Federal Reserve Increases Rate by 0.5 %

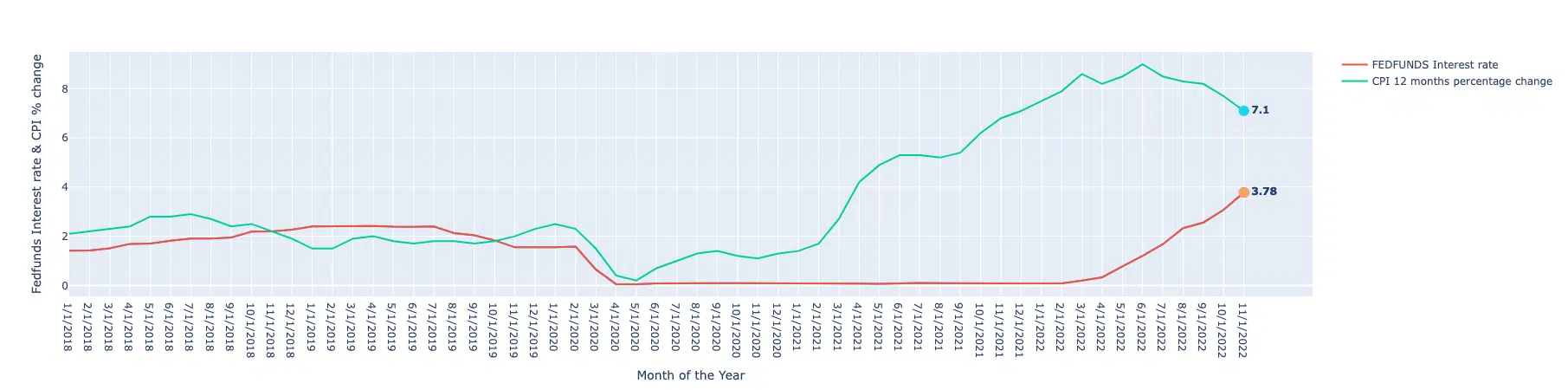

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. Russia’s war against Ukraine is contributing to upward pressure on inflation. “The Committee is strongly committed to returning inflation to its 2 percent objective,” says chairman Powell. During the press conference chairman Powell referenced the Producer Price Index reading of 7.4% from December 9th and the Consumer Price Index reading of 7.1% from December 13th as reasons the Federal Reserve needs to keep a restrictive stance on policy.

The Board of Governors of the Federal Reserve System voted unanimously to raise the interest rate paid on reserve balances to 4.4 percent, effective December 15, 2022. As part of its policy decision, the Federal Open Market Committee voted to authorize and direct the Open Market Desk to execute transactions in the System Open Market Account. The Board approved requests to establish that rate submitted by the Boards of Directors of the.

The increase in rates took very few by surprise

The 10-year Note trading within the last 7 days of trading value and the S & P 500 only moved 24.5 points from open to close.

What does History Say?

The chart listed below shows the relationship between Federal Funds Interest Rate and Consumer Price Index. Typically as a general rule based on history, it takes a Federal Funds Rate greater than CPI to really curb inflation.

If you would like to be in the know when the Economic report data comes out, please subscribe to our market updates on our Home page.

[Posted by Paradigm Futures on For release at 2:00 p.m. EST December 14, 2022]