EIA Report Shows a Drop in Inventory, Overshadowed by Looming FED Decision

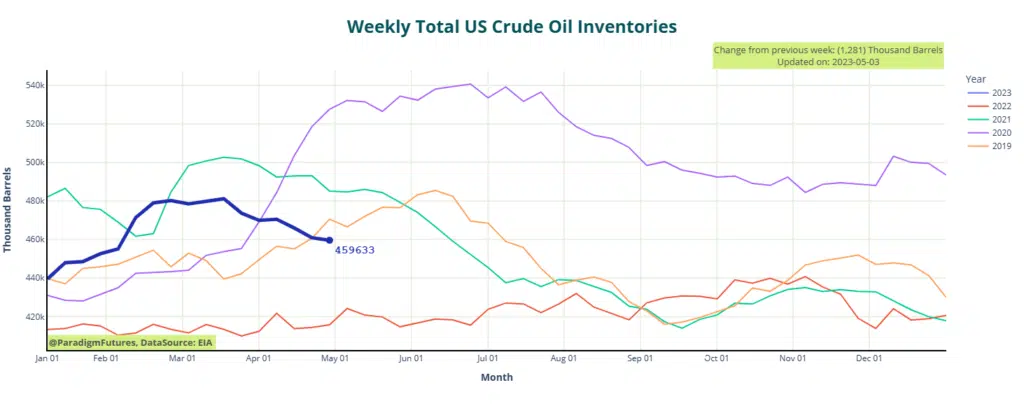

Later today, analysts expect the Fed to announce another rate hike, while Congress negotiates the debt ceiling. Both of these could cause a slowdown in US economic growth. Which is suggested by the decrease in diesel demand, which is also not seen as positive. However, this decline has eased concerns about a middle distillate shortage. With driving season approaching, there are indications that gasoline demand may also decrease.

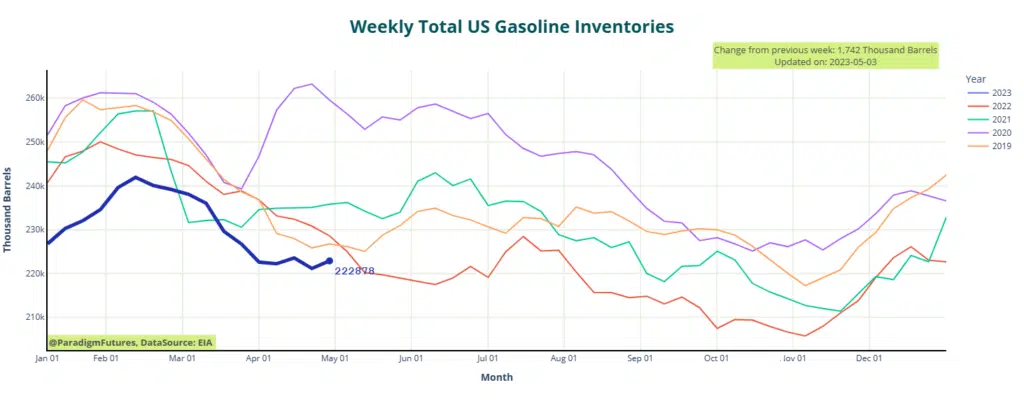

Gasoline inventories increased by 1.7 million barrels in the week ending on April 28th, with an average daily production of 9.4 million barrels. In contrast, the previous week experienced an inventory draw of 2.4 million barrels and an average daily production of 10 million barrels.

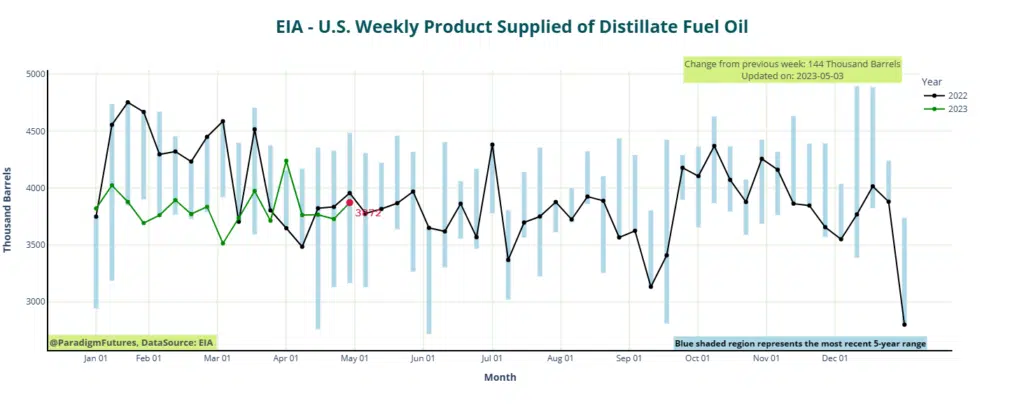

Middle distillate inventories had a reduction of 1.2 million barrels in the week ending on April 28th, with production averaging 4.6 million barrels per day. The previous week saw a moderate draw of 600,000 barrels in middle distillate inventories, with production averaging 4.7 million barrels daily.