Crude oil is the world’s most actively traded commodity, and trading the Globex Crude Oil with Paradigm Futures using a futures account can offer several advantages for investors.

Here are seven reasons why oil producers, end users, and speculators may choose to trade crude oil using a futures account.

Price Transparency

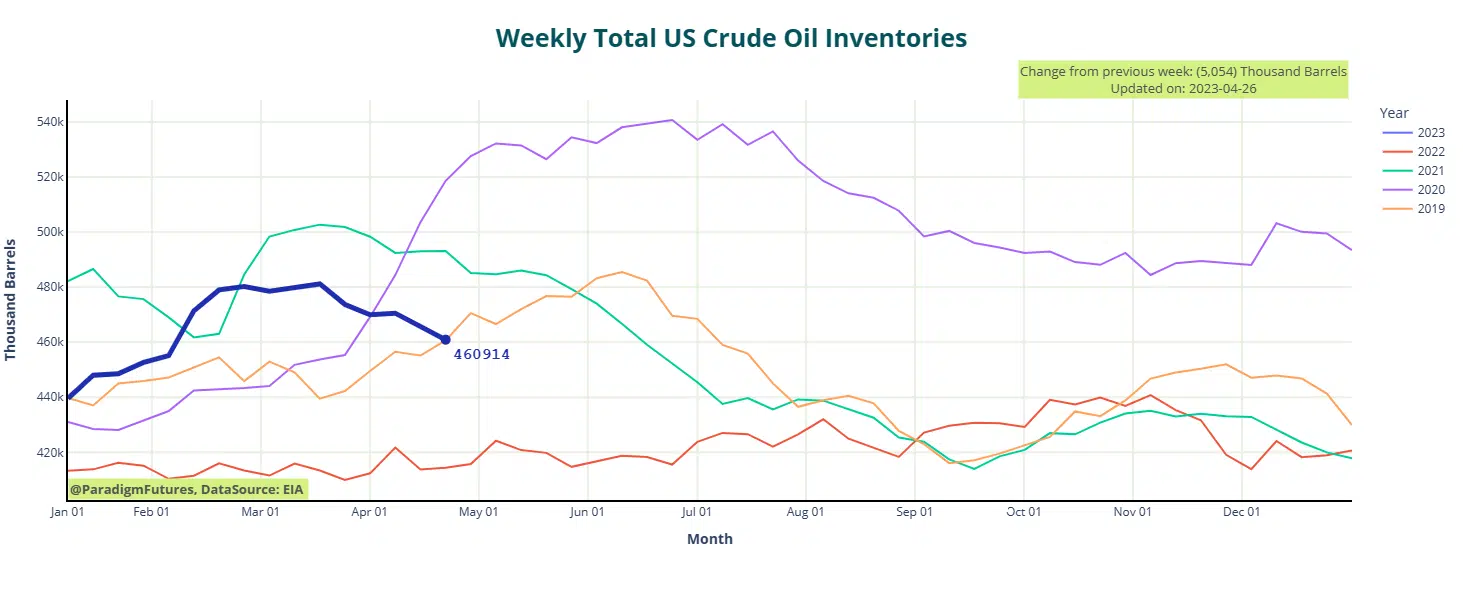

The crude oil futures market is highly transparent, with real-time price information available to all participants. This transparency allows traders to make informed decisions based on market conditions and price trends.

Leverage

Futures contracts allow traders to control a large amount of oil with a relatively small amount of capital. This leverage amplifies potential profits but also increases the risk.

Traders can use this leverage to maximize their returns with a well-thought-out strategy, which is where Paradigm Futures can help.

Liquidity

The crude oil futures market is one of the most liquid markets globally, with high trading volumes and a significant number of participants. This liquidity ensures that traders can quickly enter and exit positions anytime, even for large orders, without significantly impacting prices.

With about 4 million contracts of open interest and over a million contracts traded daily, there is enough liquidity to easily place large trades.

Risk Management

Futures contracts provide traders with practical risk management tools. Using stop-loss orders and hedging strategies, traders can mitigate potential losses and protect their capital from adverse market movements.

As a crude oil producer, your risk is if the market goes lower and potentially below the cost of production, and as an end user, your risk is if the price of oil climbs higher. With a futures account at Paradigm Futures, you can effectively offset your risk by hedging in your futures account.

Diversification

Crude oil futures provide an opportunity to diversify an investment portfolio. By adding commodities like crude oil, traders can reduce their overall portfolio risk and potentially benefit from non-correlated price movements between oil and other asset classes like stocks or bonds.

Global Market Access

Crude oil is a globally traded commodity, and futures contracts allow traders to access international markets and profit from price fluctuations across different regions. This global market access provides opportunities, regardless of the trader’s location.

For example, trading hours running 5:00 pm- 4:00 pm (Sun- Fri) settle at 1:30 pm CST. With the global market, there is an opportunity to place your trades anywhere in the world conveniently.

Speculative Opportunities

Crude oil futures attract many participants, including speculators who aim to profit from short-term price movements. The volatility and liquidity of the crude oil market create ample trading opportunities for speculators who can accurately anticipate and react to price fluctuations.

Talk with a Series 3 licensed professional at Paradigm Futures to help tailor a trading strategy that fits your risk profile.

While trading crude oil futures can be lucrative, it is essential to understand the risks involved. Futures trading carries a substantial risk of loss, and individuals should have a thorough understanding of the market, develop a well-researched strategy, and consider seeking advice from financial professionals before entering such trades.

The risk of loss in trading futures and/or options is substantial, and each investor and/or trader must consider whether this is a suitable investment. Past performance — whether actual or indicated by simulated historical tests of strategies — is not indicative of future results.