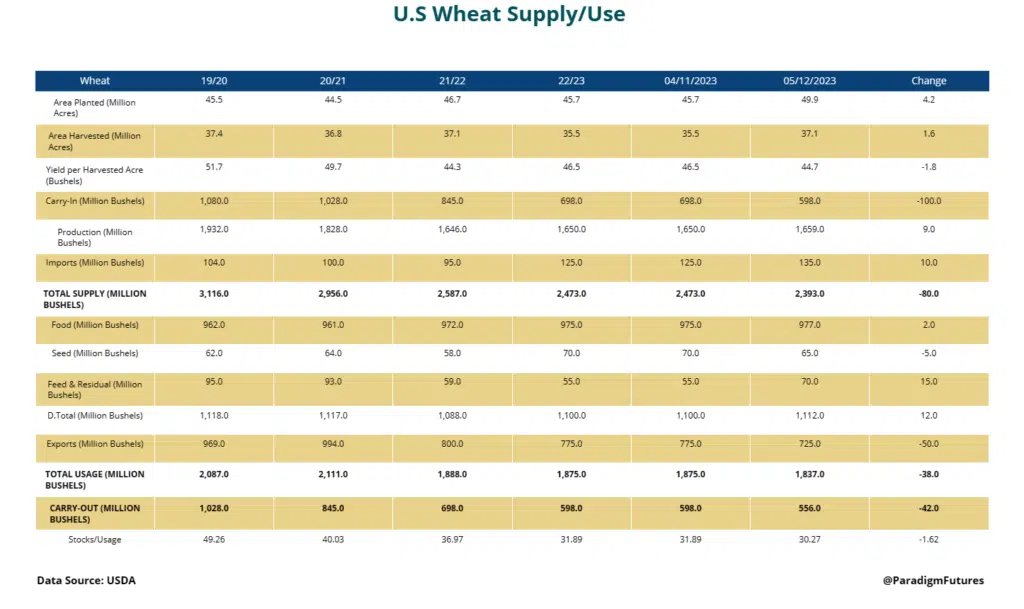

WHEAT

For the new crop season of 2023-2024, USDA forecasts domestic wheat production to reach 1.659 bb with an average yield of 44.7 bushels per acre. Ending stocks for the new crop are expected to reach 556 mb, with food, seed, and residual use pegged at 1.112 bb and exports at 725 mb. The U.S. farm gate prices for the new crop are estimated at $8.00.

For the old crop season of 2022-2023, USDA estimates wheat ending stocks to be 598 mb, with wheat production estimated at 1.650 bb. The U.S. farm gate old-crop prices are estimated at $8.85. Winter wheat production for the new crop is forecasted to be 1.13 bb, up 2% from 2022.

As of May 1, the forecasted yield for the United States is 44.7 bushels per acre, down 2.3 bushels from last year. The area expected to be harvested for grain or seed is estimated at 25.3 million acres, up 8% from last year. The hard red winter production is projected to be 514 mb, down 3% from the previous year, while soft red winter production at 406 mb is up 21% from 2022. The white winter production is estimated to be 210 mb, which is down 11% from last year, including 10.2 mb of hard white and 200 mb of soft white.

Globally, the USDA estimates the new-crop wheat production at 789.76 mmt, with new-crop ending stocks projected at 264.34 mmt. For the old-crop, the world ending wheat stocks are estimated to be 266.28 mmt, excluding China, at 127.20 mmt. New world wheat crop production for 2023-2024 is projected to be 139.00 mmt in the European Union, 81.5 mmt in Russia, 16.5 mmt in Ukraine, 37.00 mmt in Canada, 29.00 mmt in Australia, and 19.5 mmt in Argentina.